Jensen’s Alpha follows on from Alpha. It is a risk-adjsuted measure of excess return over the market portfolio. Jensen’s alpha considers excess returns to be those over and above the returns predicted by the CAPM pricing model. A positive Jensen’s alpha value means that the portfolio has beat the expected returns.

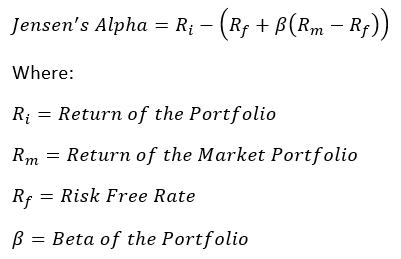

Jensen’s Alpha is calculated as follows: R(i) – (R(f) + B * (R(m) – R(f))). As such it considers the market correlation, through use of Beta, as well as the equity risk premium (R(m) – R(f)), thus providing a more robust figure than basic Alpha, which simply provides a single figure that the portfolio is above or below the market portfolio.