As we move closer and closer to a no-deal Brexit, the likelihood is, that come the end of the UK’s transition period for leaving the EU (1st January 2021), major shareholders will need to consider a number of new factors to ensure they are making the correct disclosure to the correct competent authority of the issuer.

Should there be no extension, and no deal, the choice of a home Member State under the Transparency Directive will consist of the EU 27 Member States and the three EEA EFTA States (Iceland, Liechtenstein, and Norway).

Where a major shareholder would have once fulfilled their transparency disclosure obligation by making a disclosure to one home member state, come the 1st January 2021, they may now have dual disclosures obligations.

Last month, ESMA updated the Transparency Directive Questions and Answers, amending question 26 on the choice of the TD home member state, providing that, after the end of the UK’s transition period for leaving the EU:

“…an issuer which currently has the UK as it Transparency Directive home Member State and is admitted to trading on one or several regulated markets in EU27 / EEA EFTA must determine its TD home Member State according to the rules laid down in TD Article 2(1)(i). The issuer is required to disclose its new home Member State in accordance with TD Articles 20 and 21 and additionally to disclose its home Member State to:

-

- The competent authority of the Member State where it has its registered office, where applicable;

- The competent authority of the home Member State; and

- The competent authorities of all host Member States.”

The UKs current position is that DTR currently applies to issuers with securities admitted to trading on a regulated market in the EU and for which the FCA is the home competent authority. After the transition period, the DTR requirements will apply to issuers with securities admitted to trading on a UK regulated market, regardless of where the elected home member state is. The home/host state distinction will be removed.

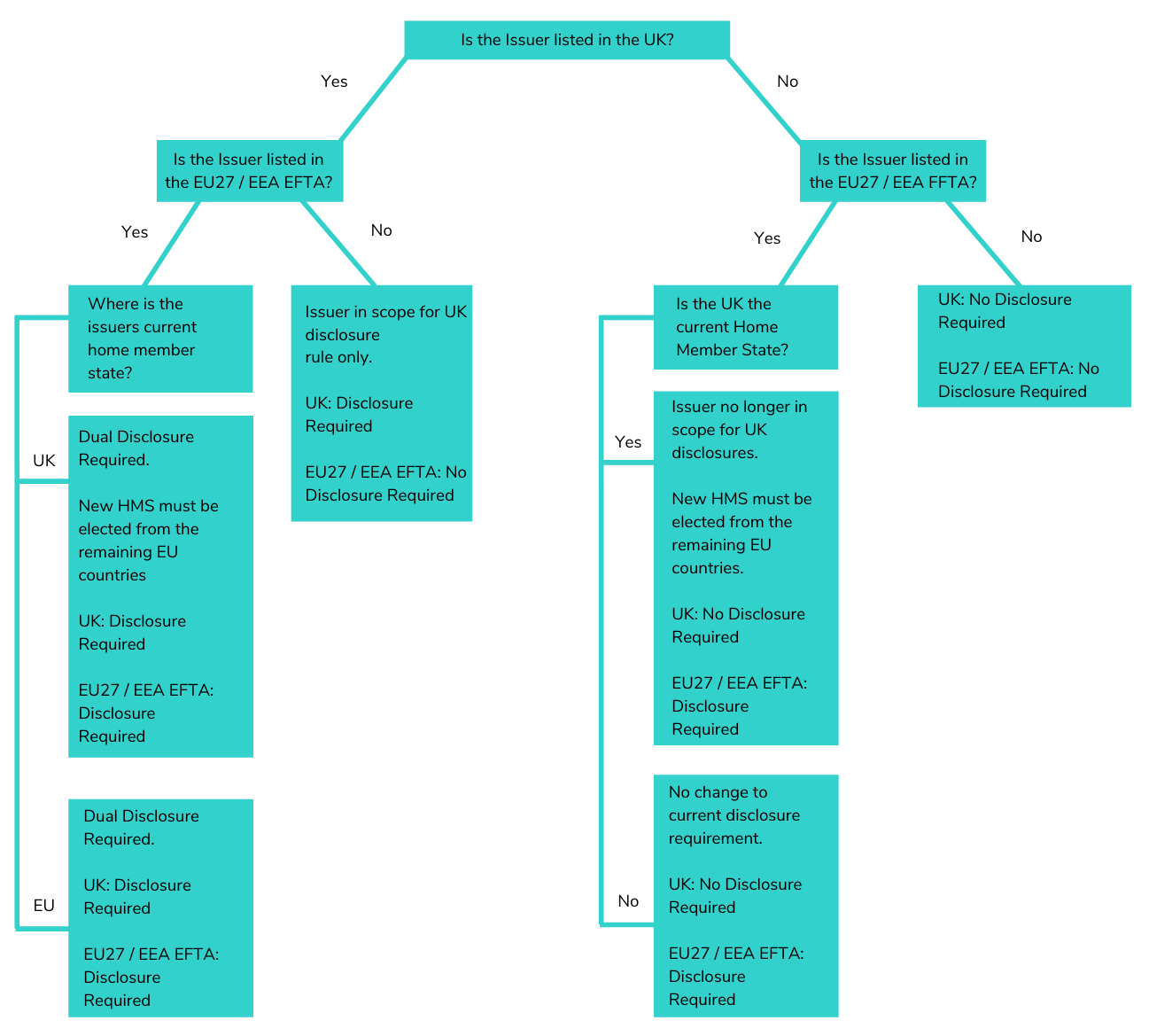

This raises several important questions for major shareholders:

- Which jurisdictions rules should be applied, and to which jurisdiction(s) should required disclosure to be made for:

a. Issuers listed in UK and EU, with home member state UK?

b. Issuers listed in UK and EU, with home member state EEA?

c. Issuers listed in the EU with the UK as home member state?

d. Issuers listed in the UK with the EU as home member state?

Decision Tree

Below we provide a high-level decision tree of the above scenarios:

This means that an issuer on a UK regulated market, whose home member state is not the UK, will now be subject to UK rules. In turn, issuers admitted to trading on a regulated market in the EU, whose home member state was the UK, will now have to elect a new home member state in the EU.

This all seems fairly straight forward until you take into account the second part of the ESMA Q&A update:

“ESMA is of the view that the Member State where the issuer’s securities are admitted to trading on a regulated market should be considered its home Member State. Where the issuer’s securities are admitted to trading on regulated markets situated or operating within more than one Member State, ESMA is of the view that those Member States should be considered the issuer’s home Member States until a subsequent choice of a single home Member State has been made and disclosed by the issuer.”

Due to issuers being relatively poor at timely announcements of home member states, a scenario where the issuer is listed in multiple EU jurisdiction and is yet to announce a HMS must be considered.

DTR Exemption List

In addition to establishing the competent authority for major shareholding disclosures, major shareholders should monitor the FCA’s major shareholding rules (DTR 5) exemptions for certain countries considered equivalent. Issuers with securities admitted to trading on a regulated market in the UK that are incorporated in any of these countries are exempt from the requirements under DTR 5:

- USA

- Japan

- Israel

- Switzerland

The FCA may in the future expand upon this list.

New FCA DTR 5 Portal

For those required by the above to either continue to make disclosures in the UK, or for those with new obligations, they should both ensure they are registered for the new FCA DTR 5 portal. The FCA have confirmed that in Q1 2021 they will be changing how investors submit the standard form for notification of major shareholdings (TR-1 Form) as required under DTR 5.

With the new process, investors will need to complete an electronic TR-1 Form which will be available on the DTR 5 reporting element of the FCA Electronic Submission System (ESS).

After launching the new DTR 5 portal in Q1 2021, investors will no longer be allowed to send TR-1 Forms by email.