Small AIFMs are AIFMs where the value of the AIF assets do not exceed the thresholds in article 3(2) of the directive.

The thresholds being:

Small AIFMs are AIFMs where the value of the AIF assets do not exceed the thresholds in article 3(2) of the directive.

The thresholds being:

500 million euros in total in cases where the portfolios of AIFs consist of AIFs that are unleveraged and have no redemption rights exercisable during a period of 5 years following the date of initial investment in each AIF; or

100 million euros in total in other cases, including any assets acquired through the use of leverage.

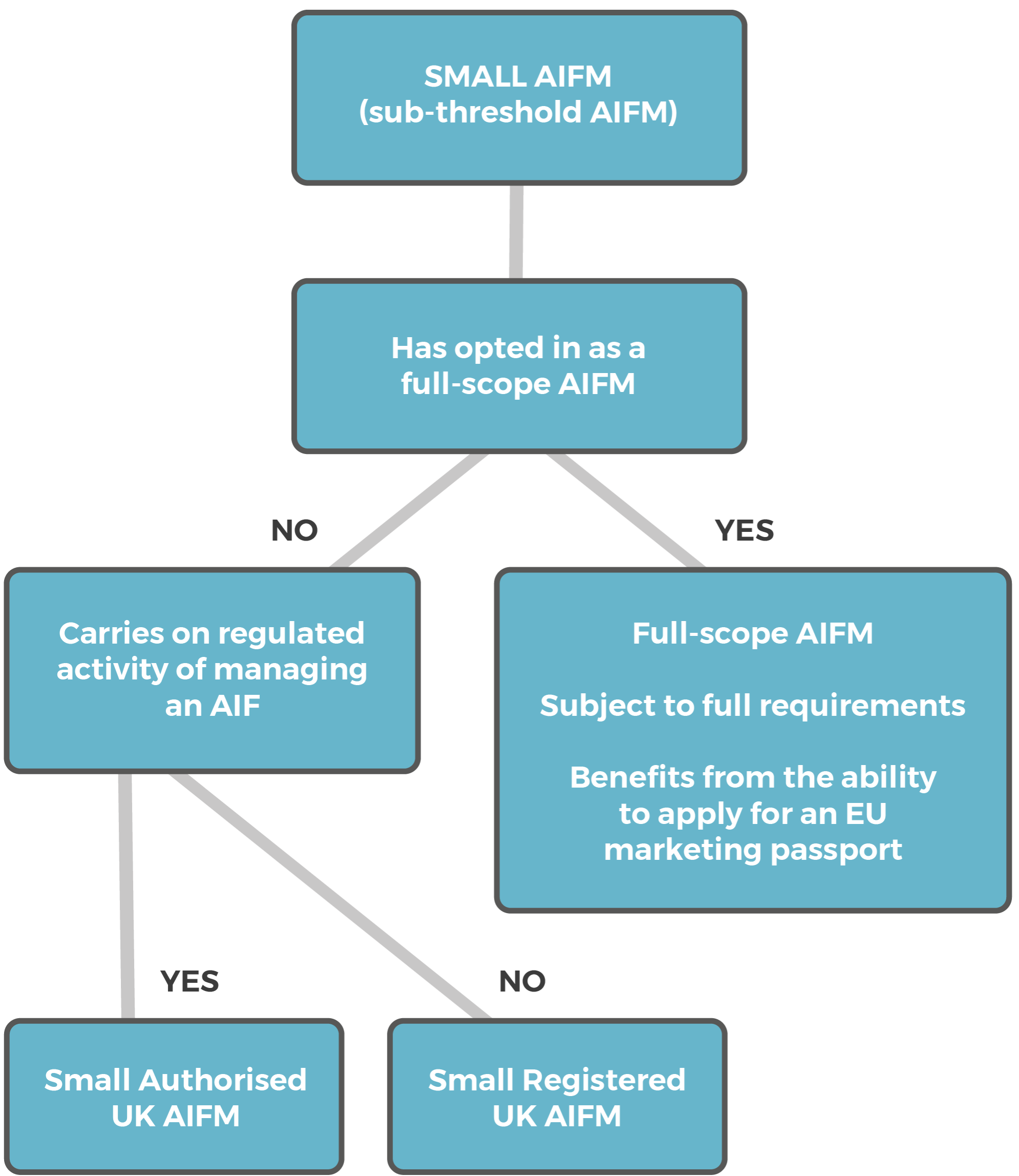

Where an AIFM is a small AIFM, it is largely outside the scope of the AIFMD.

However, it may choose to opt-in. It would then become subject to the requirements of the AIFMD. However, it would also benefit from the ability to apply for an EU marketing passport.

A small AIFM does not have to opt-in. If it does not opt-in, then it will not, for the most part, be subject to the AIFMD, although they are required to comply with the requirements set out in Article 3 of the Directive. These mainly relate to reporting, including Annex IV Reporting – see below.

They will also be subject to national regulations in respect of any regulated activities.

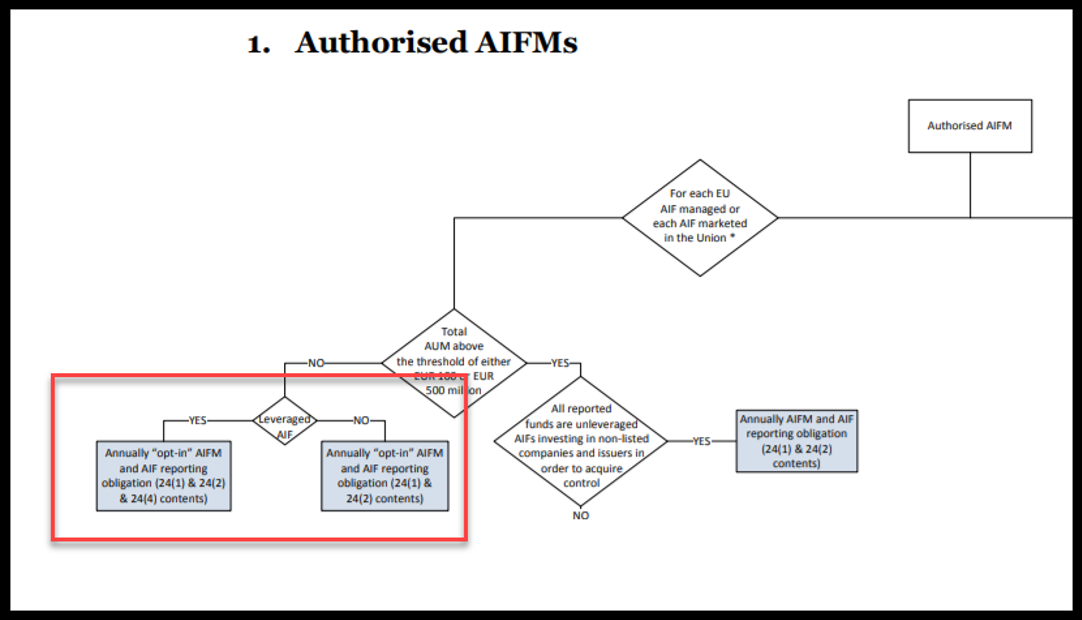

Small AIFM that have opted-in will reported annually:

24(1) and (2) if not leveraged

24 (1), (2) and (4) if leveraged

However, small AIFMs that have not opted-in are nevertheless still subject to the reporting requirements. They are subject to the annual AIFM and AIF minimum reporting obligation under Article 3(3)(d) contents.

The UK Regulation in the FCA FUND sourcebook refers generally to “Full Scope AIFMs.” A “full scope AIFM” is a UK AIFM which:

is not a small AIFM; or

is a small AIFM but has opted in to AIFMD in accordance with article 3(4) of AIFMD.

In the UK, small AIFMs that have not opted in will be either:

Small UK Authorised AIFM

Small UK Registered AIFM.

A small authorised UK AIFM carries on the regulated activity of managing an AIF and is subject to FCA rules in respect of that activity. In contrast, a “small registered UK AIFM” does not carry on a regulated activity in respect of its activities as an AIFM for an AIF for which it is entitled to be registered.

The basis for this is to be found at Articles 9 to 12 of the UK Regulation implementing AIFMD, where it is provided that to qualify as a small registered UK AIFM, the small AIFM must be:

a corporate, internally managed AIF (e.g. an investment trust);

the manager of CIS which holds mainly land; or

a manager meeting the conditions for registration as a manager of a European Social Entrepreneurship Funds (“EuSEF”) or European Venture Capital Funds (“EuVECA”), subject to meeting certain specific criteria in each case.

Note: A small AIFMs may act in a dual capacity as both a small authorised UK AIFM for one or more AIFs, and a small registered UK AIFM for one or more other AIFs.