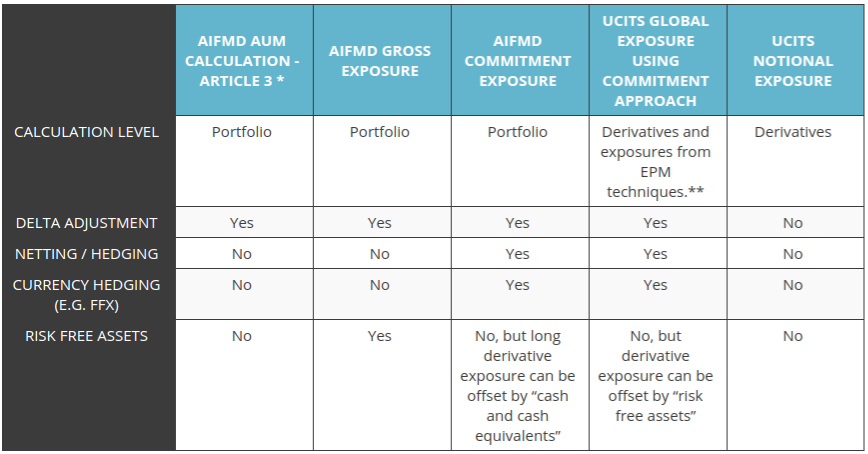

Following the EU Directives on UCITS and AIFMD and ESMA’s guidelines on the same, there are now 5 different calculations of exposure required.

Additionally, there is a lack of clarity across the calculations on certain issues such as the treatment of share class FX, margin and borrowing.

These are considered below.

Funds-Axis suggestions for clarification and change are set-out here. This includes reduction of the number of calculation methods to only 3 measures of exposure.