The method for calculating the MRM is set out in Delegated Regulation 2017/653 at Annex II, Part 2.

The first step in the CRM classification is to perform a credit risk assessment.

This happens at the Direct Level, look-through level or both (as required).

For this purpose, where available, a PRIIP manufacturer shall define ex-ante one or more external credit assessment institutions (ECAI) whose credit assessments will consistently be referred to for the purpose of the credit risk assessment.

Use of credit ratings (see Article 37)

Where multiple credit assessments are available according to that policy, the median rating shall be used, defaulting to the lower of the two middle values in case of an even number of assessments

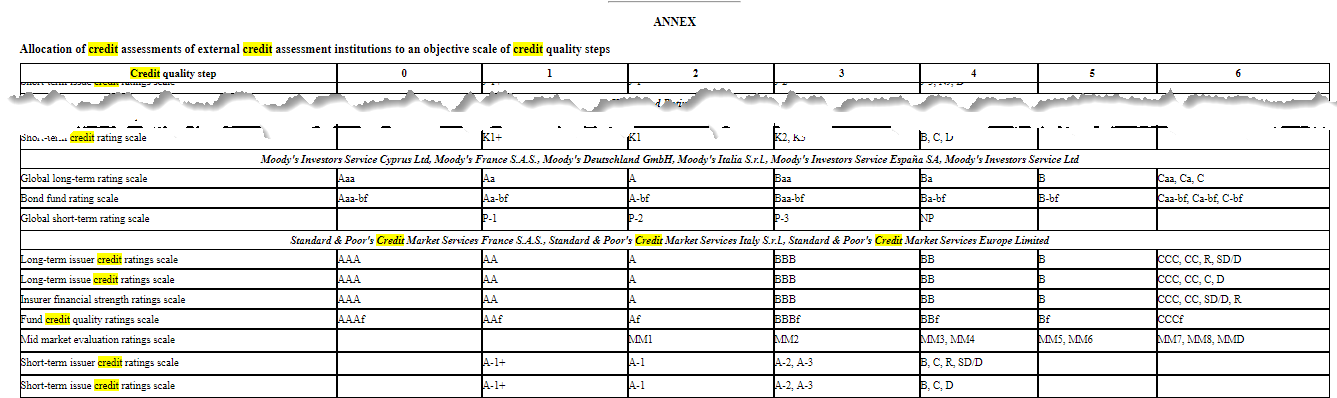

In performing the calculation, the credit ratings of ECAIs are assigned to an objective scale of credit quality steps based on Commission Implementing Regulation (EU) 2016/1800.

E.g. S&P Long Term Issuer Credit Rating of AAA is a “1”, whereas “A” is a “3.”

Where credit ratings are not available (see Article 38)

Where credit ratings are unavailable, a default credit assessment as set out in point 43 of the Annex:

Holdings to include / exclude (see Articles 35 and 36)

Not all holdings of the PRIIPS need included. It is only those holdings which entail credit risk exposure. Hence, it will not include equity holdings. Further, no credit risk shall be taken to be entailed where:

Further, you only need to consider the credit risk entailed by each underlying investment representing an exposure of 10 % or more of the total assets or value of the PRIIP.

Issuer level calculation

In the case of credit risks assessed on a look-through basis, as an issuer level you calculate the weighted average credit quality steps of each relevant obligor. This is done by the considering the proportion to the total assets they respectively represent (Article 40).

Roll-up to Portfolio Level

After, calculating the weighted average of each relevant obligor, this then rolls up to become the weighted average credit rating of the PRIIPs.

Example: Calculation on Look through basis

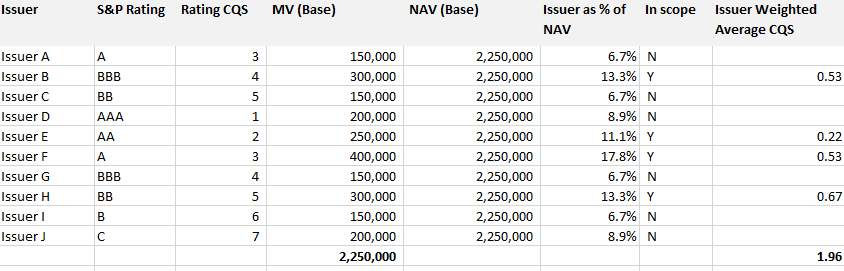

In this example, we have a portfolio of 10 bonds, with a net asset value of £2.25m.

The bonds have a variety of S&P Ratings, which equate to a Rating CQS based on Regulation (EU) 2016/1800.

Some issuers are less than 10% NAV and hence out of scope of the calculations.

For the ones in scope their Issuer holding as % of NAV is multiplied by the Rating CQS to calculate the Issuer Weighted Average CQS.

The issuer Weighted Average CQS is then aggregated up to a portfolio level credit risk – 1.96.

In Step 2, we will how this credit risk is then mapped to an (Unadjusted) Credit Quality Step (CQS), in this case of 2.

NOTE: for the vast majority of UCITS the CRM (see steps 2 to 4) will be 1 (taken to entail no credit risk), not least because a large number of holdings will be excluded from the step 1 above, due to general rule applying to equities and bonds (other government and public securities and covered bonds) of maximum 5% in any one issuer, increased to a maximum of 10% for 40% of NAV.