Whilst under UCITS KIIDs, investors are provided with past performance disclosure, PRIIPs regulation prescribes displaying forward-looking performance scenarios, showing various possible outcomes, accompanied by disclaimer that it does not guarantee the future performance.

| INVESTMENT [ ] SCENARIOS | [1] YEARS | [5] YEARS | [10] YEARS RECOMMENDED HOLDING PERIOD |

|

|---|---|---|---|---|

| Stress Scenario | What you might get back after costs Average return each year | [ ] [ ] | [ ] [ ] | [ ] [ ] |

| Unfavourable Scenario | What you might get back after costs Average return each year The scenario occurred between xx/yy and aa/zz. | [ ] [ ] | [ ] [ ] | [ ] [ ] |

| Moderate Scenario* | What you might get back after costs Average return each year The scenario occurred between xx/yy and aa/zz. | [ ] [ ] | [ ] [ ] | [ ] [ ] |

| Favourable Scenario | What you might get back after costs Average return each year The scenario occurred between xx/yy and aa/zz. | [ ] [ ] | [ ] [ ] | [ ] [ ] |

* The interim scenario is only required where the Recommend Holding Period is 10 years or more.

SCENARIOS

As shown above the information is required to be shown in 4 separate scenarios, for up to 3 different time periods:

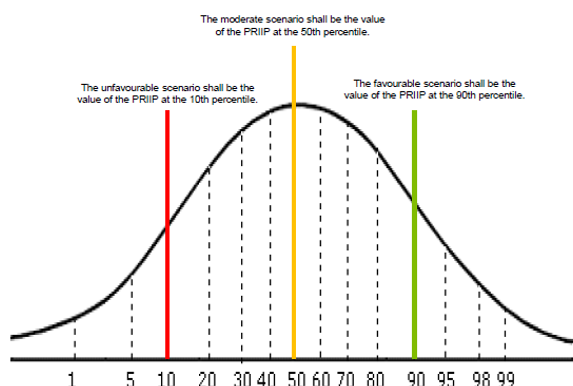

Favourable – The best performance equivalent to the RHP period out of a universe of performance to each month-end back from calculation date to a period equivalent to the RHP. i.e. if the RHP is 5 years, choose the best 5 year performance ending at the 60 month ends back from the calculation date;

Moderate – As above except the median performance; and

Unfavourable – As above except the worst performance subject to the caveat that if a performance from any pricing point >1yr and Stress – Uses a complex mathematical formula to highlight the 99th percentile worst performance for 1 year and 95th percentile worst performance for greater time periods.

HOLDING PERIODS

It also need to be presented based on:

The Recommended Holding Periods, and

Interim holding periods.

The number of interim periods to be shown depends on the Recommended Holding Period (“RHP”).

| RECOMMENDED HOLDING PERIOD (RHP) | |

|---|---|

| Less than one year | None |

| Between one and ten years | At one year |

| 10 years and greater | At one year and half of the RHP |

THE CALCULATION OF PERFORMANCE SCENARIOS

The calculation of performance scenarios is prescriptive, including that performance scenarios:

Are to be presented net of all the costs related to the product;

Must reflect stress, unfavourable, moderate and favourable scenarios;

Must be presented forward-looking

Must be based on historical performance equivalent to the greater of ten years or the recommended holding period plus five years.

Whilst forward looking, it is based on Market Risk Measure (MRM) and based on historical data.

For category 2 PRIIPs, this means applying the Cornish-Fisher VaR expansion.