The following retail products are defined as a PRIIP:

UCITS

Structured deposits (but not deposits linked solely to interest rates)

Financial products with capital and/or return guarantees

All investment funds, whether closed ended or open ended

Derivative instruments (including options, futures and contracts for difference)

Unit linked life insurance

Certain pension products

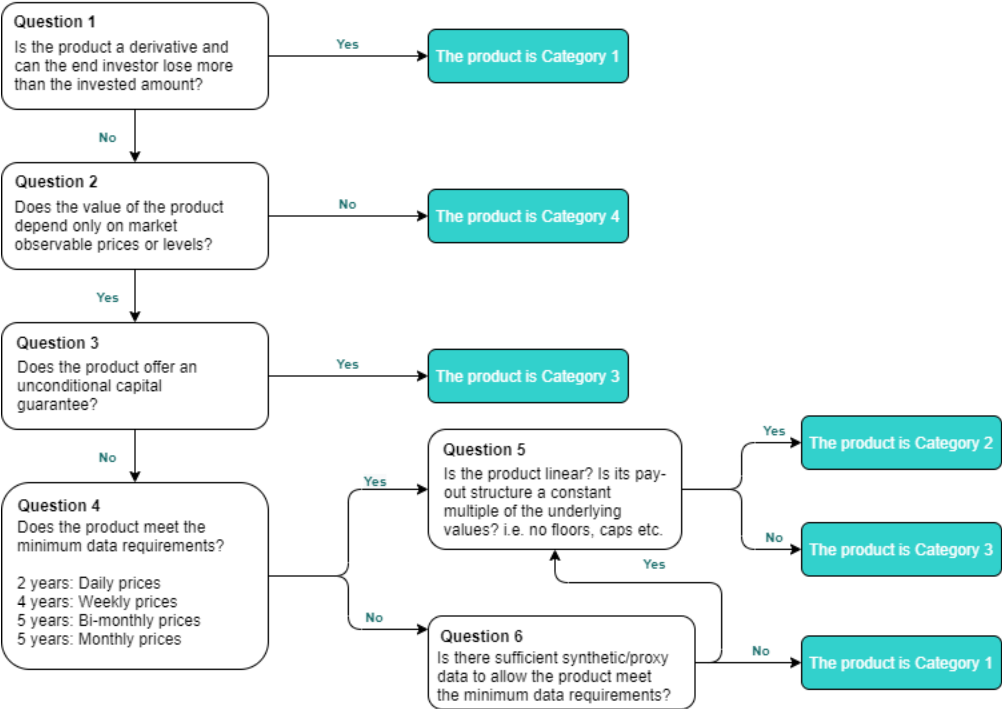

For the purposes of determining the MRM, PRIIPs are divided into four categories, based on the structural features of the PRIIP.

This is described below:

CATEGORY 1

Category 1 covers the following:

PRIIPs where investors could lose more than the amount they invested;

Derivatives and PRIIPS with insufficient historical performance data* or illiquid underlying assets

PRIIPs or underlying investments of PRIIPs which are priced on a less regular basis than monthly, or which do not have an appropriate benchmark or proxy, or whose appropriate benchmark or proxy is priced on a less regular basis than monthly.

CATEGORY 2

Category 2 covers:

Standard unit linked products

PRIIPs which, either directly or on a synthetic basis, offer non-leveraged exposure to the prices of underlying investments, or

a leveraged exposure on underlying investments that pays a constant multiple of the prices of those underlying investments, where there is sufficient historical data available.*

CATEGORY 3

Category 3 covers:

Structured products

PRIIPs whose values reflect the prices of underlying investments, but not as a constant multiple of the prices of those underlying investments, where there is sufficient historical data available.*

CATEGORY 4

Category 4 covers:

PRIIPs whose values depend in part on factors not observed in the market, including insurance-based PRIIPs which distribute a portion of the PRIIP manufacturer’s profits to retail investors.

NOTES:

* Sufficient historical data

Sufficient historical data means where there is at least:

– 2 years of daily prices of the underlying assets,

– 4 years of weekly prices,

– or 5 years of monthly prices.

The requirement can also be met where existing appropriate benchmarks or proxies are available, provided that such benchmarks or proxies fulfil the same criteria for the length and frequency of the price history.

By way of summary, UCITS and AIFs will typically be:

If the pay-off of the UCI is linear,

• It would be classified as Category 2 provided there is enough data available for the calculation

• If there is no data, it would be Category 1.If the pay-off is not linear (for example a structured UCITS),

• It would be a Category 3 product, provided the data history requirements are met.

This is summarised in the table below:

| Sufficient historical data available? | Investors can lose more than they invested** | Priced less regularly than monthly*** | Is structured Product? | Is leveraged | Leveraged at constant multiples? | PRIIIPs category |

|---|---|---|---|---|---|---|

| No | 1 | |||||

| Yes | 1 | |||||

| Yes | 1 | |||||

| Yes | No | No | No | 2 | ||

| Yes | No | No | Yes | Yes | 2 | |

| Yes | No | No | Yes | No | 3 | |

| Yes | No | Yes | Yes/No | Yes/No | 3 |

** A UCITS cannot be structured in a way that investor can lose more than invested

*** A UCITS must be priced at least twice per month.