Title and Identification of the UCITS

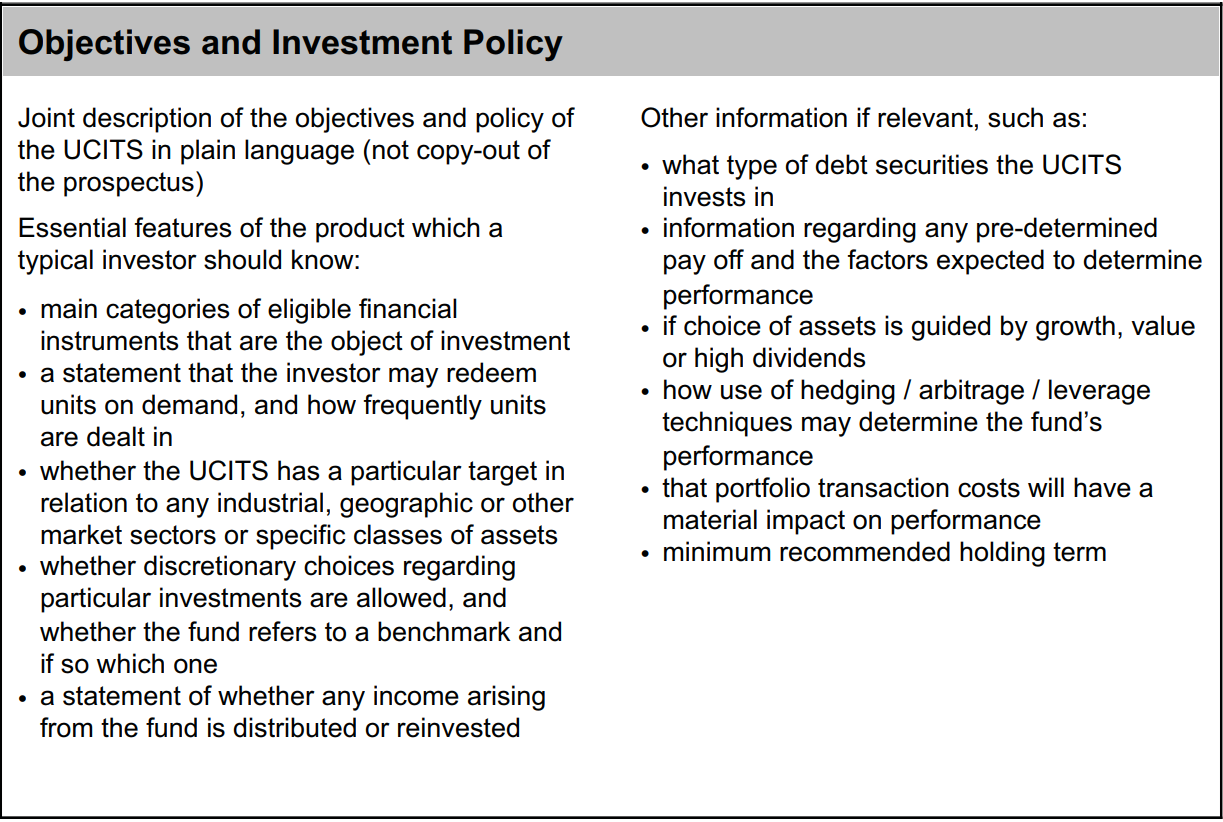

Objectives and Investment Policy

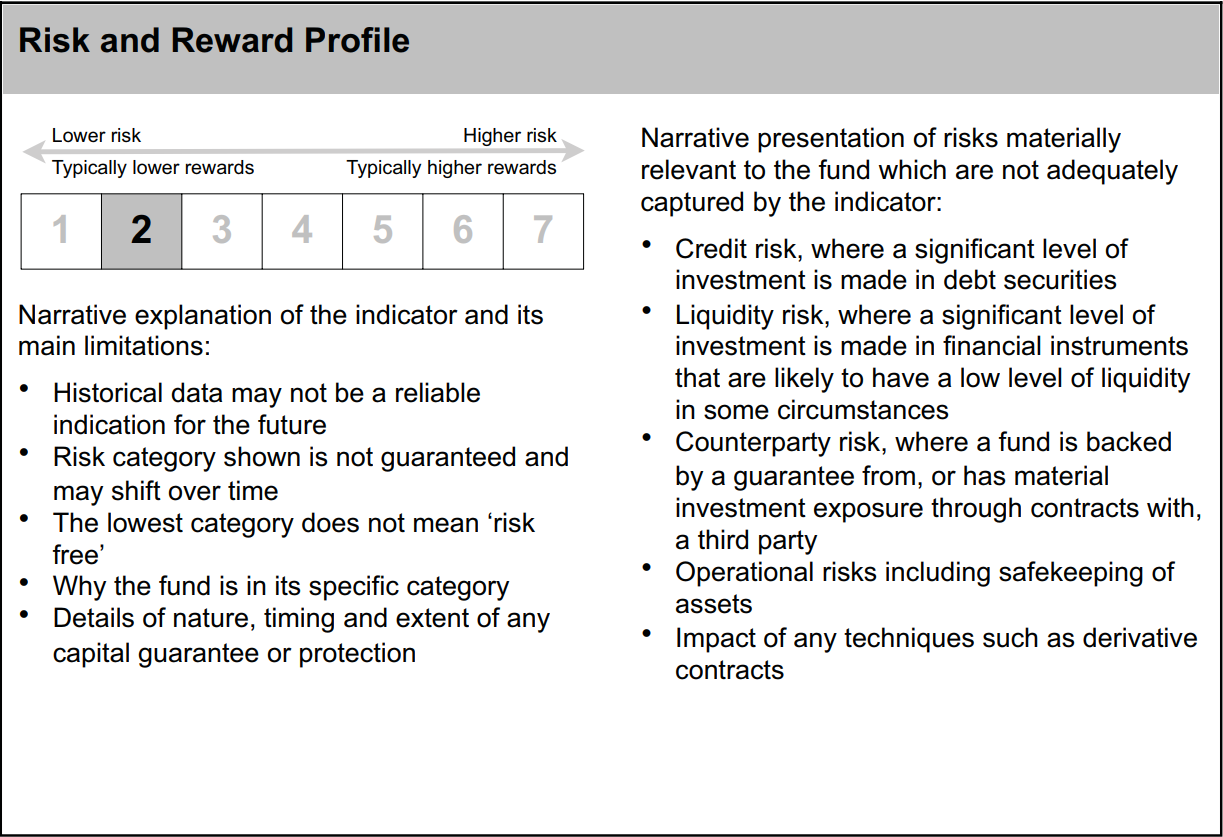

Risk & Reward Profile

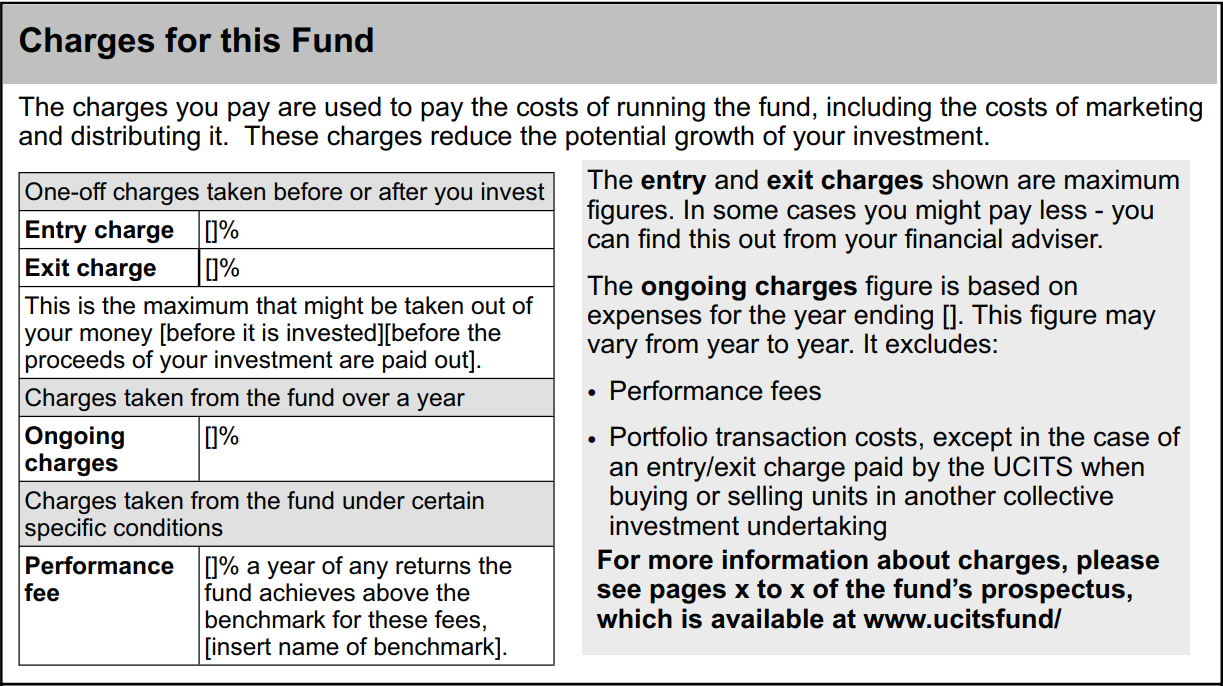

Charges for the fund

Past performance

Practical Information

Additionally, UCITS V requires a UCITS or its manager must adopt a remuneration policy pursuant to the amended UCITS Directive. The KIID must contain a prescribed statement to the effect that details of the up-to-date policy are available by means of a website. A link to the relevant website must also be included, along with a disclosure outlining that a paper copy of the policy will be available upon request. All existing KIIDs had to be updated by February 2017.

Further information on each of these sections is set out below:

RISK AND REWARD PROFILE

This section includes:

The Synthetic Risk Reward Indicator (SRRI), a numeric indicator between 1 and 7 – click here for more details.

Narrative explanation of the computation and limitation of the SRRI; and

Narrative presentation of the UCITS’ risks not captured in the SRRI (e.g. credit, liquidity, counterparty and operational risk).

As regards the Narrative presentation of the UCITS’ risks not captured in the SRRI , the Regulation at Article 8 provides:

Article 8. 5. The narrative explanation referred to in paragraph 1(b) shall include the following categories of risks, where these are material:

credit risk, where a significant level of investment is made in debt securities;

liquidity risk, where a significant level of investment is made in financial instruments, which are by their nature sufficiently liquid, yet which may under certain circumstances have a relatively low level of liquidity ….

counterparty risk, where a fund is backed by a guarantee from a third party, or where its investment exposure is obtained to a material degree through one or more contracts with a counterparty;

operational risks and risks related to safekeeping of assets;

impact of financial techniques … such as derivative contracts on the UCITS’ risk profile where … used to obtain, increase or reduce exposure to underlying assets.

It is supposed to cover the risks not captured in the Risk Number – they should be mutually exclusive! In this regard, it is worth noting that the SRRI Risk Number is a volatility number. It does not indicate the level of leverage. It should be the material risk, specific to the fund, that merits inclusion.

CHARGES FOR THE FUND

Notes:

One-off entry and exit charges – this is the maximum in %. You can make statement that investor may pay less and to contact your distributor to discuss.

On-going charges –

– CESR lists on-going charges to include in the on-going charges. This doesn’t include transaction charges, soft-commissions, margin calls etc. or performance fees.Performance Fee –

– You can cross refer to prospectus for full description of performance fee and calculation methodology.There is also a requirement to disclose the performance fees charged for the latest twelve month period if a performance fee exists for the class. This can be to the date of the last audited accounts or the date to which the costs of the KIID are prepared e.g. 31/12. A sample disclosure would be “During the year ended 31 December 2020, the impact of performance fees charged to the shareclass was 0.02% of average NAV of the period.”

Below is the extract from UCITS Reg Article 12.3 which outlines the requirement.

3. Performance fees shall be disclosed in accordance with Article 10(2)(c). The amount of the performance fee charged during the UCITS’ last financial year shall be included as a percentage figure.

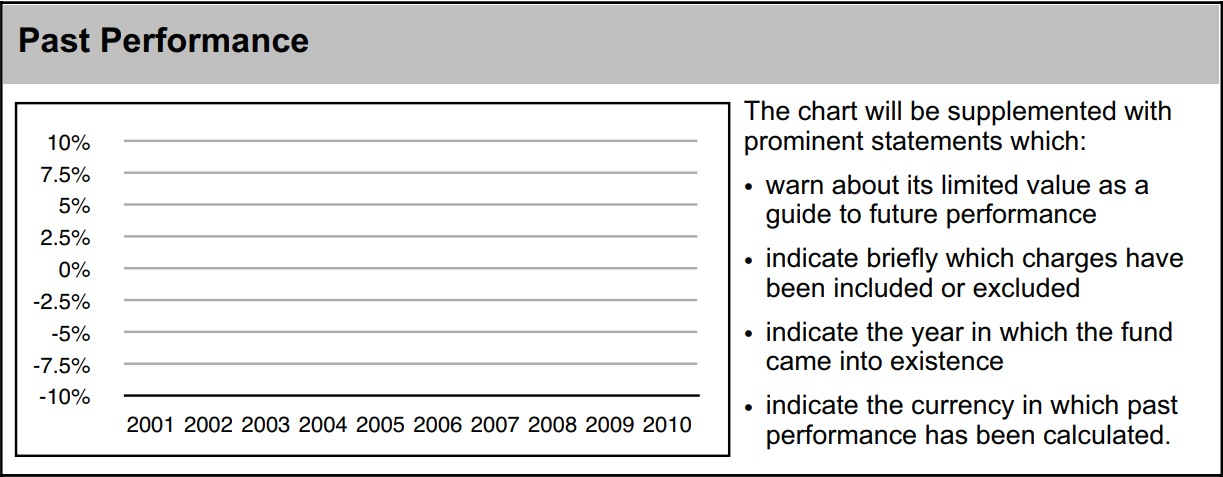

PAST PERFORMANCE

Article 15 of the Regulation provides:

This is graphical information in bar chart format covering the performance for the last 10 years.

The bar chart must not exceed half a page in the KIID

UCITS with performance of less than 5 complete calendar years shall use a presentation covering the last 5 years only

For any years for which data is not available, the year shall be shown as blank with no annotation other than the date.

For a UCITS which does not yet have performance data for one complete calendar year, a statement shall be included explaining that there is insufficient data to provide a useful indication of past performance to investors.

Narrative

The narrative should include:

a warning guide on future performance;

a brief indication of included and excluded charges

Year of inception of the UCITS

Currency of past performance

Benchmark

Where there is benchmark, then this must include a bar showing the performance of a benchmark alongside each bar showing the UCITS past performance. Benchmark performance must not be shown for years in which fund did not exist.

This must cover one complete calendar year, with annual update 35 days after 31 December, regardless of UCITS tear end date

ESMA 10-530 provides detail on the selection and presentation of performance scenarios.

Dormant Period

Where a class has a dormant period, it is not permissible to show performance for that period. It is standard practice to disclose the period of dormancy so investors understand why the graph has a gap.

For example, standard wording could be:

“The Class was dormant from 2nd November 2019 to 6th February 2020 and accordingly no performance is shown for the affected years.”

PRACTICAL INFORMATION

This practical information includes:

Name of the depositary

Where to obtains documents and NAV price

Tax Statement of the UCITS’ home state

The managements company’s liability for the KIID’s content

Information on umbrella fund

If not based on representative shareclass, include information on class of share

Disclosure of the member state of domicile, supervisory authority and date of KIID publication.

Note: You are able to refer to the Prospectus for further information.