Institutional investment managers who hold at least $100 million in market value of qualifying securities are required to file a 13F Report within 45 days of each calendar quarter.

It must be submitted in xml format via the SEC’s EDGAR platform.

Relevant securities are those published on the SEC website. The list is only available in pdf format and only based on CUSIP, not ISIN.

A. Background

SEC section 13(f) and SEC Rule 13f provide that every “institutional investment manager” that uses the United States mail (or other means or instrumentality of interstate commerce) in the course of their business and which exercises “investment discretion” with respect to accounts holding section 13f securities having an aggregate fair market value on the last trading day of any month of any calendar year of at least $100,000,000 shall file a report on Form 13F with the Commission within 45 days after the last day of such calendar year and within 45 days after the last day of each of the first 3 calendar quarters of the subsequent calendar year.

B. Summary of Requirements

1. WHO MUST FILE A FORM 13F

Institutional investment managers that use the United States mail in the course of their business and that exercise investment discretion over USD100 million or more in Section 13(f) securities must file a Form 13F.

An institutional investment manager is an entity that either invests in, or buys and sells, securities for its own account, or a natural or legal entity exercising investment discretion over the account of any other natural person or entity. Institutional investment managers can include investment advisers, banks, insurance companies, broker-dealers, pension funds, and corporations. A trustee will also be considered an institutional investment manager. However, the SEC has confirmed a natural person who exercises investment discretion over his or her own account will not be considered an institutional investment manager.

Institutional investment managers eligible to submit a form 13(f), which utilise sub-adviser(s) are required to consider their sub-advisory agreements to determine responsibility for Form 13F filings. A 13f notice indicating that other reporting managers are required to report holdings on their behalf may need to be submitted.

2. WHAT SECURITIES TO REPORT ON FORM 13F

Section 13(f) securities are equity securities of a class described in Section 13(d)(1) of the Securities and Exchange Act. Generally, the list includes exchange-traded (e.g., NYSE, AMEX, NASDAQ), equity options and warrants, shares of closed-end investment companies, and certain convertible debt securities. Shares of open-end investment companies (i.e., mutual funds) are not to be included on Form 13F. Shares of exchange-traded funds (“ETFs”), however, are on the Official List and are required to be included in the 13F report.

Below is a summary of which securities to include or exclude from the report:

| INCLUDED ON REPORT | EXCLUDED FROM REPORT | |

|---|---|---|

| GENERAL |

Securities on Official List of Section 13(f) Securities * Positions as of trade date (not settlement date) |

Securities not on the Official List Positions less than 10,000 shares and holdings of under $200,000 (both need to be met) Securities of the Manager or of a controlled entity are not relevant for the 13F AUM Threshold, but inclusion in the 13F Report is optional |

| FOREIGN ISSUER | Only if traded on US exchange or quoted on NASDAQ (typically identifiable by having a CINS number which appears on the 13F list) ** |

“Pink sheet” ADRs Securities traded on non-US exchanges |

| SHORT POSITIONS | N/A | NB: Netting of long & short positions not permitted. (Report long positions only) |

| FUNDS | Closed-Ended Investment Companies & ETF’s | Open ended Funds (Mutual Funds) not included. |

| DEBT | Convertible Debt | Non-Convertible Debt |

| LOANED SECURITIES | Securities loaned to a third Party | Securities borrowed from a third party |

| OPTIONS (CALLS AND PUTS) | Options held | Options written (e.g. short positions are not reported) |

| SWAPS & WARRANTS | Swaps & Warrants held | Those not resulting in investment manager exercising investment discretion over the underlying) |

* The current list of 13(f) securities can be found by following the below link: http://www.sec.gov/divisions/investment/13flists.htm

** An extension to the CUSIP numbering system, which is used to uniquely identify securities offered outside of the United States and Canada. Just as with CUSIP numbers, the CINS number consists of nine characters. International securities, whether corporate or municipal, are identified by a CINS number. CINS is an abbreviation for CUSIP International Numbering System.

3. WHEN TO FILE FORM 13F

Form 13F must be filed no later than 45 days after the end of the March, June, September, and December quarters. If the filing deadline falls on a weekend or a holiday, then your filing is due on the next business day. (Tip: The filing deadlines are Eastern time. Managers in other time zones should note that filings submitted after 5:30 p.m. Eastern time will receive a filing date of the next business day.)

Initial Filing for first-time filers: When holdings have reached the threshold of USD100 million in 13(f) securities as of the last trading day of any month during a calendar year for the first time, an initial Form 13F report for the December quarter of that year (within 45 days after the end of the quarter) is required to be submitted. You will then need to submit filings for the 3 subsequent quarters (March, June, and September) of the following calendar year, even if the market value of your Section 13(f) securities falls below USD100 million.

Final Filings: You must submit filings for the first 3 quarters of the calendar year following the year in which the market value of your Section 13(f) securities falls below the USD100 million threshold.

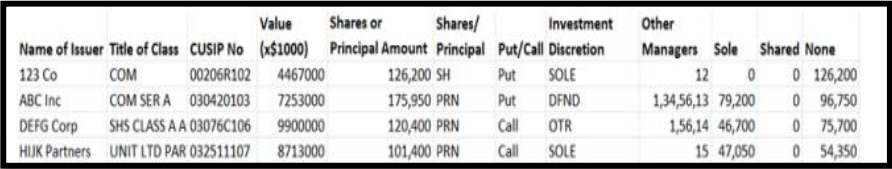

4. THE FORM

Form 13F is a single EDGAR document with 3 parts:

Cover Page;

Summary Page; and

Information Table ( 12 Column XML report as below which is attached as a separate document)

5. PREPARING THE 13F REPORT

Below are some miscellaneous points in respect of how the report must be produced, together with some specific points in respect of options.

Miscellaneous

Some points of note include:

The “name of issuer” and “title of class” appearing in the report need to be the official namings from the 13F list, not other descriptions from Bloomberg, Reuters etc.

The value reported to be rounded to the nearest dollar value rather than nearest one thousand dollars.

The CUSIP appears in the 13F list split out as, for example, B38564 10 8. In the Report, it needs to appear as a single 9 digit string of text, e.g. B38564108.

For options (Call/ Puts), a manager should use the CUSIP number of the underlying securities to which the option relates

Not all the CUSIPs appearing on the 13F list are valid CUSIPs

There should be no holdings on the report with a negative figure in “Shares or Principal amount”

The Shares/Principal column should typically be populated as “SH” except for convertible debt where you would expect them to be populated as “PRN”

Options

The treatment of Options is noteworthy.

For determining whether an investment manager exceeds the 13F AUM threshold, options are considered at the value of the options. Only long options are included; long options are purchased puts and calls. Options with a negative value are included at zero value. Securities of the Manager or controlled entity are additionally excluded from the calculation.

Populating the 13F Form:

Only purchased options are included;

Options are included at the value of the underlying assets, without any delta adjustments. For Options, the “Value (*$1000)”is populated throughout to be the same as Number of contracts * contract size * Price of the underlying asset (converted into USD and divided by 1000);

The CUSIP, name of issuer and title of class appearing in the 13F Report should be those of the underlying of the option not those of the option itself (the details for both the option and the underlying appear on the 13F List); and

Options maturing as at the quarter end date do not need to be reported.

6. FILING A FORM 13F

You can submit either of:

A full XML which includes the Cover page, Summary page and Information Table; or

an XML for the Information Table only, in which case the content for the Cover page and Summary page gets manually entered into EDGAR.

Where you do not have an automated solution, there is a relatively simple process to convert excels into the required XML format.

The Form must be filed electronically using the SEC’s EDGAR system. To file through EDGAR, you will need a Form ID, the EDGAR Filer Manual, and EDGARLink software, all of which are available through the SEC’s website.

The filer needs a Central Index Key (CIK) and CIK Confirmation Code (CCC) to submit documents to the EDGAR system and provide access to online tools and secure SEC websites. These SEC EDGAR Filer Access Codes are created by the SEC and provided when a company or individual registers with the SEC as an EDGAR filer. Filer codes consist of five unique sets of numbers; four provided by the SEC and, one created by the registrant.

Please follow this link for instructions on submitting a request to the SEC for EDGAR access codes.

An agent can make the filing on your behalf. In this case, the agent needs to be registered with EDGAR as a filing agent and needs to have obtained a CIK. To do this, the agent needs to have signed the relevant form on the company letterhead and have it notarised.

SEC GUIDANCE

The SEC’s Division of Investment Management has responded to Frequently Asked Questions about Form 13F at: