None

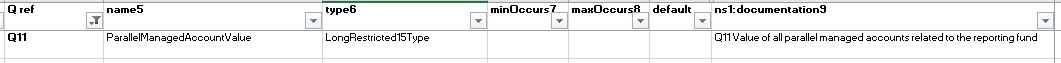

Q. 11.1: I manage a parallel managed account that holds derivatives in its investment portfolio. When calculating the value of the parallel managed account to determine whether it is a dependent parallel managed account subject to aggregation according to Instruction 5 or reporting the value of the parallel managed account related to a reporting fund in Question 11, am I required to calculate the gross notional value of the derivatives held in the parallel managed account, even if I report such derivatives at market value to my clients?

A. 11.1: No. When calculating the value of a parallel managed account for purposes of either determining whether it is a dependent parallel managed account that is aggregated with the reporting fund or reporting its value in Question 11, you should use the market value of the derivatives held in the parallel managed account, instead of the gross notional value, if that is how the value of the account is reported to the account holder. (Posted July 19, 2012)