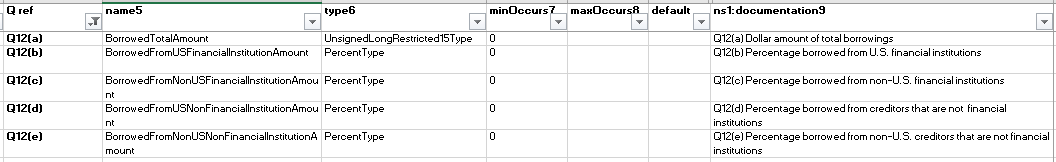

None

Q. 12.1: Questions 12 and 43 ask for information regarding the value of a fund’s borrowings. In addition to traditional lending activity, what other types of transactions should I consider to be borrowings for purposes of these questions?

A. 12.1: For purposes of Questions 12 and 43, borrowings should include secured borrowings, unsecured borrowings, as well as synthetic borrowings, but would not include leverage embedded through the use of derivatives. The types of borrowing that would be reported include, but are not limited to: (i) selling securities short, (ii) securities lending transactions, (iii) reverse repurchase agreements, (iv) transactions in which variation margin is owed, but as a result of not reaching a certain set threshold, has not been paid by a fund, or (v) transactions involving synthetic borrowings (e.g., total return swaps that meet the failed sale accounting requirements). (Posted July 19, 2012)

Q. 12.2: If selling securities short is considered a borrowing for purposes of Questions 12 and 43, how should I calculate the value of a short transaction?

A. 12.2: In determining the value of a borrowing that includes selling a security short, “value” means the value that is reported internally and to current and prospective investors of the fund that is selling the security short. See Instruction 15.

For example, assume on the first data reporting date a fund borrows $100 from its prime broker to purchase $100 worth of Security A and borrows $50 worth of Security B from its prime broker to sell short, and then, on the second data reporting date, Security A is marked to $120, Security B is marked to $60, and the fund posts to the prime broker $8 in cash collateral. For purposes of calculating the value of the fund’s borrowings for Question 12 and 43, the fund’s borrowings on the first data reporting date would be $150, which consists of the $100 borrowed from the prime broker to purchase Security A and $50 from the short sale of Security B. With respect to the second data reporting date , the value of the fund’s borrowings would be $160, which consists of the $100 from the purchase of Security A and the $60 from the short sale of Security B and excludes the $8 collateral pledged by the fund in accordance with the instructions to Questions 12 and 43, which require that a fund not net out amounts that the fund loans to creditors or the value of collateral pledged to creditors . (Posted July 19, 2012)

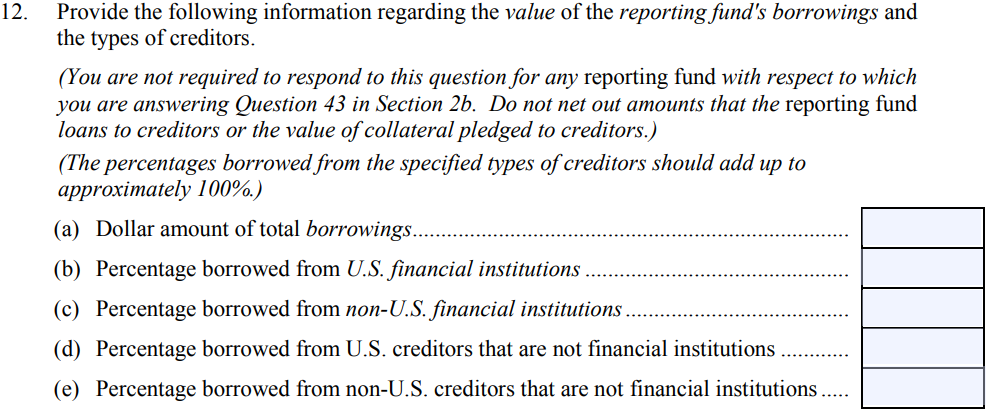

Q. 12.3: Question 12 asks for certain information regarding the value of the reporting fund’s borrowings. I report similar information for qualifying hedge funds in Question 43. Should I also complete Question 12 for these qualifying hedge funds?

A. 12.3: No. You are not required to complete Question 12 for any reporting fund with respect to which you are answering Question 43 in Section 2b. If you answer Question 43 with respect to a reporting fund, you should leave each part of Question 12 blank. (Posted February 12, 2014)