None

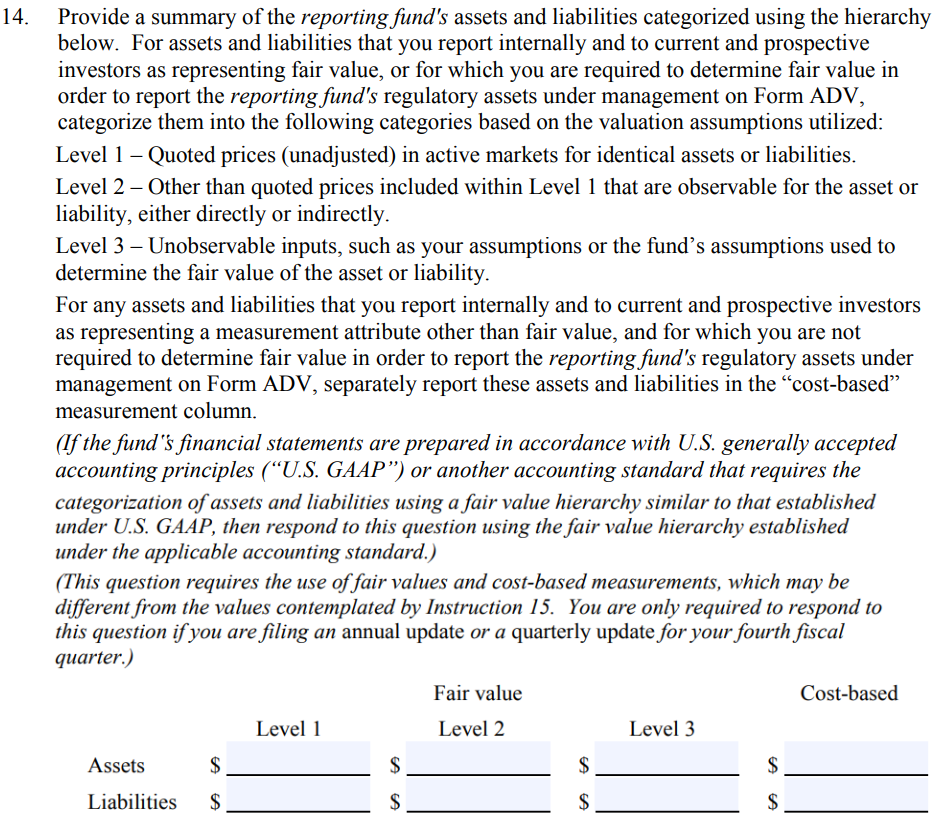

Q. 14.1: When filing my annual update or a quarterly update for my fourth fiscal quarter, Question 14 requires me to provide a summary of the reporting fund’s assets and liabilities categorized using the hierarchy described in the question. Am I required to categorize each asset and liability in accordance with this hierarchy?

A. 14.1: No. You are only required to categorize in accordance with the hierarchy described in Question 14 those assets and liabilities that are required to be presented in the reporting fund’s financial statements at fair value (regardless of whether the reporting fund is actually audited). (Posted April 25, 2013)

Q. 14.2: In the cost-based column in Question 14, should I include those assets and liabilities that are not reported at fair value and therefore are not reflected in the fair value hierarchy, such as certain receivables and payables?

A. 14.2: Yes. You should include assets and liabilities in the cost-based column that would be presented in a fund’s financial statements using a measurement attribute other than fair value. See Investment Advisers Act Release No. 3308, footnote 210. As a result, the sum of the amounts entered in the assets row of Question 14 should approximate the reporting fund’s gross assets reported in Question 8 at the time of reporting (except for funds with uncalled commitments included in their gross assets, in which case the sum of the values in the assets row of Question 14 will equal the gross assets minus the uncalled commitments amount because such amounts are not reflected as assets on a fund’s balance sheet). Also, the sum of the amounts in the liabilities row of Question 14 should approximate the total liabilities reported on the fund’s financial statements. If an asset or a liability is reported as representing fair value, but the fair value of the asset or liability is equal to its cost, then that asset or liability should still be categorized in the fair value hierarchy and should not be included in the cost-based column. (Updated February 12, 2014)

Q. 14.3: Should I include cash and cash equivalents when providing a summary of a reporting fund’s assets and liabilities in Question 14?

A. 14.3: Yes, according to FAQ 14.2, the sum of the amounts entered in the assets row of Question 14 should generally approximate the reporting fund’s gross assets reported in Question 8 at the time of reporting (except in the case of funds with uncalled commitments). Accordingly, cash should be included in the cost-based column and cash equivalents should be included in the applicable column in the fair value hierarchy or the cost-based column, depending on the nature of the cash equivalents. (Posted February 12, 2014)