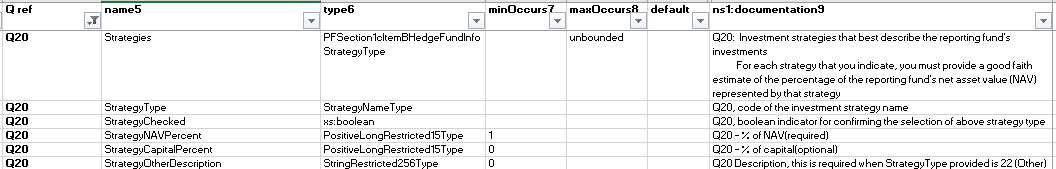

Q20 & Q27 should not have any empty fields, if no value is applicable, then Zero (0) has to be filled in.

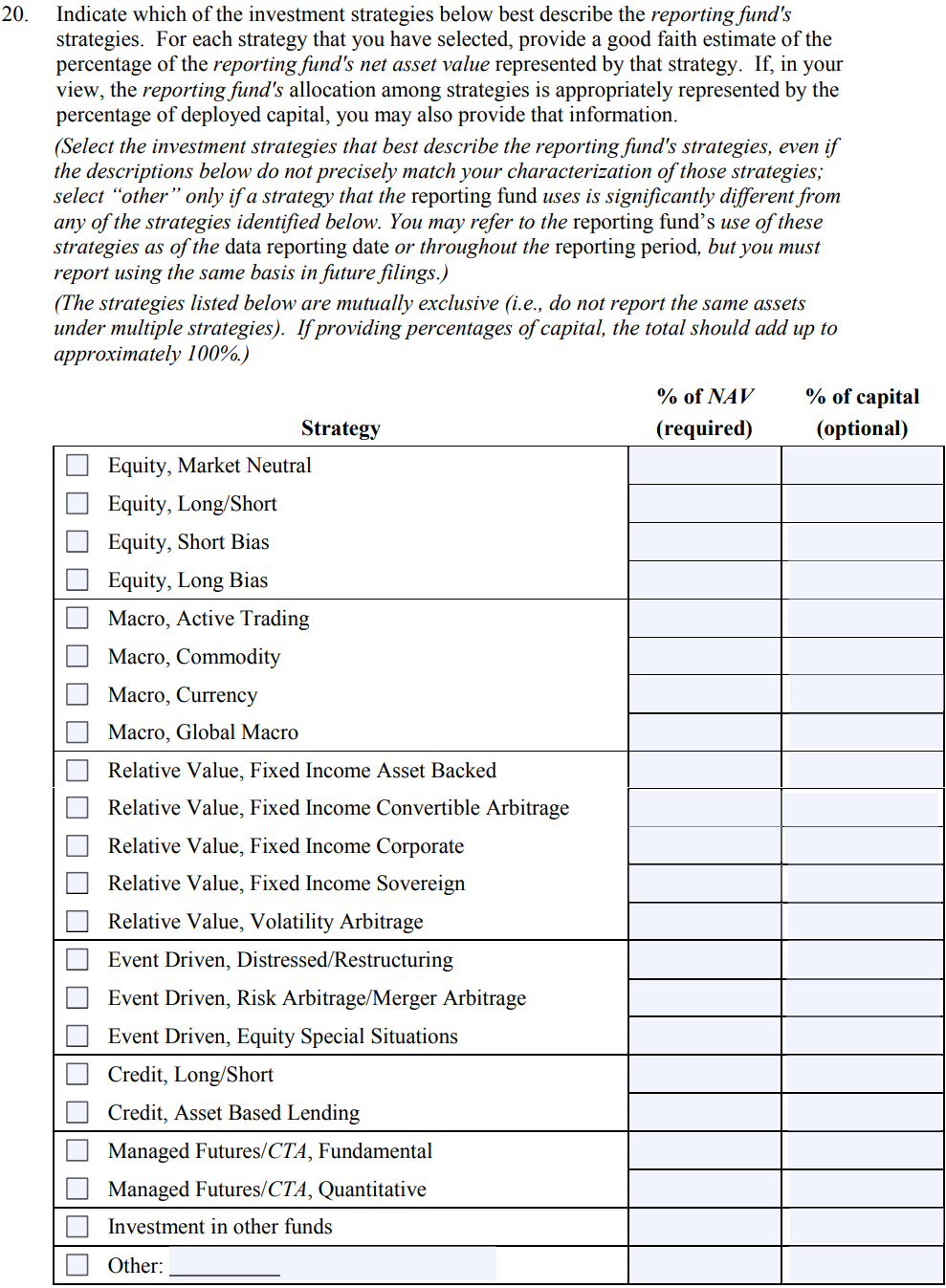

Investment strategy must sum to 100.

The percentage of NAV is a required field and the % of capital is an optional field.

Any investment strategy’s not being used on the portfolio can be removed from the XML. Populating zeros and N/A’s will lead to errors in the XML upload.

If a field is blacked out lie in the description column above the field will not appear in the XML.