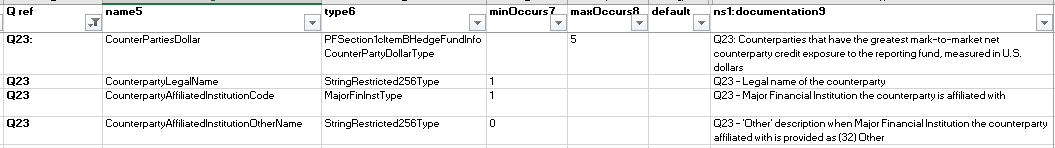

If there are no Counterparties to report for these two questions they can be removed from the XML.

It is possible if the fields are not populated in the excel they will not be generate in the XML.

If there are no Counterparties to report for these two questions they can be removed from the XML.

It is possible if the fields are not populated in the excel they will not be generate in the XML.

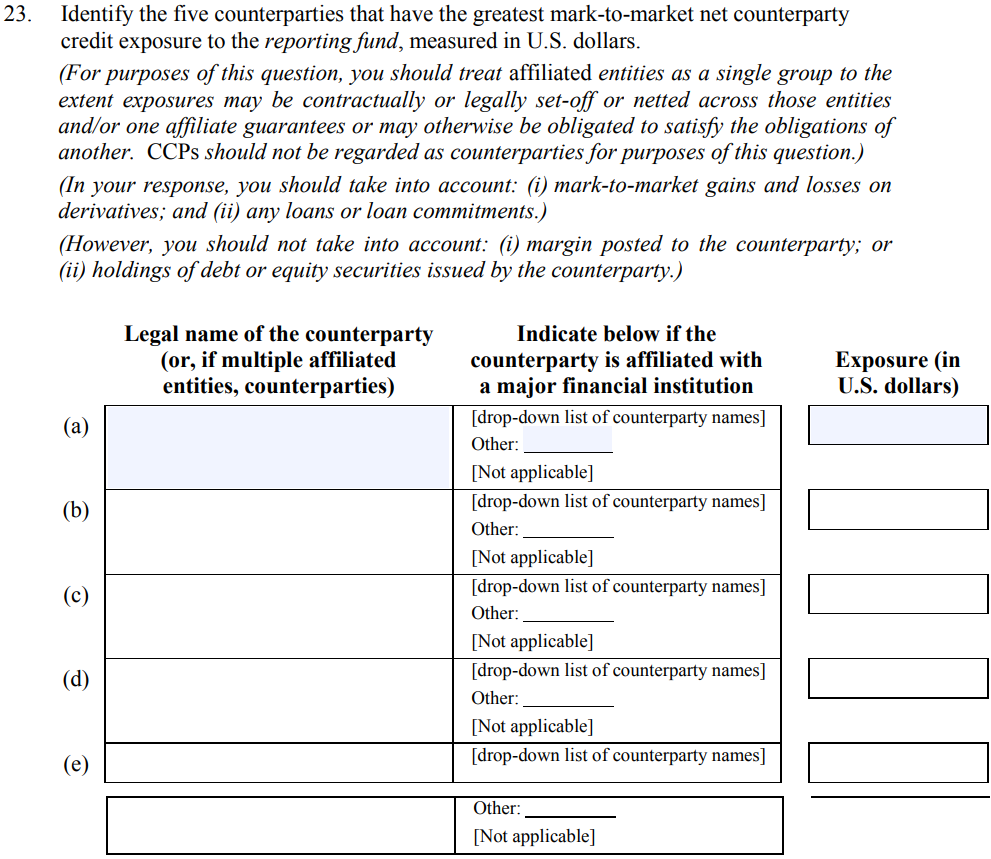

Q. 22.1: Questions 22 and 23 ask for information about the counterparty credit exposure of a fund. Should I include the value of securities held by a fund’s custodian or prime broker or the value of any open futures positions or the amount of excess margin at a futures commission merchant (“FCM”) when responding to these questions?

A. 22.1: As the instructions to Questions 22 and 23 indicate, these questions are designed to report over-the-counter derivatives positions, loans, and loan commitments. As a result, you should not include assets held in custody at any custodian or prime broker (that are not otherwise held as collateral by such custodians or prime brokers as derivative counterparties or lenders), nor should you include futures positions or excess margin held at an FCM in the account of the private fund when responding to these questions. (Posted July 19, 2012)

Q. 22.3: Questions 22 and 23 ask for the top five counterparties to which a fund has the greatest counterparty credit exposure and the top five counterparties which have the greatest counterparty credit exposure to the fund, respectively. If a private fund that I manage uses five different counterparties to engage in securities lending, short transactions, reverse repurchase agreements, repurchase agreements, and over-the-counter derivatives transactions that are not centrally cleared, how should I account for these transactions in Questions 22 and 23?

A. 22.3: Questions 22 and 23 focus on a fund’s counterparty credit exposure and the instructions to these questions state that you should not take into account any margin posted by or to the counterparty. As a result, you should report the following for each type of transaction identified:

Securities lending – the current market value of the securities the fund has lent to the counterparty in Question 22. You do not include any collateral that it has received from the counterparty;

Short transactions – the current market value of the security that the fund has sold short in Question 23(see Q.12.2 above for more details). You do not include any cash proceeds received as a result of the transaction;

Reverse repurchase agreements – the amount of cash received from the counterparty in Question 23. You do not include the amount of any collateral posted to the counterparty;

Repurchase agreements – the amount of cash lent to the counterparty in Question 22. You do not include the amount of any collateral posted by the counterparty;

Non-cleared derivatives transactions with an unrealized gain – the amount of the unrealized gain on the transaction in Question 22. You exclude the amount of any collateral posted by the counterparty or the fund; and

Non-cleared derivatives transactions with an unrealized loss – the amount of the unrealized loss on the transaction in Question 23. You exclude the amount of any collateral posted by the counterparty or the fund. (Posted July 19, 2012)

Q. 22.4: A private fund that I manage has open over-the-counter derivatives positions with two swap dealers that are unaffiliated with one another. The fund’s set-off positions with the first swap dealer have a net gain of $50,000, but the set-off positions with the second swap dealer have a net loss of $25,000. How should I account for these positions for purposes of Questions 22 and 23?

A. 22.4: You should not net positions across different counterparties unless such entities are affiliated with one another and netting is permitted by the instructions to Question 22 or 23. Because the fund you manage is not permitted to net its positions across the two unaffiliated swap dealers, you would report the $50,000 position in Question 22. Further, the $25,000 unrealized loss position would be reported in Question 23 because the second swap dealer has a net counterparty credit exposure to the fund . (Posted July 19, 2012)

Q. 22.5: The instructions to Question 22 and 23 state that I should not take into account margin posted by or to a counterparty for purposes of identifying the top counterparties to which a fund has the greatest counterparty credit exposure and the top counterparties that have the greatest counterparty credit exposure to the fund, respectively. Does this instruction mean I should not take into account either initial margin or variation margin?

A. 22.5: For calculating responses for Questions 22 and 23, you should not include amounts attributable to either initial margin or variation margin. You would, however, include initial margin and variation margin as appropriate for purposes of responding to Questions 36 and 37, which are based on the counterparties identified in Questions 22 and 23, respectively, and must be completed by large hedge fund advisers for each qualifying hedge fund.

For example, assume a fund you manage has entered into a derivative position with a counterparty with whom you have an ISDA agreement in place and the following sequence of events occurs: (i) the fund posts $1 million of initial margin to the counterparty; (ii) the fund incurs a $400,000 unrealized gain on the derivative position; and (iii) the fund then receives $200,000 of variation margin from the counterparty. For purposes of Question 22, you should report the $400,000 unrealized gain and disregard the collateral. For purposes of Question 23, you would not report any amount for this counterparty because the fund has a mark-to-market gain. If you are a large private fund adviser and the fund is a qualifying hedge fund required to complete Section 2b, you would report that the fund has received $200,000 in Question 36 because the counterparty paid $200,000 to the fund. You would not, however be required to report any amount in Question 37 because the counterparty was not listed in Question 23. (Posted July 19, 2012)