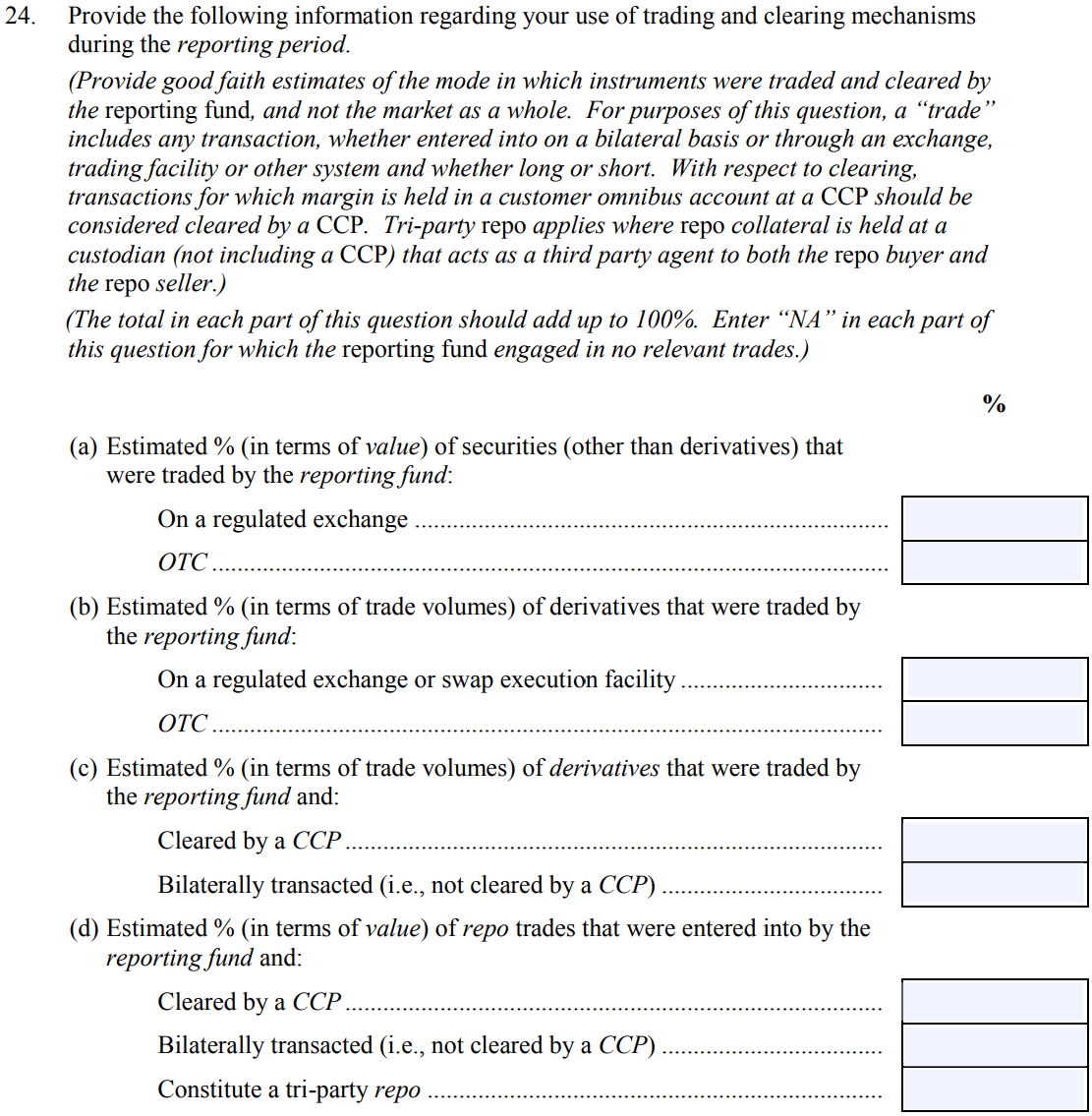

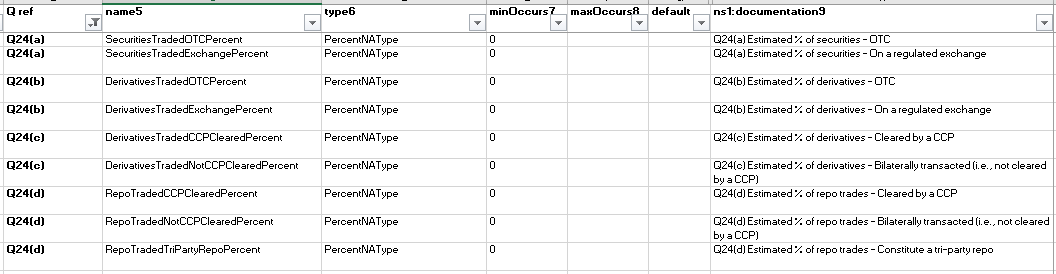

Q. 24.1: One of our reporting funds has entered into an exchange-traded futures contract through an FCM that is a clearing member of the exchange. How should I report this transaction for purposes of Question 24 and Question 39?

A. 24.1: For purposes of Question 24, the transaction would be classified as a derivative and therefore included in response to Questions 24(b) and 24(c). For purposes of Question 24(b), because the transaction was traded on an exchange , the transaction would be included under the sub-heading “On a regulated exchange or swap execution facility . ” In addition, because the transaction was cleared through the exchange, for purposes of Question 24(c), it would be included under the sub-heading “Cleared by a CCP.”

Question 39, however, asks whether the reporting fund “directly” cleared any transactions through a CCP. Because the fund is not a clearing member and it did not directly clear through the CCP, you would respond “No” to Question 39 if this is the reporting fund’s only derivative transaction. (Posted June 29, 2012)

Q. 24.2: How should I calculate the percentage of derivatives trade volume in Questions 24(b) and 24(c) for a fund?

A. 24.2: In determining the trade volume percentage of derivatives trades for purposes of Questions 24(b) and 24(c), you should use the weighted-average of the notional amount of the aggregate derivatives transactions (except for options, in which case you would use the delta adjusted notional value, and interest rate derivatives, in which case you would use the 10-year bond equivalent) entered into by the fund during the reporting period. For example, assume the reporting fund only entered into the following three trades during the reporting period:

(i) purchased contracts of gold on the futures exchange worth $50,000, (ii) entered into an over-the-counter interest rate swap that was cleared by a CCP with a 10-year bond equivalent of $1,000,000, and

(iii) purchased an over-the-counter call option that was not cleared by a CCP with a delta equivalent of $500,000. You would compute the fund’s trade volume as follows:

(i) For Question 24(b), because the futures transaction was the only transaction that was traded on a regulated exchange or swap execution facility, the fund should report 3% ($50,000/$1,550,000) on the first line and 97% ($1,500,000/$1,550,000) on the second line.

(ii) For Question 24(c), because the futures transaction and the interest rate swap were cleared by a CCP, the fund should report 68% ($1,050,000/$1,550,000) on the first line and 32% ($500,000/$1,550,000) on the second line. (Posted March 8, 2013)

Q. 24.3: For Questions 24(b) and 24(c), I am reporting trade volume by using the weighted-average of the notional amount of the aggregate derivatives transactions, but have found it operationally difficult to provide the delta adjusted notional values for options and 10-year bond equivalents for interest rate derivatives. May I instead use the gross notional values for such options and interest rate derivatives when calculating my responses to these questions?

A. 24.3: Yes, but you should provide a notation in Question 4 explaining the use of gross notional values. (Posted August 8, 2013)