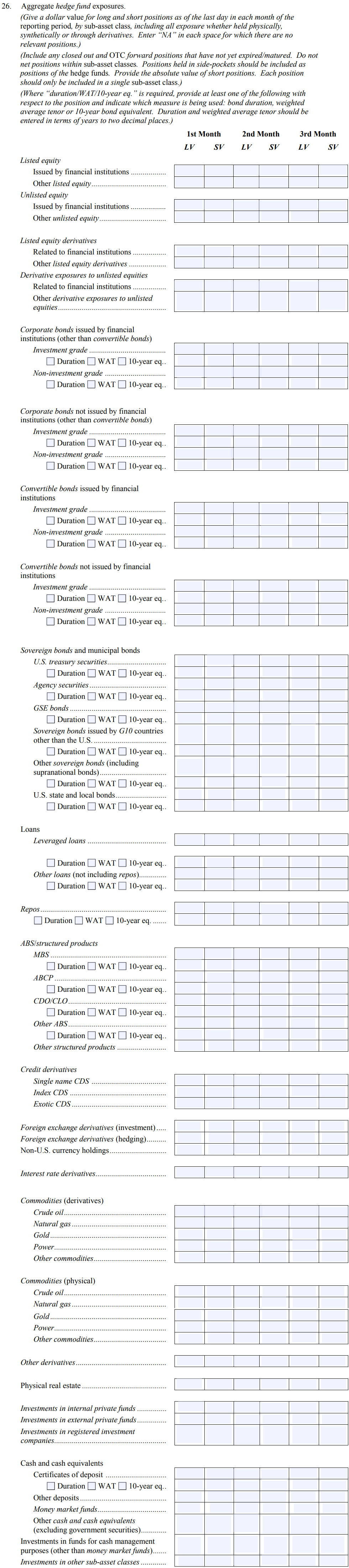

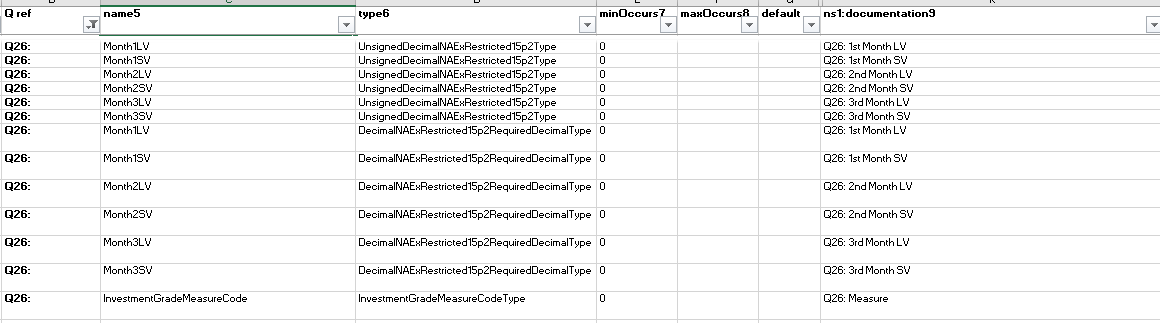

Q. 26.1: Questions 26 and 30 ask for hedge fund exposures to “listed equity derivatives. ” Does “listed” refer to whether the derivative is listed or whether the equity asset underlying the derivative is listed?

A. 26.1: The term “listed equity derivatives” refers to the fund’s exposures to derivatives for which the underlying asset is listed equities. For example, if a fund has purchased an over-the-counter option from a bank on the equity securities issued by a software company that are listed on a regulated exchange, you would include the delta adjusted notional value of the option under the sub-heading “other listed equity derivatives” identified under the “listed equity derivatives” asset class. (Posted June 29, 2012)

Q. 26.2: How should I account for a position of a fund that could accurately be classified in multiple sub-asset classes identified in Questions 26 and 30?

A. 26.2: Because the instructions to these Questions note that any particular position should only be included in a single sub-asset class, you should choose the sub-asset class that describes the position with the highest degree of precision. For example, a Canadian currency position should be included in the “non-U.S. currency holdings” sub-asset class even though the definition of “cash and cash equivalents” includes non-U.S. currencies. (Posted June 29, 2012)

Q. 26.3: The definitions for certain fixed-income asset and sub-asset classes in Questions 26 and 30 require us to include certain types of derivatives on the particular asset or sub-asset classes when measuring exposure for such asset or sub-asset class. See “corporate bonds,” “convertible bonds,” “GSE bonds,” and “sovereign bonds”. Should we also include derivative exposures when measuring exposures to each of the sub-asset classes under the “ABS/structured products” asset class (i.e., “MBS,” “ABCP,” “CDO/CLO,” “Other ABS,” and “Other structured products”)?

A. 26.3: Yes. The instructions to Question 26 and 30 specify that you should include all exposure whether held physically, synthetically, or through derivatives. For example, you should categorize a forward position on a mortgage-backed security in the “MBS” sub-asset class in the “ABS/structured products” asset class and report the notional amount of the forward position. (Posted March 8, 2013)

Q. 26.4: Instruction 15 states that, unless otherwise specifically indicated, the value of derivatives (other than options) should be reported in terms of such derivatives’ gross notional value. The definition of “interest rate derivative”, however, requires filers to present this information in terms of 10-year bond equivalents. How should I report a reporting fund’s exposure to interest rate derivatives in Questions 26 and 30?

A. 26.4: Because Instruction 15 applies unless otherwise specifically indicated, you should follow the requirement in the definition and report the exposure of interest rate derivatives in terms of 10-year bond equivalents. (Posted March 8, 2013)

Q. 26.5: Should I report the value of a reporting fund’s Reverse Repos as the Short Value (SV) in the “Repo” sub-asset class in Questions 26 and 30?

A. 26.5: Yes, the amount of cash borrowed via Reverse Repos should be considered the short value (SV) of Repos when reporting the exposures in Questions 26 and 30. You should carefully review the definitions of “Repo” and “Reverse Repo” in the Glossary of Terms. If a reporting fund sells a security with an agreement to repurchase such security at a later date at an agreed upon price, then such arrangement is defined as a “Reverse Repo” and is considered a borrowing. See also FAQ 12.1. On the other hand, if a reporting fund purchases a security together with an agreement to sell such security at a later date at an agreed price, then such arrangement is defined as a “Repo” and is not considered a borrowing. (Posted February 12, 2014)