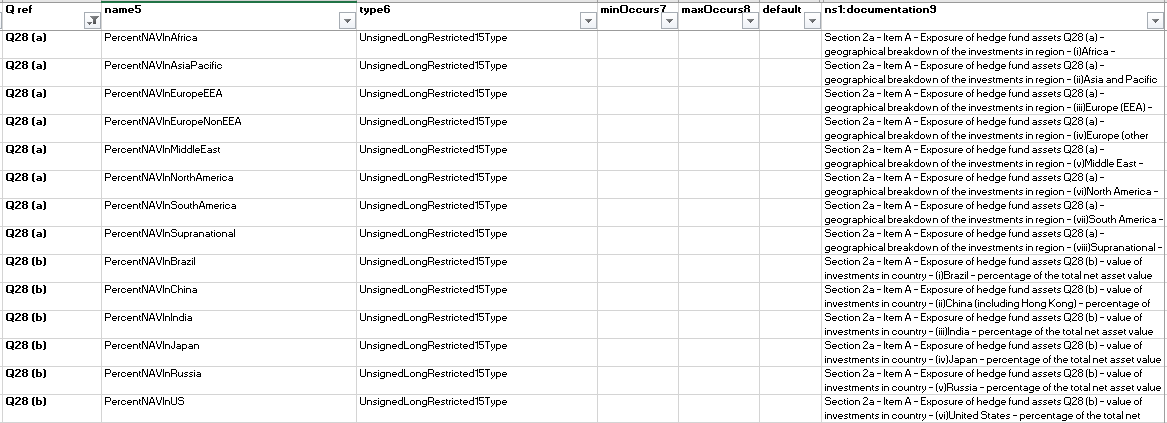

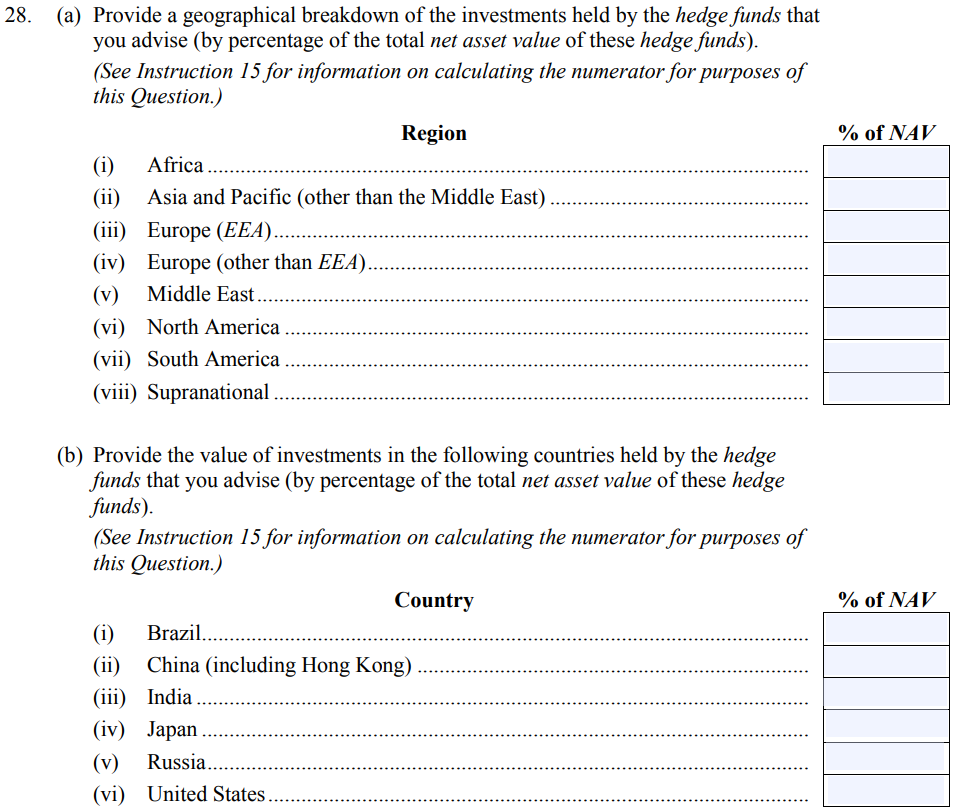

For question 28 part (a) must sum to 100 however part (b) does not need to sum to 100.

For the XML conversion you will need to ensure part (b) sums to 100 and then manually update the XML to the correct figure.

For question 28 part (a) must sum to 100 however part (b) does not need to sum to 100.

For the XML conversion you will need to ensure part (b) sums to 100 and then manually update the XML to the correct figure.

Q. 28.1: Questions 28 and 78 require large private fund advisers to provide a geographical breakdown of the investments held by certain private funds they advise. For purposes of these Questions, how should I treat, for example, a derivative in which the underlying asset is an equity security issued by a Canadian company that the private fund enters into with a French bank?

A. 28.1: In responding to Questions 28 and 78, you have flexibility to determine how to report the geographical area of investments. You are permitted to classify such investments in a manner that is consistent with your internal methodologies and the reporting of such information to investors. See Instruction 15. You may want to describe these assumptions in Question 4. For instance, in the example above, you could classify the geographical breakdown of such an investment as either exposure to North America or to Europe, depending on how you classify the exposure internally and report the information to investors, and you could note this treatment in Question 4. (Posted June 29, 2012)

Q. 28.2: Mexico is geographically considered to part of North America, but for purposes of our own risk assessments, we treat it as part of South America. May I report exposures to Mexican securities under the South America category in Questions 28 and 78?

28.2: Where such flexibility is allowed, you can respond to Questions using your own internal methodologies provided the information is consistent with information you report internally and to investors and explain such methodologies in Question 4. See Instruction 15. As a result, if your internal risk assessments and reports to investors consistently treat exposures to Mexican securities as exposure to South America, then you may report any such investments under the “South America” category, and you may note such treatment in Question 4. (Posted June 29, 2012)