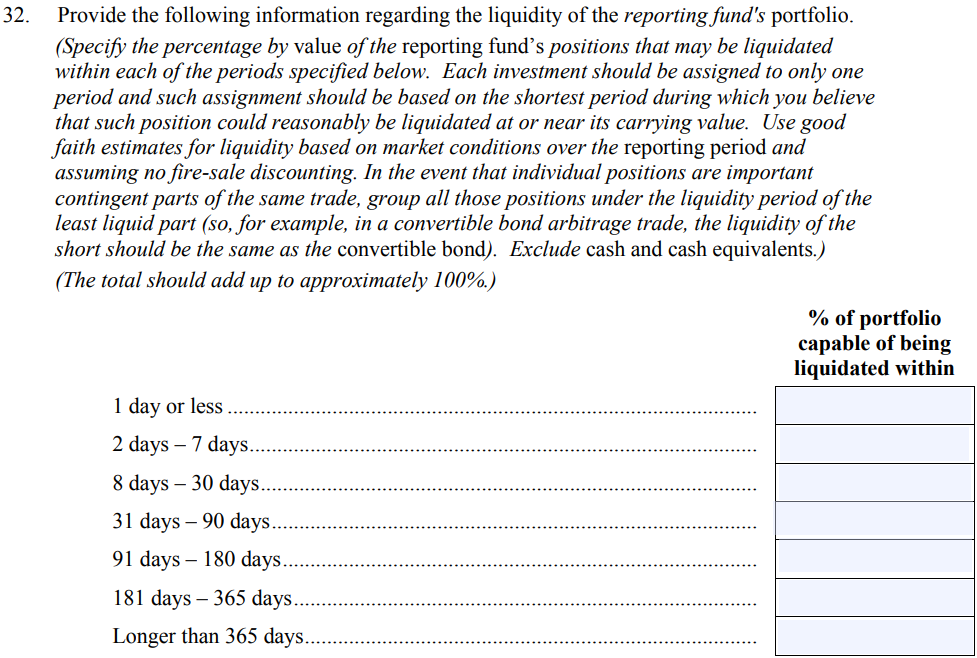

Portfolio liquidity should sum to 100.

Q. 32.1: Question 32 asks about the liquidity of the reporting fund’s portfolio. The instructions to that question state that I should exclude cash and cash equivalents from the response. If my reporting fund only holds cash and cash equivalents, however, how should I respond to Question 32?

A. 32.1: If your reporting fund only holds cash and cash equivalents, report that 100% of the portfolio is capable of being liquidated within 1 day or less. You should note in Question 4 that the reporting fund only holds cash and cash equivalents to provide context to your responses. (Posted January 18, 2017)

Q. 32.2: Question 32 asks for the percentage by value of the reporting fund’s positions that may be liquidated within specified time periods. What does the term “value” mean for purposes of Question 32?

A. 32.2: For purposes of Question 32, you should report the percentages of the portfolio’s net asset value that is capable of being liquidated in the time periods set forth in the question. (Posted January 18, 2017)

Q. 32.3: The instructions to Question 32 require excluding cash and cash equivalents. In calculating the percentage of the reporting fund’s positions that may be liquidated within each of the specified time periods, should I exclude cash and cash equivalents from both the numerator and denominator when calculating the percentages?

A. 32.3: Yes. (Posted January 18, 2017)