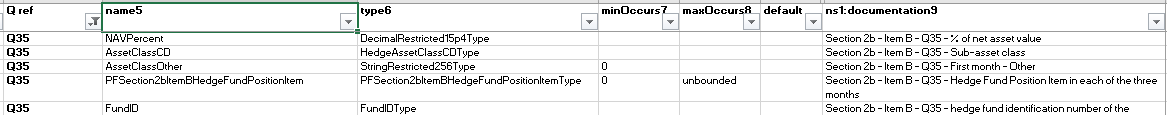

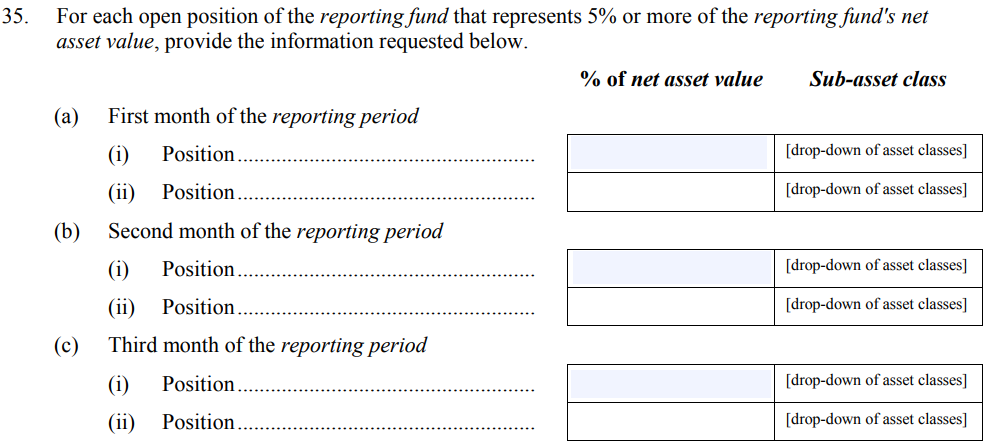

If there are no open positions that hold more than 5% of the NAV you can leave these fields blank.

The tags will be generated in the XML however it is not a required field.

If there are no open positions that hold more than 5% of the NAV you can leave these fields blank.

The tags will be generated in the XML however it is not a required field.

Q. 35.1: When reporting a reporting fund’s relevant open positions, should I report a short position that represents more than 5% of the reporting fund’s net asset value as a negative value?

A. 35.1: Yes. (Posted March 8, 2013)

Q. 35.2: Should we consider cash and cash equivalents to be a “position” for purposes of reporting open positions in Questions 34 and 35?

A. 35.2: No. You should exclude cash and cash equivalents when responding to Questions 34 and 35. The value of unencumbered cash should be reported in Question 33. (Updated January 18, 2017)