This question does not have required fields. It is ok to leave these fields black if they are not applicable.

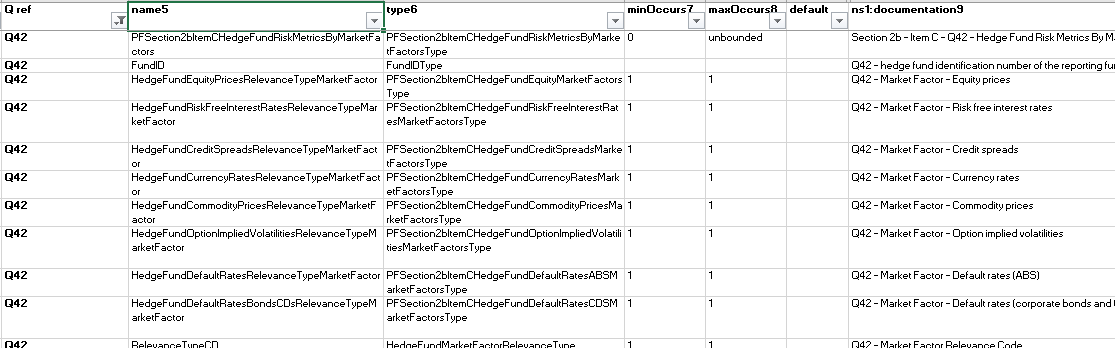

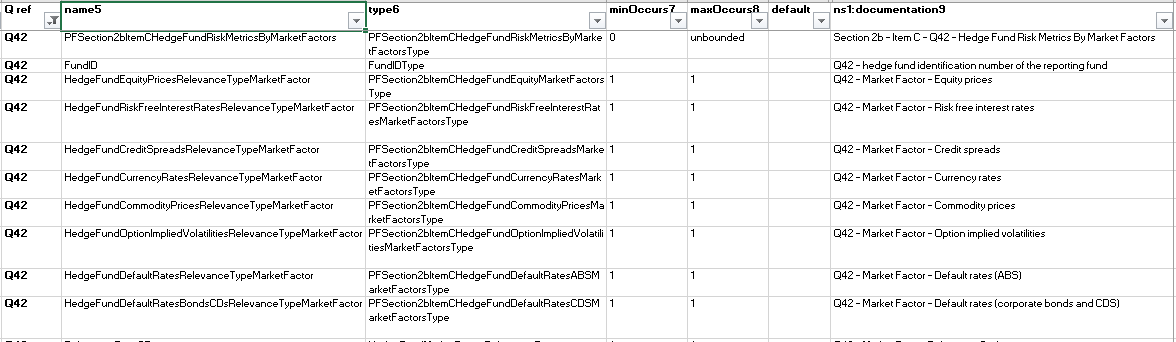

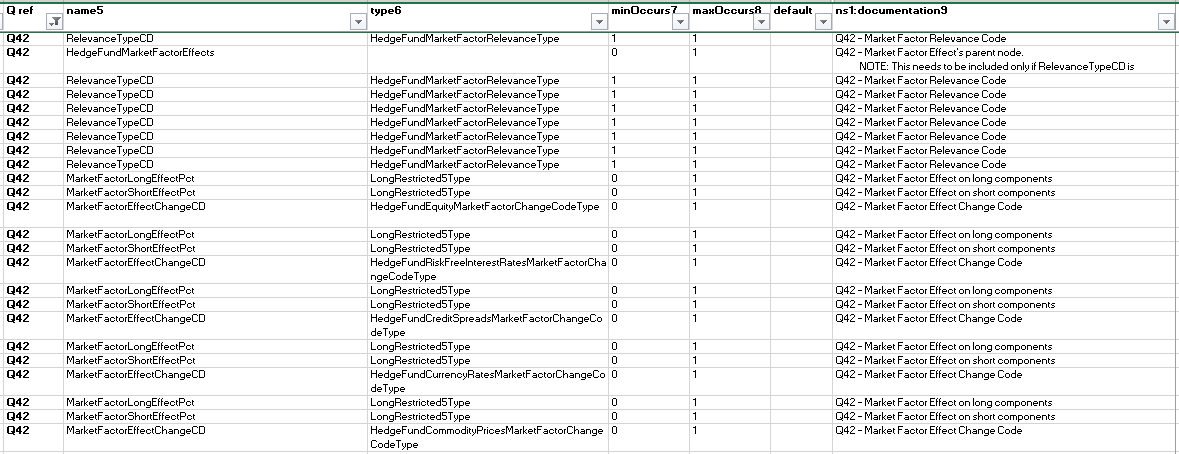

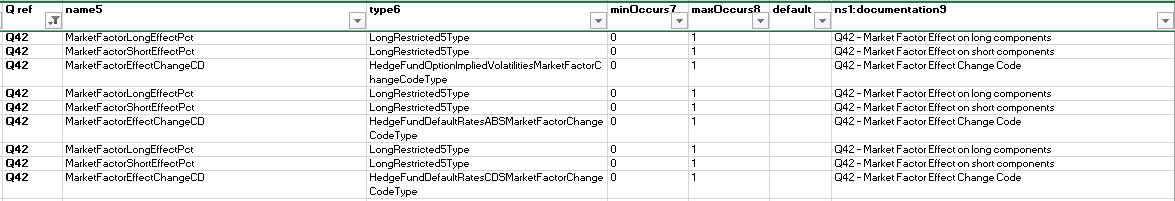

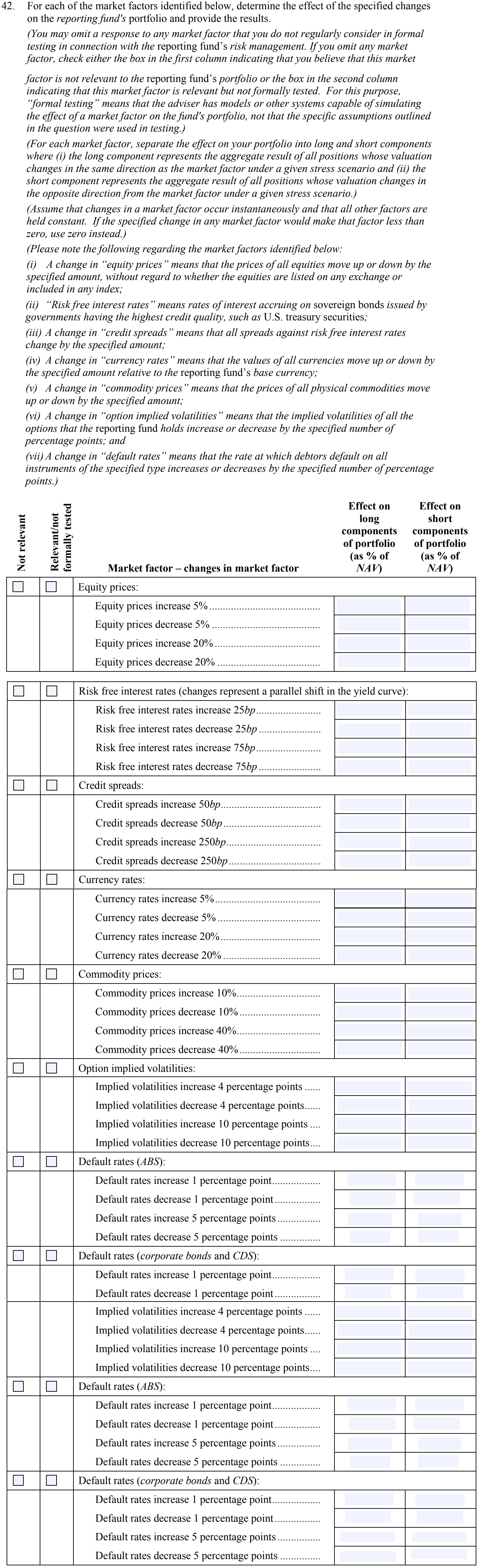

Q. 42.1: Question 42 requires an adviser to report the effect of specific changes for different market factors on a reporting fund’s portfolio if the adviser regularly considers the specified market factor in formal testing in connection with the reporting fund’s risk management. Formal testing is described to mean that the adviser has implemented systems capable of simulating the effect of a market factor, not that the specific assumptions or changes identified under each market factor in the Question were actually used in testing. While I maintain systems that are capable of simulating a market factor as part of my risk management, I do not currently use those systems to test for the factors identified in Question 42 or, even if I do test for a particular market factor, I do not test for the specific changes in the market factor identified. How do I respond to Question 42?

A. 42.1: As indicated in the instructions to Question 42, advisers are only required to report on market factors that they believe are relevant to a fund’s portfolio and have the capacity to test using their current models or other systems. For instance, if you currently have models or other systems in place as part of the risk management systems for a reporting fund that have the ability to test changes in currency rates and you believe that currency rate changes are a relevant market factor to the fund’s portfolio, but you either do not test for changes in currency rates or you test for changes other than those specified in Question 42 (i.e., increase 5%, decrease 5%, increase 20%, and decrease 20%), then you are still required to provide a response to the currency rate market factor changes specified in Question 42. (Posted July 19, 2012)