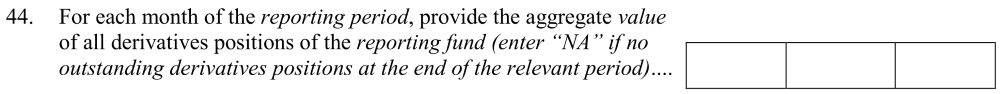

If there are no derivative positions, zeros can be populated in the XML.

Q. 44.1: One of my reporting funds has entered into several derivatives transactions with a single swap dealer. If I have an ISDA agreement in place with the swap dealer that allows me to net across all my positions, how should I report these derivatives transactions for purposes of Question 44?

A. 44.1: Question 44 requires you to report the aggregate “value” of all derivatives positions. Value is defined in Instruction 15 and requires that the fund report the gross notional value of its derivative positions without netting across positions. Instruction 15 defines “positions” and requires advisers to determine whether a set of legal and contractual rights constitutes a single “position” in a manner consistent with the fund’s internal recordkeeping and risk management procedures. In accordance with this Instruction, you may only net across your positions if doing so is consistent with your internal recordkeeping and risk management procedures, regardless of whether your ISDA agreement with the swap dealer allows netting.

Further in reporting the aggregate value of all derivatives positions in Question 44, you should not include any closed-out out positions, if those positions were closed out with the same counterparty and result in no credit or market exposure to the fund. (Posted July 19, 2012)

Q. 44.2: When reporting the aggregate value of all derivatives positions of a reporting fund in either Question 13(b) or Question 44, may I report a negative number?

A. 44.2: No. You should report the absolute value of outstanding derivatives position. (Posted March 8, 2013)