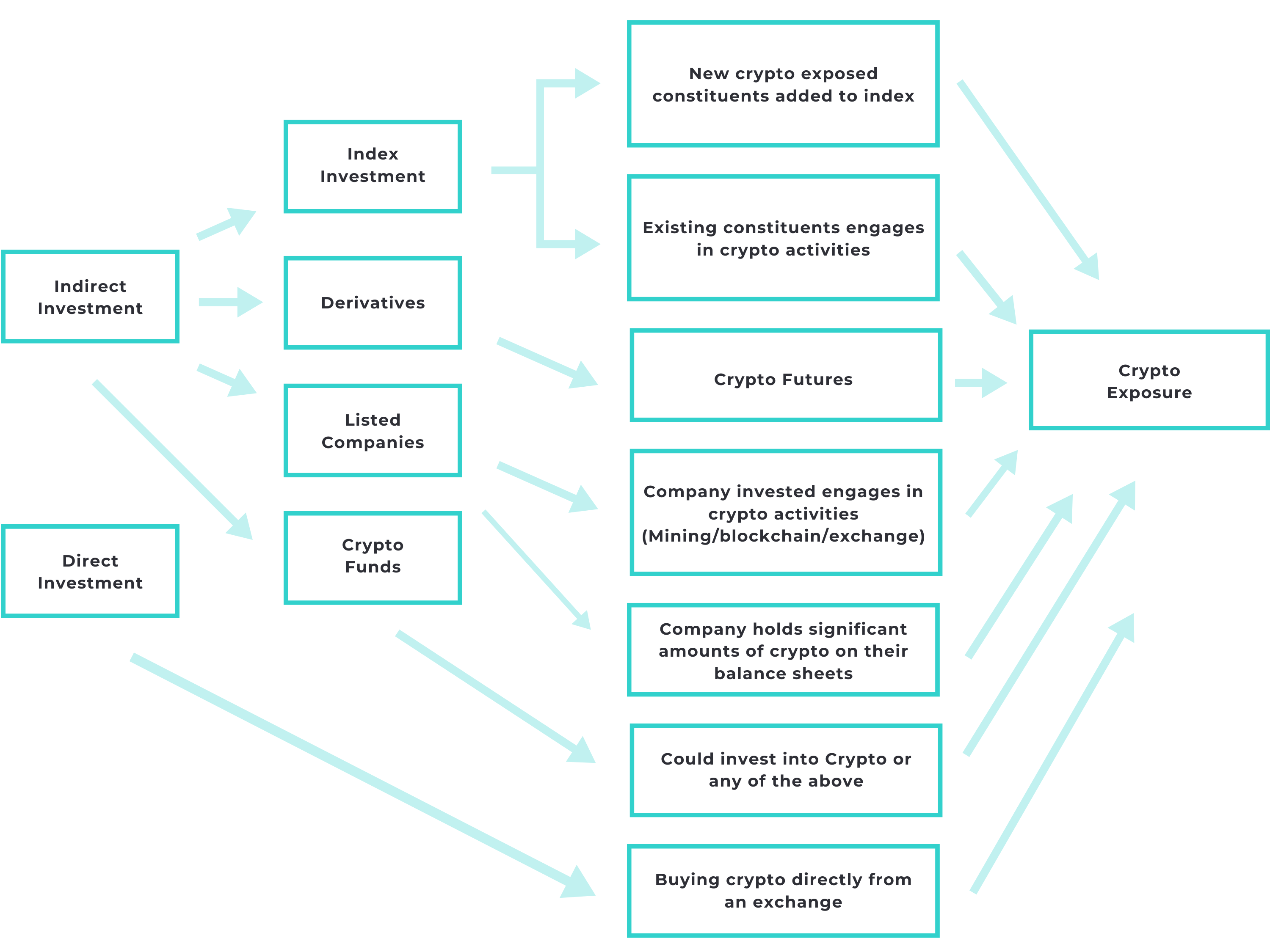

Exposure can come from:

Background

The risks related to Cryto Exposure include:

- Volatility: Prices of crypto assets rise and fall dramatically, often driven by media or social media hype, and few constraints on price manipulation exist.

- Liquidity: When trading on a crypto asset trading platform, the CTP may not have enough crypto assets to cover your order. There are also no guarantees the demand for any given crypto asset will continue, which may make it difficult to transfer your crypto assets into fiat money.

- Online Risk: Crypto asset service providers and intermediaries may exist anywhere in the world. It can be difficult or even impossible to identify or locate the service provider or intermediary and take any action if you have a problem.

- New Technology: As a relatively new technology, the public interest in or demand for crypto assets may not continue to grow or be sustainable. When a new crypto asset launches, often it is based on an idea – not a proven business model. There is no guarantee the project will succeed. There is also no certainty that crypto assets will weather future changes and challenges related to technology development, regulatory changes or political challenges.

- Technical and Cybersecurity: Technology and platforms used for crypto assets, such as online wallet companies and exchanges, are susceptible to cybersecurity threats and hacking, putting your deposits at risk. Crypto asset transactions are also at risk of delayed or failed transactions, and loss of access to your digital wallet (and your crypto assets) if you lose your password.

- Potential for Fraud: Any individual or company that trades or advises in securities or derivatives must be registered with FCNB. A CTP, depending on how it operates, may be subject to securities regulation. Some CTPs claim to be registered businesses, but this is not the same as being registered with a securities regulator. Always check registration with the National Registration Search tool.

Direct vs. Indirect Exposure