In this section we have some trouble-shooting formation in respect of AIFMD Annex IV Reporting, including in respect of:

- XML validation errors

- AIFM Report

- AIF Report

In this section we have some trouble-shooting formation in respect of AIFMD Annex IV Reporting, including in respect of:

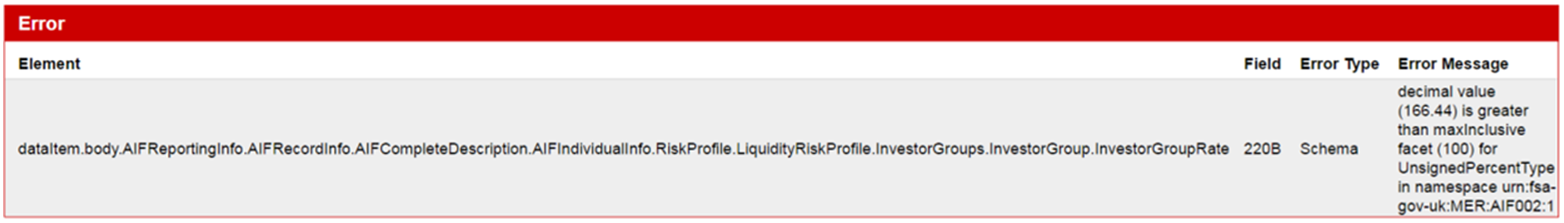

Below is an example of a GABRIEL pre-validation error where we have the presence of values of greater than 100 for variable data e.g. investor groups, investor concentrations etc.

This is a data issue that should not be corrected in the XML. Instead the user should aim to correct this data in the file uploaded to FundWare which contains such data.

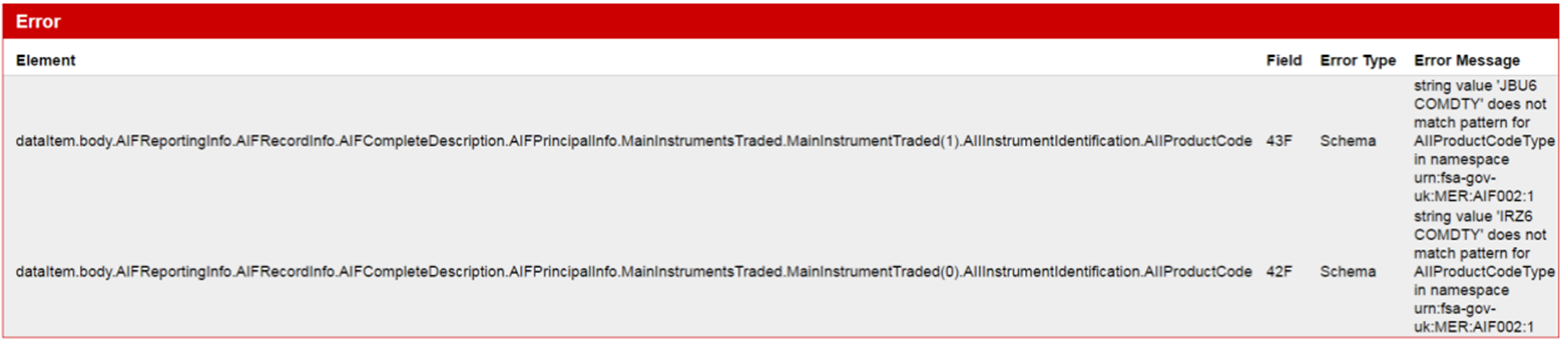

AII product codes will cause schema errors in GABRIEL where these codes do not meet the specified criteria. An example of such an error is shown below.

They should remove the space in the AII product code.

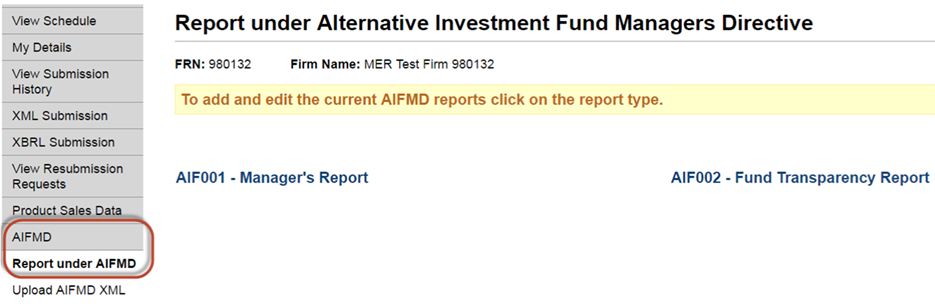

To see the return once it has successfully passed pre-validation, follow the below instructions:

The below errors are identifying that we have identified in the trades section of the AIF 24(2) report; that there are derivatives cleared through a CCP, but not reported any central counterparty exposure at the reporting period end date.

There are two options:

The error shown below indicates that the data uploaded in the Scheme Investors file has not been properly checked and confirmed as summing to exactly 100.

To resolve, the user must edit the file upload to meet the stated requirement.

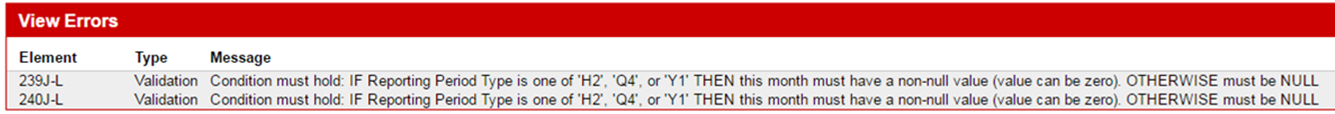

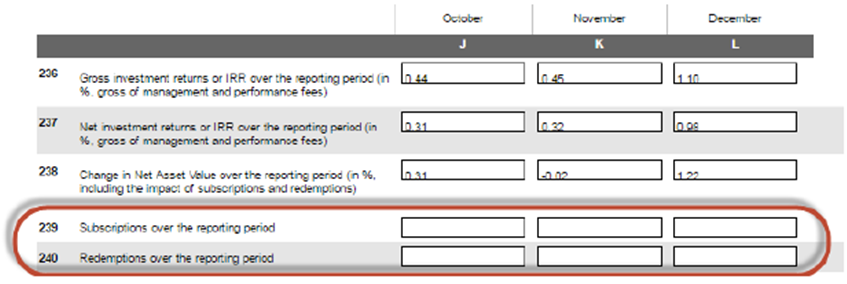

Shown below is an error indicating that there is some of variable data missing – in this case, for Q4.

The first step is to navigate to the relevant section of GABRIEL to identify the missing data elements.

Once the missing data has been identified, the correct data should be uploaded into FundWare via the appropriate file mapping. Once the data has been successfully uploaded the user will be required to regenerate the XML files from FundWare and then upload this new XML file to GABRIEL.

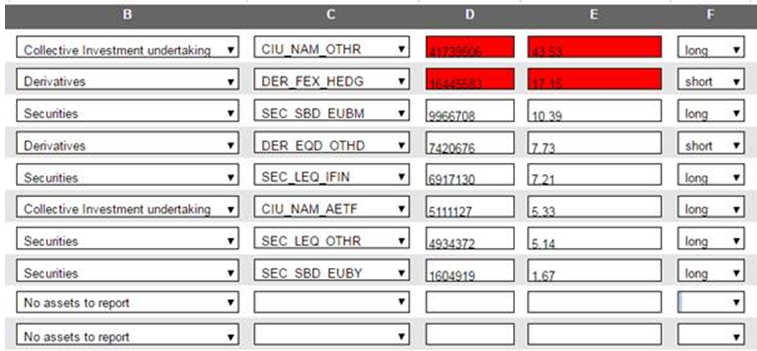

The error received below suggests that GABRIEL is recognising a rounding error between the aggregated value reported and the percentage reported.

If this error appears, remove the smallest record where less than 1% as shown below.

Resubmit this with the record removed, as shown below where the security accounting for 0.7% has now been removed.