Please also ensure you do your VLOOKUP back to your list of expecting funds so that all reporting funds appear in the files. Your lookup should be both ways – checking your file against your list of expecting funds, and your list against your file. This must be done prior to upload.

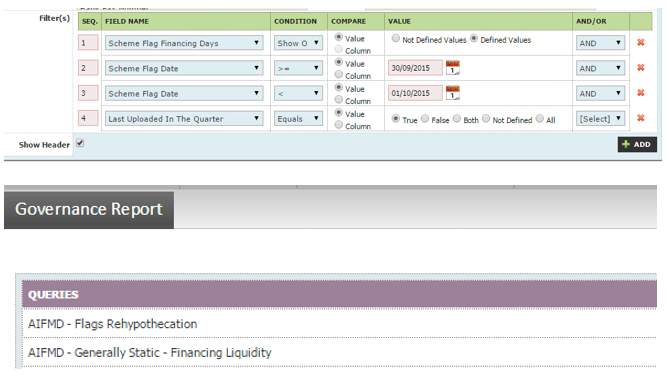

This check is to upload and test the generally static data for AIFMD clients.

This includes:

- Funding sources

- Stress test results

- Financing liquidity

- Investor liquidity

- Prime brokers

- Investment strategy

- Disclosure assumptions

- Master/feeder status

Please bring forward the files that have been uploaded in the previous quarter and run the governance reports, checking for anomalies, before asking your clients to perform the same checks.

Please bring forward the files that have been uploaded in the previous quarter and run the governance reports, checking for anomalies, before asking your clients to perform the same checks.

Before uploading the below files, the date must be changed in both the workbook and worksheet names, but also in the date column in the spreadsheet body:

- AIFMD_Financing – for financing liquidity – value for each fund must sum to 100%. For a NURS this will be 100% in 181-365 days. Must be uploaded for all reporting funds.

- AIFMD_InvestorLiquidity – for investor liquidity – value for each fund must sum to 100%. For a daily pricing fund this will be 100% in 2-7 days. Must be uploaded for all reporting funds.

- AIFMD_IPB – for prime brokers – N/A for a NURS fund. If no prime brokers, no need to upload.

- AIFMD_ISC – for investment strategy – value for each fund must sum to 100%. The investment strategy must conform to that available depending on the Predominant AIF Type (field in scheme master). Please refer to the ESMA tables in the below Appendix. The AIFMD investment strategy must be uploaded for all reporting funds.

- AIFMD_FHDA – (as applicable) for any disclosures in the AIFM report – likely to be N/A for the BAU clients. If N/A, no requirement to upload. Check whether this has previously been uploaded for the client. If so, ask them to confirm whether they want any comments uploaded. If not, you can work on the basis they do not wish to upload any assumptions.

- AIFMD_SCDA – (as applicable) for any disclosures in the AIF report – likely to be N/A for the BAU clients. If N/A, no requirement to upload. Check whether this has previously been uploaded for the client. If so, ask them to confirm whether they want any comments uploaded. If not, you can work on the basis they do not wish to upload any assumptions.

- AIFMD_IMF – to identify the master fund for any feeder funds (may not be applicable for all). If N/A, no requirement to upload.

- AIFMD_ReH – for rehypothecation – False and 0 for a NURS fund. Must be uploaded for all reporting funds.

For stress tests and funding sources, this can be edited in the scheme master. If this requires done on a large scale, this can be done by way of custom attribute upload – please ask a Manager for assistance.

Run the above governance report and confirm that for the relevant quarter-end, the data in the reports reflects what has been uploaded.

Once again, you will need to do your two-way VLOOKUP – between your list of funds and the governance report, and then from the governance report to the list of funds, to ensure a scheme does not drop off.

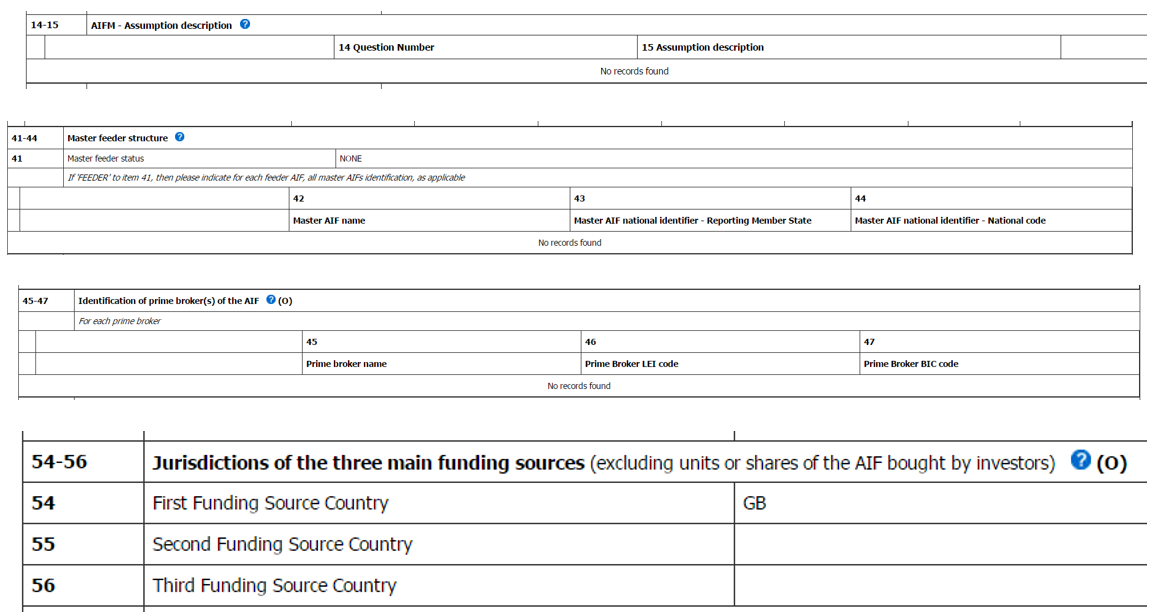

Please run a sample AIF report and confirm that all the uploaded data elements are reflecting correctly in the relevant section of the report:

| a) Hedge Fund Strategies | ||

|---|---|---|

| (Complete this question if you selected ’Hedge Fund’ as the predominant AIF type in item 57. Report only relevant sub strategies.) | ||

| Equity: Long Bias | EQTY_LGBS | |

| Equity: Long/Short | EQTY_LGST | |

| Equity: Market Neutral | EQTY_MTNL | |

| Equity: Short Bias | EQTY_STBS | |

| Relative Value: Fixed Income Arbitrage | RELV_FXIA | |

| Relative Value: Convertible Bond Arbitrage | RELV_CBAR | |

| Relative Value: Volatility Arbitrage | RELV_VLAR | |

| Event Driven: Distressed/Restructuring | EVDR_DSRS | |

| Event Driven: Risk Arbitrage/Merger Arbitrage | EVDR_RAMA | |

| Event Driven: Equity Special Situations | EVDR_EYSS | |

| Credit Long/Short | CRED_LGST | |

| Credit Asset Based Lending | CREDA_LGST | |

| Macro | MACR_MACR | |

| Managed Futures/CTA: Fundamental | MANF_CTAF | |

| Managed Futures/CTA: Quantitative | MANF_CTAQ | |

| Multi-strategy hedge fund | MULT_HFND | |

| Other hedge fund strategy | OTHR_HFND | |

| b) Private Equity Strategies | ||

| (Complete this question if you selected ‘Private Equity’ as the predominant AIF type in item 57. Report only relevant sub strategies.) Indicate the private equity strategies that best describe the AIFs strategies |

||

| Venture Capital | VENT_CAPL | |

| Growth Capital | GRTH_CAPL | |

| Mezzanine Capital | MZNE_CAPL | |

| Multi-strategy private equity fund | MULT_PEQF | |

| Other private equity fund strategy | OTHR_PEQF | |

| c) Real Estate Strategies | ||

| (Complete this question if you selected ‘Real Estate’ as the predominant AIF type in item 57. Report only relevant sub strategies.) Indicate the real estate strategies that best describe the AIFs strategies |

||

| Residential real estate | RESL_REST | |

| Commercial real estate | COML_REST | |

| Industrial real estate | INDL_REST | |

| Multi-strategy real estate fund | MULT_REST | |

| Other real estate strategy | OTHR_REST | |

| d) Fund of Fund Strategies | ||

| (Complete this question if you selected ‘Fund of Funds’ as the predominant AIF type in item 57. Report only relevant sub strategies.) Indicate the ‘fund of fund’ strategy that best describe the AIFs strategies |

||

| Fund of hedge funds | FOFS_FHFS | |

| Fund of private equity | FOFS_PRIV | |

| Other fund of funds | OTHR_FOFS | |

| e) Other Strategies | ||

| (Complete this question if you selected ‘Other’ as the predominant AIF type in item 57. Report only relevant sub strategies.) Indicate the ‘other’ strategy that best describe the AIFs’ strategies |

||

| Commodity fund | OTHR_COMF | |

| Equity fund | OTHR_EQYF | |

| Fixed income fund | OTHR_FXIF | |

| Infrastructure fund | OTHR_INFF | |

| Other fund | OTHR_OTHF | |