You will be testing liquidity for AIFMD and asking clients to mirror the checks we have performed.

Below is the email to clients in respect of AIFMD Liquidity Testing. The Liquidity Test Script details the check that must be performed and is available in Sheet 6 of your preparation tracker.

You must perform this testing yourselves and confirm that all instruments are assigned to an AIFMD Liquidity bucket, there are no blanks and that everything looks reasonable prior to sending to the client. Please fill your preparation tracker in as you go, raising any issues with a Manager for resolution.

Please note that for Artemis we do not use liquidity in FundWare and instead they provide us with a file to upload. You can fill the Audit in as N/A and there will be a specific section for Artemis at the end to be filled in. Instead of conducting the below check, you should instead upload the file and run the AIF report to ensure the numbers tie in to what has been uploaded.

Please be aware that liquidity will differ from client to client and therefore the liquidity test script will not be exactly tailored to each client’s custom attributes. It may be that your client e.g. puts all ETFs in the 1 day or less bucket instead into buckets depending on its CIS type etc. This is not necessarily wrong – liquidity is tailored to suit an individual client’s viewpoint. In this case, so long as the classification is not widely different to the test script, and the custom attribute is bucketing all the assets that fall into this category together correctly, this is not an issue. Use your judgement to determine whether a classification is appropriate – you will all have some form of exceptions to the test script. Please do not make any amendments to the custom attributes. Instead, please mark up anything that looks incorrect in the holding export report, make a comment in the relevant section of the test script, and at the end you can raise any queries or issues with a Manager.

Checking back to the AIF report

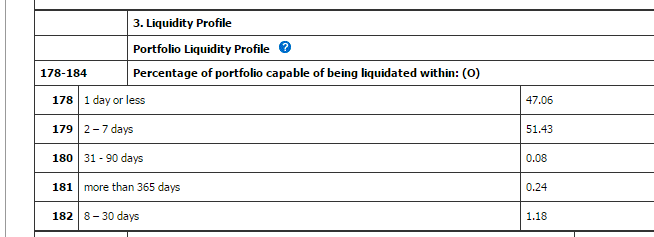

Once all assets are classified correctly, you should perform a check to ensure the data is reflecting correctly in the AIF report. Run the Liquidity Monitoring Report for the AIFMD buckets for the quarter end for the relevant funds. Run the AIF report (fields 178-184, which is 24(2)) for several funds and reconcile the two sets of numbers – they should be the same, subject to minor rounding differences. Any differences must be raised with a Manager. The analysis must be saved as part of the governance around this. Please note that any differences may be a result of check 16 not being completed for your client. The liquidity section of the AIF report is based on a % of NAV, so therefore, if the NAV tolerance is not equal to 100% for the AIF you are reviewing, then the figures within the AIF report will not reconcile to the Liquidity Monitoring Report.