In order to test and validate the AIFMD sub-types, you should:

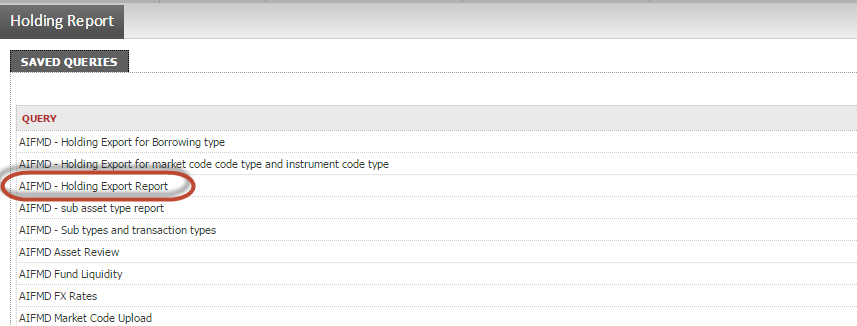

· Run the AIFMD Holdings export report

So far, as part of the AIFMD preparations, you checked the security data set-up in a series of tests, including:

Key to the AIFMD Report is that each holding is then auto-assigned to a certain AIFMD sub-type. There are calculations in the Annex IV report that rely on each holding having this categorisation – if any of the categorisations are wrong or there are any blanks, this will mean the reports are wrong. This is done via custom attribute definitions within FundWare. You need to perform some high-level testing that these seem appropriate. You then need to send the below email to clients.

In order to test and validate the AIFMD sub-types, you should:

· Run the AIFMD Holdings export report

· Filter on the column “Sub Asset Type Name” and ensure that it is populated throughout and that there are no blanks – to resolve blanks, you will need to edit custom attributes. Please discuss any blanks with a Manager and do not make any changes to custom attributes.

· Run through the set-of tests set-out in the “AIFMD sub-asset type checklist” worksheet within the “AIFMD Preparation and Testing Tracker” excel to test that each instrument is assigned to correct AIFMD Sub-types.

· Check that each sub-type maps to the both the correct AIFMD Asset Type and AIFMD Macro Asset Type and that there are no blanks – the list of these is available in the “AIFMD sub-asset type checklist” available within the preparation tracker. Log comments beside each entry in the checklist, highlighting where something doesn’t appear to be classifying correctly

If there are any instruments that you think are incorrectly classified, please advise a Team Lead and we will resolve together, either through amending the Rule Custom Attributes or by using the custom attribute dropdowns in the security master.

Before raising with this a Team Lead, please ensure that you have reviewed all classifications and identified what the correct sub asset type should be.

Please note that the DerivCP and DerivCPOffset lines should be classed as other cash and cash equivalents – SEC_CSH_OTHC.

For funds, we must be careful to have regard to whether the investment into a CIS is a CIS managed by the Manager. There are three sub-asset types relating to CIS managed by the manager (AIFM):

1. Investment in CIU operated/managed by the AIFM – Money Market Funds and cash management CIU

2. Investment in CIU operated/managed by the AIFM – ETF

3. Investment in CIU operated/managed by the AIFM-Other CIU

Any funds that are managed by the AIFM itself (note that the reference is to the AIFM, therefore it can only include the AIFs managed – not the UCITS) must be classed as one of the three above.

For any CIS identified as being in one of the 3 sub asset types above, these assets must be risk-free for Article 3 exposure to prevent double-counting at the AIFM level (i.e. counting Fund 1’s investment into Fund 2, and Fund 2’s use of the investment from Fund 1 to purchase assets).

Once satisfied that everything is now classing correctly, including approval of any changes and risk-free assets, the below email can be sent to your client.

For any security that has been identified as a listed equity you need to also ensure that these securities have been given a 4-digit MIC code in your market code check (Check 9).

Therefore, anything with a sub-asset type of:

· Listed equities issued by financial institutions (SEC_LEQ_IFIN)

· Other listed equity (SEC_LEQ_OTHR)

Must have a 4-digit MIC code populated e.g. XLON or XNYS. There can be none with a Market Code of OTC, XXX or blank.

If any security that has one of the two sub asset types assigned but does not have a 4-digit MIC code applied, you must go back and correct this using your AIFMD_MKTCD file.