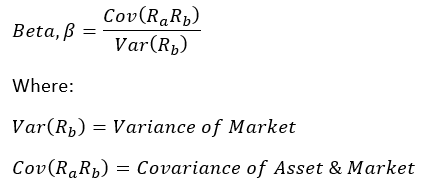

Beta is a risk & volatility measure of an asset’s correlation to the market. If the market portfolio moves by 1 unit, and a security moves by x units; beta = x. Beta is calculated as the Cov(a,b)/Var(b), where a represents the asset & b represents the market.

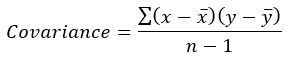

Variance is discussed here. Calculating covariance often involves creating a variance-covariance matrix, however the basic formula for covariance is as follows: (Sum(x – x-bar)*(y – y-bar))/n-1. Where n is the sample size.