The Treynor Ratio is a measure of risk-adjsuted returns. Risk-adjsuted means that returns are weighted based on the level of risk taken to achieve such returns; a portfolio with high returns may simply have achieved this through taking excess risk and so may not be an optimally managed portfolio. The Treynor Ratio is also known as the reward to volatility ratio.

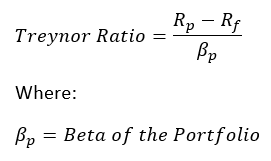

The Treynor Ratio is calculated as follows: (Average Return – Risk Free Rate)/Beta. Beta is a measure of an asset’s volatility relative to the market (Click here for more info on Beta), and so Treynor’s ratio considers a risk premium over the risk-free rate, but also considers the asset’s correlation to the market.