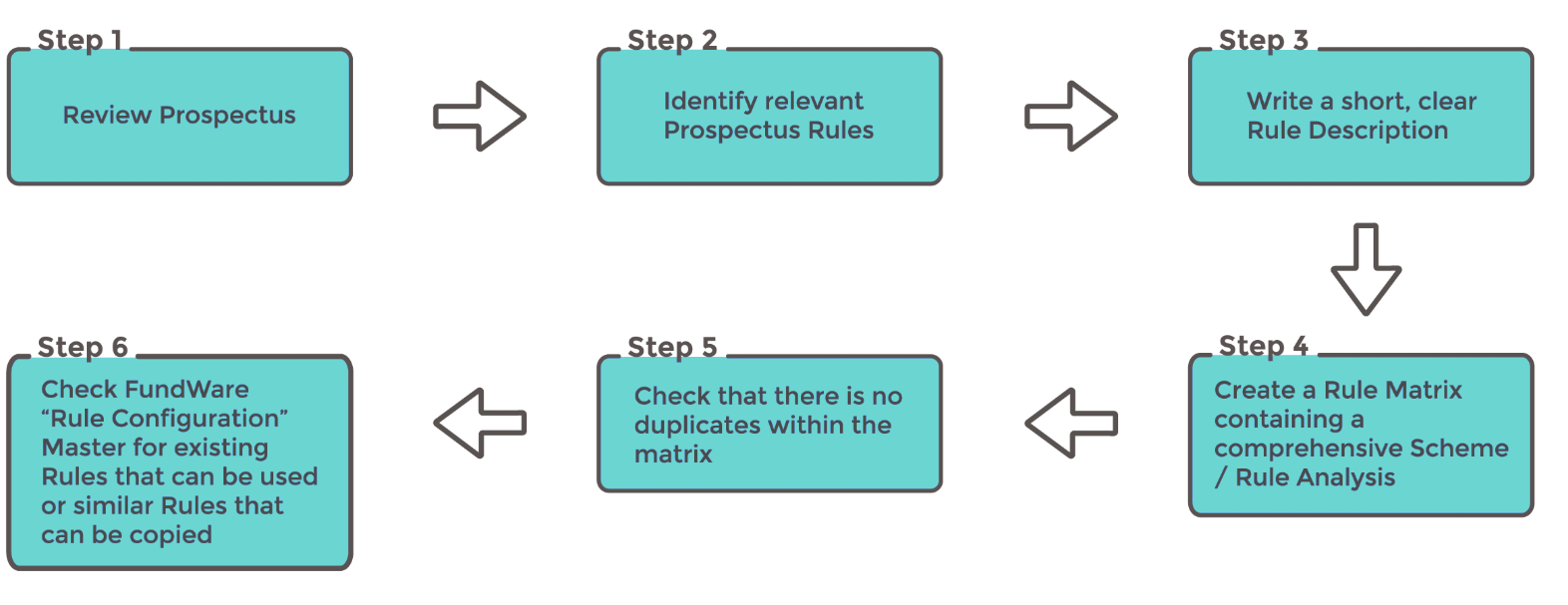

We adopt a six step process when performing a prospectus review. Before any rules get coded, we must walk through the following steps;

Identifying & Defining Rules

Sample Prospectus Interpretation

It is important when creating new prospectus rules that they are in a easily digestible format as this helps enable greater end user understanding. *Step 3.

| Bad Example: | Good Example - break down into 4 succinct rules: |

|---|---|

| (1) The Fund aims to invest in the equity of a maximum of forty five publicly listen companies, primarily selected from the Fund's benchmark, the FTSE All-Share Total Return Index (as described in the Appendix to the Supplement) | (1) Equity Securities: Max 45 Listed Companies |

| (2) The Fund may also invest up to 20% of its net assets in the equirt of companies publicly quoted outside the UK. | (2) Max 20% in Equities of companies listed outside the UK |

| (3) The global exposure as a result of the Fund's investment in the FDI will be measured using the commitment approach and will be limited to 100% of Net Asset Value. (For the avoidance of doubt, the Fund shall not invest in other collective investment schemes) | (3) 200% Max Total Exposure (incl. 100% FDI) |

| (4) No investment in CIS |

Rule Matrix Creation

The rules plucked from the prospectus should then be listed in a rule matrix, showing clearly to which scheme(s) they belong to. Sample shown below.

| Rule Code | Rule Text | Prospectus Extract | Scheme 1: ABC | Scheme 2: XYZ | Scheme 3: XXX | Scheme 4: DBD |

|---|---|---|---|---|---|---|

| P1056: | P1056: Max 20% in Emerging Markets | The Fund will predominantly invest in Frontier Markets in the WEC. The Fund may invest up to 30% of the Net Asset Value of the Fund in Emerging Markets. | Y | Y | Y | |

| P1053 | P1053: Max 20% in Corporate debt securities | The Series may also invest up to 20% of net assets in convertible and non-convertible corporate debt securities rated below investment grade, also known as junk bonds, or unrated securities which the Investment Adviser has determined to be of comparable quality. | Y | Y | ||

| P1058 | P1058: Max 30% in non-investment grade debt | Any bonds in which the Fund invests may be fixed and/or floating, corporate and/or government bonds that may or may not be of investment grade or may be unrated by a recognised rating agency such as Moody's or Standard & Poor's. The Fund will not invest more than 30% in below investment grade bonds. | Y | Y | ||

| P1057 | P1057: Max 30% in non-CNY denominated debt securities | Any such investment in non-RMB denominated debt securities is expected to be minimal and in any event shall not exceed 30% of the net assets of the Series. | Y |