| Data Field | Description | Quantity vs Value |

|---|---|---|

| Issuer Total Shares Issued / Issued Capital | Total number of shares created by a company. This will therefore include treasury shares. It is made up of voting, non-voting, preference shares etc. It does not include debt. | Quantity |

| Issuer Shares Outstanding | Total number of shares issued by a company which are actively held by shareholders. This therefore excludes Treasury Shares; as these are not actively held by shareholders. (Please see Treasury Shares section for more details) Free float, closely held and unlisted securities are included in “Shares Outstanding”. Shares Outstanding = Total Shares issued minus Treasury Shares | Quantity |

| Issuer Voting Right Shares | Total number of shares issued that carry voting rights. This will not include treasury shares as they do not have voting rights. Voting shares are shares that give the stockholder the right to vote on matters of corporate policy making as well as who will compose the members of the board of directors. | Quantity |

| Issuer Market Capitalisation | Total value amount of a company’s outstanding shares. It is calculated by multiplying the price of a stock by its total number of outstanding shares. Treasury shares are excluded from this calculation. For example, a company with 20 million shares selling at $50 a share would have a market cap of $1 billion. | Value |

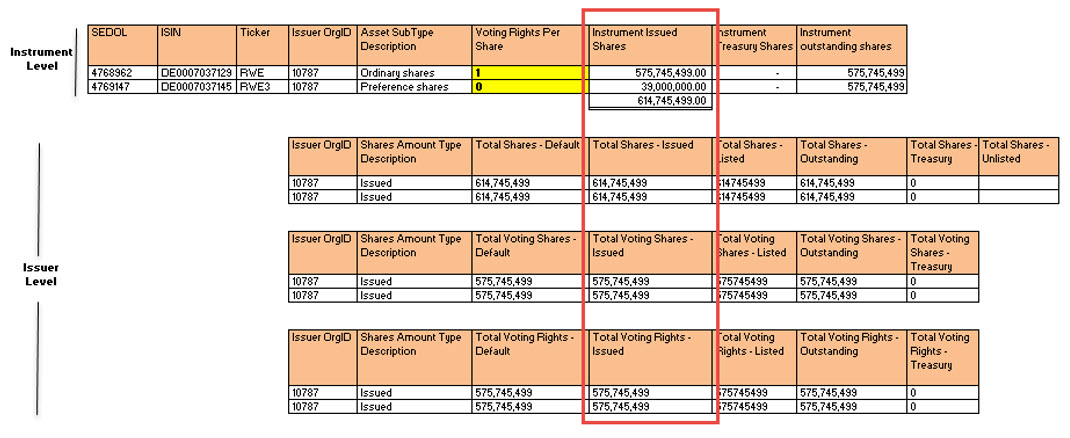

| Instrument Shares Issued / Issued Capital | For Equity, “Issued Capital” is the total number of shares issued, excluding Treasury Shares for that class of issue. Issuer and Instrument issued capital may be the same – e.g. where there is only one class of shares and they are voting shares with 1 vote per share. However, it is important to have both issuer and instrument level as this is not always the case. Where the issuer issues multiple share classes with different votes per share – the instrument and issuer figures will not match. Both Voting and Non-Voting shares are included, so this aspect is irrelevant. | Quantity |

| Instrument Voting Right Shares | For Equity, “Voting Right Shares” is the total number of shares issued that carry voting rights, excluding Treasury Shares for that class of issue. Issuer and Instrument voting right shares may be the same – e.g. where there is only one class of shares and they are voting shares with 1 vote per share. However, it is important to have both issuer and instrument level as this is not always the case. Where the issuer issues multiple share classes with different votes per share – the instrument and issuer figures will not match. | Quantity |

| Voting Rights per Share | Typically, shareholders would have 1 vote per share, however depending on the type of share and the length of time held, votes per share can increase – e.g. 2 votes per share held. Voting Right Shares would have a minimum of 1 vote per share. A voting right is the right of shareholders to vote on matters of corporate policy, including decisions on the makeup of the board of directors, issuing securities, initiating corporate actions and making substantial changes in the corporation's operations. Note: Preference shares have no voting rights attached. | Quantity |

| Treasury Shares / Total Shares – Treasury | Issued shares repurchased by the issuing company. These shares are not actively held by shareholders, rather, they are the portion of shares that a company keeps in its own treasury. These stocks do not have voting rights and do not pay any distributions. Treasury shares do not make up part of “Outstanding Shares”, as this is the portion of stock currently held by all investors, not the issuing company. | Quantity |

| Asset Ratio for | Required for Depositary Receipts. This represents the ratio of the number of Underlying Shares you would receive per Depositary Receipt. (Asset Ratio for: Asset Ratio Against) = No. of Depositary Receipts: No. of Shares | Quantity |

| Example: 3:2, Depositary Receipts:Shares Asset Ratio for = 3 This represents the number of Depositary Receipts. Asset Ratio against = 2 This represents the number of Shares. Therefore, for every 3 Depositary Receipts you would receive 2 Shares |

||

| This is also used to calculate the Multiplier Example: 3:2 Multiplier = 3/2 = 1.5 |

||

| Asset Ratio against | Required for Depositary Receipts. This represents the ratio of the number of Underlying Shares you would receive per Depositary Receipt. (Asset Ratio for: Asset Ratio Against) = No. of Depositary Receipts: No. of Shares Asset Ratio against = No. Underlying Shares | Quantity |

Terminology

Data Focus

We focus on issued shares and the voting rights relating to the issued shares.

Troubleshooting

For help with common issues and error messages found during the Annex IV reporting process, please click here.

Data Example

The share capital of a company can be broken down into lots of different categories.

| Security Description | SEDOL | Shares Amount | Shares Amount Type | Shares Amount Type Default Flag | Shares Amount Type Description |

|---|---|---|---|---|---|

| SE BANKEN A ORD | 4813345 | 2170019294 | LIS | Y | Listed |

| SE BANKEN A ORD | 4813345 | 2170019294 | ISS | N | Issued |

| SE BANKEN A ORD | 4813345 | 2143144845 | OUT | N | Outstanding |

| SE BANKEN A ORD | 4813345 | 2012471043 | FFL | N | Free Float |

| SE BANKEN A ORD | 4813345 | 130673802 | CLH | N | Closely Held |

| SE BANKEN A ORD | 4813345 | 26874449 | TRE | N | Treasury |

There are 2,170,019,294 shares in issue, and these are all listed. However, there are 26,874,449 in Treasury and therefore the outstanding shares are 2,143,144,845.

Of the 2,143,144,845, 2,012,471,043 are free float and 130,673,802 are closely held.