Below we set out an overview of the case study testing set-up in FundWare to provide oversight for Major Shareholding, Short Selling and Takeover Rules, across multiple jurisdictions and scenarios.

A. Objectives

The objectives of the case study section are:

- To enable demonstration of the level of accuracy with which rules are currently specified in the Rule Master

- To enable demonstration of the system’s capabilities and features

- To showcase examples of Disclosure rule breaches within FundWare Disclosure Management

B. The Organisational Structure

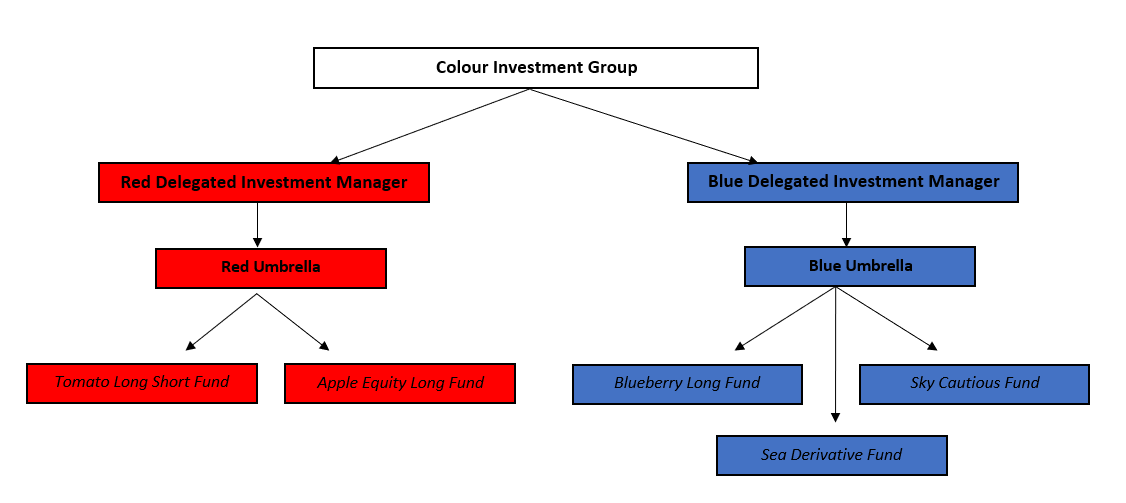

This following organisational structure has been used for the case study:

- One Group:

– Colour Investment Group - Two delegated Investment Managers:

– Blue Delegated Investment Manager

– Red Delegated Investment Manager - 5 Funds, spilt into 2 Legal Entities (SICAVs):

– Red Umbrella

– § Apple Equity Long Fund

– § Tomato Long Short Fund

– Blue Umbrella

– § Blueberry Long Fund

– § Sky Cautious Fund

– § Sea Derivative Fund

I am text block. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

C. Holdings and Dates

This case study covers a 5-to-10-day period, ranging from 20/05/2019 to 29/05/2019. With all movements in positions and subsequent disclosures occurring within these dates.

The holdings in the funds include:

- Investments in securities from a range of jurisdictions

- Both long and short holdings

- Fund Managers Exemption applies (where applicable)

- A wide variety of asset types, including ADRs, convertibles, swaps, CFDs, equity options or warrants.

Note, in this case study security information, including denominators, are not necessarily correct as some amendments have been made in order to create the necessary case studies.

The holdings for the case studies above have been changed from one day to the next at an individual, asset type level, to mimic real-world trades.

The relevant data files can be found here.

The rules/ scenarios covered in this case study will include the most common disclosures/ jurisdictions that our clients experience.

When required, additional case studies and test documentation will be published covering further jurisdictions.

The following Jurisdictions that have been chosen for this case study are:

| Major Shareholding | |

|---|---|

| Jurisdiction Rules | Case Study |

| EU TDAD | Click here |

| UK | |

| Austria | |

| Czech Republic | |

| Spain, Switzerland & Netherlands | |

| Germany | |

| Italy | |

| North America | |

| United States 13D & G | Click here |

| Canada AMR & EWR | Click here |

| Short Selling | |

|---|---|

| EU | Click here |

| Hong Kong | Click here |

| Japan | Click here |

| Australia | Click here |

| Takeovers (offer period) | |

|---|---|

| UK | Click here |

| Hong-Kong | Click here |

| France | Click here |

| Issuer Limits | |

|---|---|

| France | Click here |

| Luxembourg | Click here |

| Belgium | Click here |