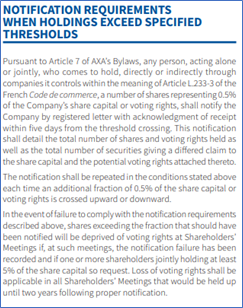

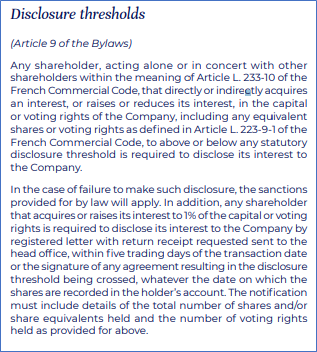

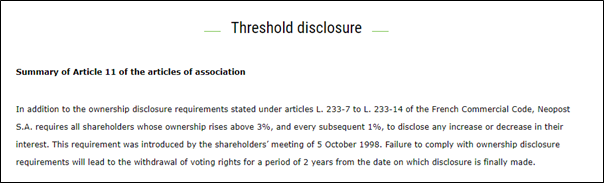

In many jurisdictions issuers have the right to impose their own private thresholds, which in the case of France (Article L. 233-7), are permitted to be as low as 0.5% of voting rights or capital. In Belgium (Law 02-05-2007), issuer may impose a threshold of 1%, 2%, 3%, 4% or 7.5%. In Austria, issuers may stipulate in their articles of association a 3% threshold.

Such issuer specific thresholds are typically found in their articles of association, but their websites (or annual reports) can also contain the relevant information including the deadline for notification and the required submission format.

Due to there being no obligation to take a harmonised approach, there can be a great disparity in the requirements – some issuers will require investors to consider TDAD instruments in their calculation (eg swaps and contracts-for-differences), others will require disclosure of the relevant transaction date, while others might also require shareholders to certify that they also have no holdings that give them access to unissued shares.

Additionally, the deadlines can vary from 4 trading days to 15 calendar days. To ensure compliance, it is crucial that attention to detail is made to the precise terms of the articles of association.