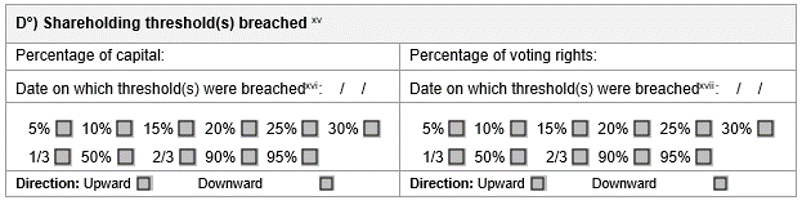

Major Shareholdings Rules are concerned with the holdings, or control over the exercise of voting rights, attached to shares in a company.

In most jurisdictions major holdings in a company requires a disclosure to the regulator and/or the company.

The purpose of the obligation is to improve transparency in the market.