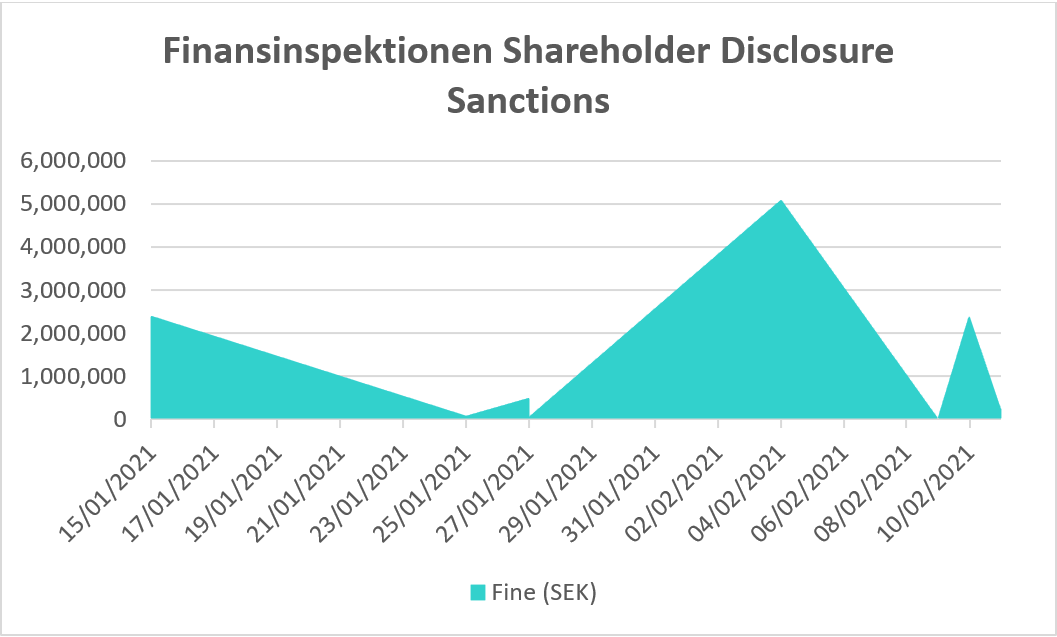

It’s been a busy couple of months for the Swedish Supervisory Authority (Finansinspektionen) – so far in 2021, they have issued fines totaling SEK 20,390,500 (USD 2,462,174) for shareholder disclosure failings.

With fines ranging from SEK 11,000 to SEK 5,100,000, as displayed in the graph below, non-compliance with Swedish disclosure requirements can be a costly affair.

But what are the rules, and why are shareholders failing to comply? Below we highlight the key shareholder disclosure requirements in Sweden.

What the Swedish major shareholding disclosure obligations?

The Transparency Directive has been implemented through Chapter 4 of the Financial Instruments Trading Act. Major shareholders are obliged to submit major shareholding notifications concerning changes to their holdings in companies whose shares are admitted to trading on a regulated market.

What are the Swedish major shareholding disclosure thresholds?

The notification obligation applies when shareholders acquire or dispose of shares in a listed company and thereby reach, exceed or fall below the 5, 10, 15, 20, 25, 30, 50, 66 2/3 and 90 per cent thresholds for voting rights or number of shares in the company.

This is where the Swedish disclosure regulations go beyond the minimum requirements stipulated in the Transparency Directive – the calculation should be made in regard to the total number of shares (including buybacks!), as well as the number of voting rights for the total number of shares of the issuer.

Do the rules only apply to Swedish registered companies?

BlackRock fell afoul of this a few years ago when they believed that the only shareholder disclosure obligation for the dual listed Lundin Mining was to the Canadian authority at 10%. In Sweden, the major shareholding notification regulations also apply to listed companies whose registered office is outside of the EEA, and have chosen Sweden as their home member state.

Finansinspektionen provides a list of these companies which is continually updated, and currently includes:

- ABB Ltd

- Africa Oil Corp

- Autoliv Inc

- Cavotec SA

- Cembrit Group A/S

- DSV Miljø Group A/S

- Etrion Corp

- Fenix Outdoor International AG

- International Petroleum Corporation

- Lucara Diamond Corp

- Lundin Gold Inc

- Lundin Mining Corp

- NGEx Resources Inc

- Oriflame Holding AG

- Semafo Inc

- Veoneer, Inc

- Vostok New Ventures Ltd

What’s included in the position calculation?

Under the main rule in Chapter 4, Section 4 of the Financial Instruments Trading Act, a person’s notifiable holding encompasses those shares they hold in their own name or on behalf of a third party. However, under the aggregation rules, there are several situations in which shares that are formally held by a third party have to be counted as part of the holding of the person with a notification obligation. Accordingly, this means that a change in one person’s holding may trigger a major shareholding notification obligation for a third party.

The major shareholding notification provisions also apply to holdings of depository receipts that confer voting rights for the shares represented by the depository receipts. Financial derivatives that grant entitlement to acquire already issued shares are also included.

Additionally, the disclosure obligations apply to other derivatives that belong to the same underlying shares and that have a similar economic effect as owning the derivatives that grant entitlement to acquire already issued shares, whether they are entitled to physical or cash settlement.

How to report to Finansinspektionen?

Notifications can be reported via the Finansinspektionen website using a Swedish e-identification. E-identification requires a Swedish civic registration number.

For those that do not have a Swedish e-identification, they can populate the “Changes in shareholdings notification” form and send it via e-mail or fax to Finansinspektionen.

Finansinspektionen provides a helpful step-by-step guide to filing the form.

What are the reporting deadlines?

The majority of the fines issued so far this year are a result of late notifications. The deadline for major shareholding notifications are short – a major shareholding notification must be submitted to both the issuer and FI as soon as possible, but no later than the third trading day following the day on which the major shareholding notification obligation arose.

What sanctions can be imposed?

For entities, a fine of SEK 15 000 is the minimum. The maximum is the highest of:

- An amount that is equivalent to EUR 10m,

- Five per cent of the legal person’s turnover in the previous financial year,

- Two times the profit that the legal person obtained as a result of the regulatory infringement, where this amount can be ascertained, or

- Two times the costs that the legal person avoided as a result of the regulatory infringement, where this amount can be ascertained,

For natural persons, fines shall be a minimum of SEK 15 000 and a maximum of the highest of:

- An amount that is equivalent to EUR 2m,

- Two times the profit that the natural person obtained as a result of the regulatory infringement, where this amount can be ascertained, or

- Two times the costs that the natural person avoided as a result of the regulatory infringement, where this amount can be ascertained.

How we can help?

Our automated shareholder disclosure monitoring software provides automated monitoring of global shareholder disclosure rules across 80+ countries on a single platform. This includes the monitoring of: