DCC plc is an Irish international sales, marketing, and support services group incorporated and registered in Ireland.

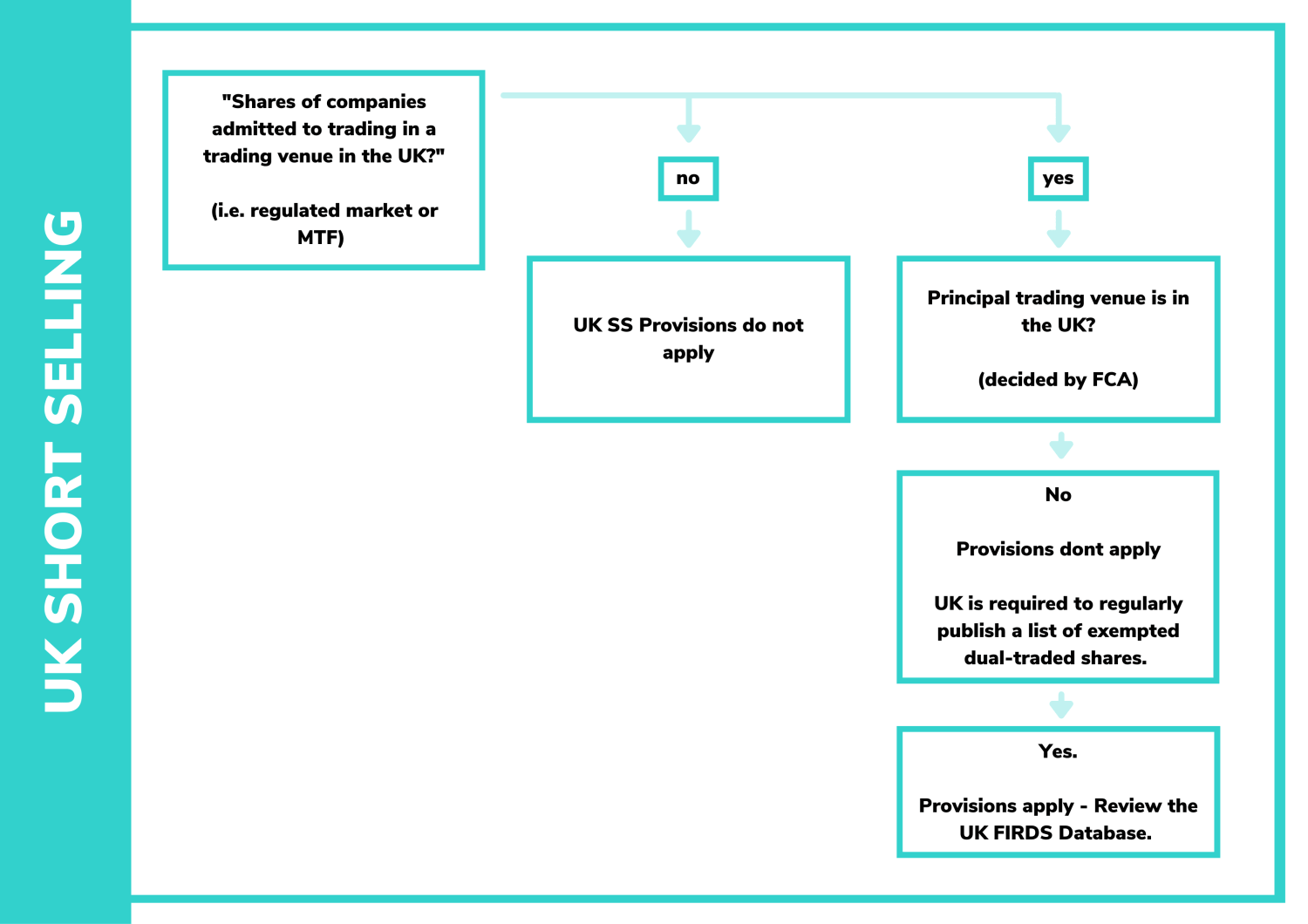

Its shares are listed on the London Stock Exchange and it is a constituent of the FTSE 100 Index.

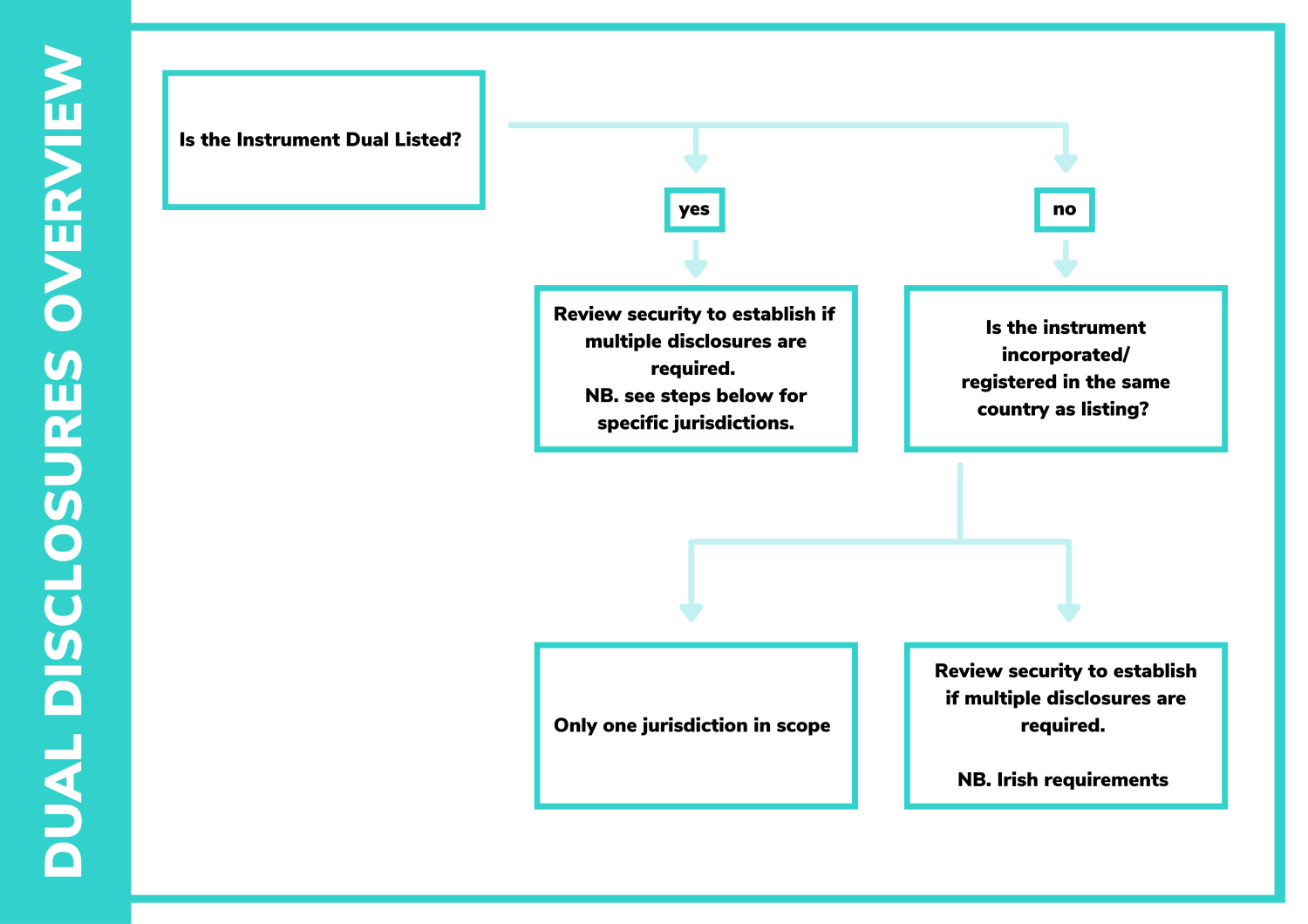

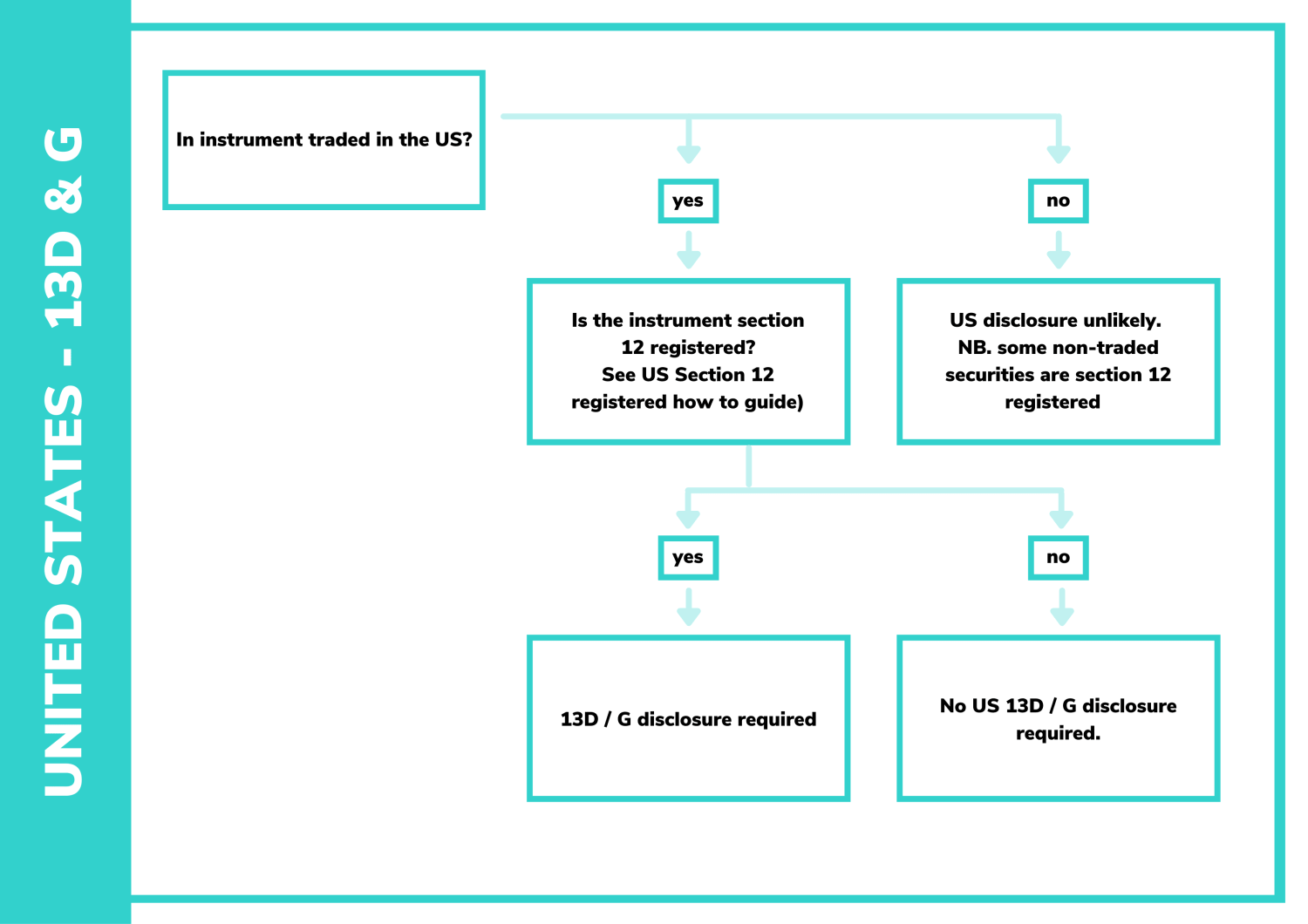

It is also traded in the EU in Germany, France, and the US.

As it is traded on a UK-regulated market, disclosures in the UK are in scope.

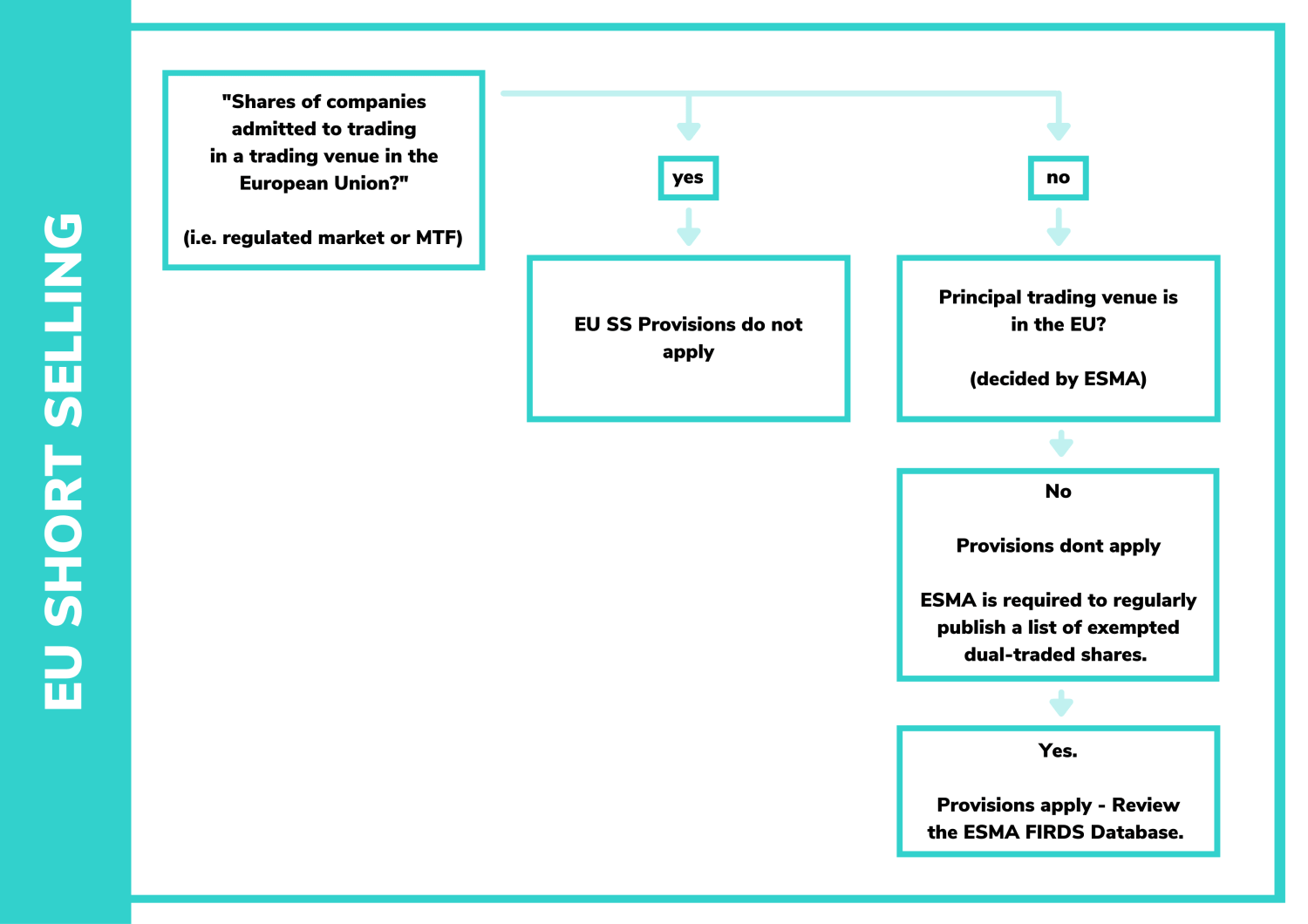

Although it is traded in Germany and France, it is not traded on regulated markets. Instead, it is traded on open markets, and therefore is not in scope for disclosure in either jurisdiction.

As it is also traded in the US, we must check that it is section 12 registered. From reviewing the registration documents, it can be found that ordinary shares are not registered under section 12.

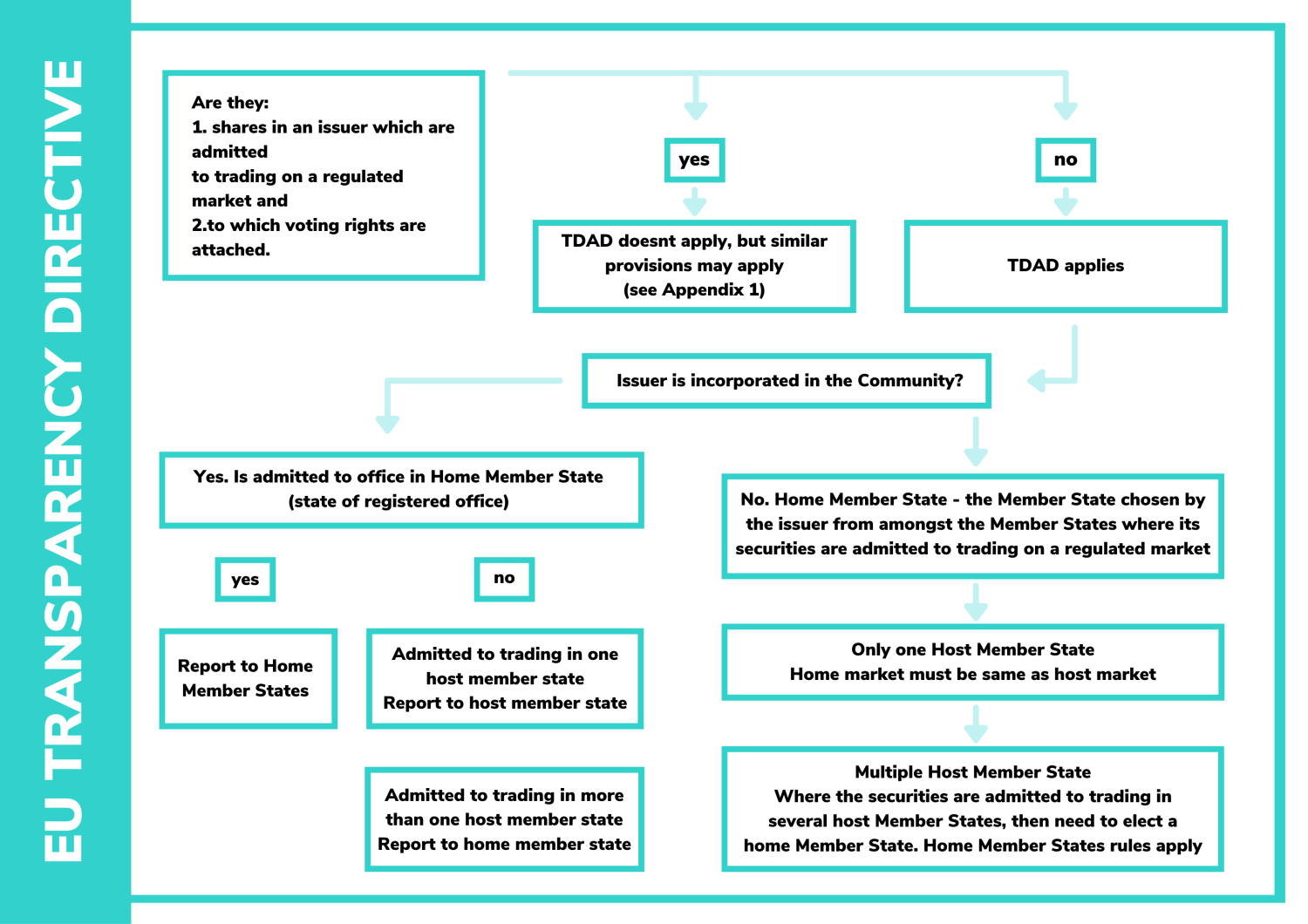

Although not traded in Ireland, the fact that the issuer is incorporated in Ireland must also be taken into account. Ireland operates two principal regimes for the notification of interests in securities: a regime implementing the EU Transparency Directive (2004/109/EC) in Ireland that is applicable to securities admitted to trading on an EU regulated market (such as the Main Markets of Euronext Ireland) and a separate and independent regime for the reporting of “interests” in the relevant share capital of public limited companies incorporated in Ireland irrespective of whether the shares are listed on a stock exchange.

Therefore, the relevant jurisdictions for disclosures in DCC plc are: