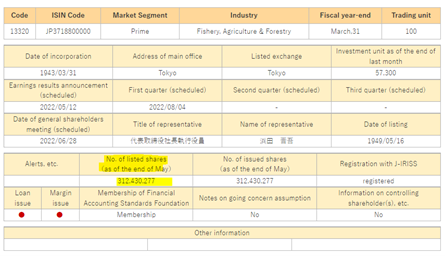

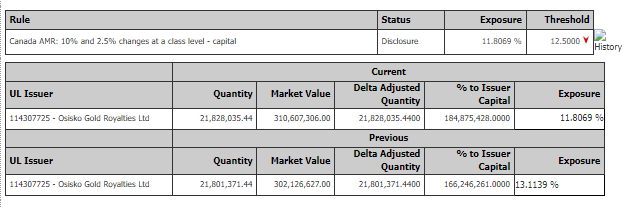

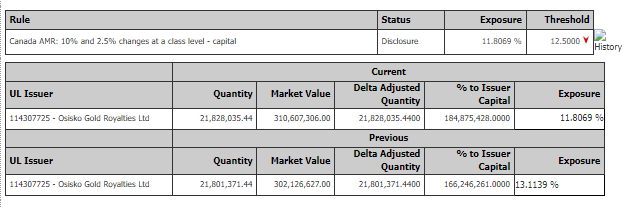

Canada AMR: 10% and 2.5% changes at a class level – capital

Q1. Is the client making disclosure for this issuer under the Early Warning Reporting Regime (e.g 2% changes from previous disclosure) or the Alternative Monthly Reporting Regime (e.g. 2.5% fixed intervals 12.5%, 15%, 17.5% etc.)?

Q2. Is the threshold breach solely due to a denominator change? If yes, then a disclosure will only be required when the client conducts a trade in the issuer.

Q3. Is the numerator correct? Review position file for convertibles to ensure they have been converted correctly as per the conversion ratio. Have all scheme/DMs been included correctly as per the organisational structure.

Q4. Is the denominator correct? Review the latest announcements on SEDAR. Correct denominator is Shareholder Outstanding – Instrument Level. See “What Denominator?” in Wiki for further information.

Q5. Does the client hold convertibles? If yes, the converted underlying amount needs added to denominator to provide a diluted % held. See Schedule 13D/G Convertible Instruments Treatment – similar principle applies.

Q6. Is the position falling below 10%? If yes, the Shortened AMR Form can be used.

Q7. Have you checked the Canadian Reporting Issuers list to ensure the issuer is in scope for EWR/AMR reporting?

Key Sources:

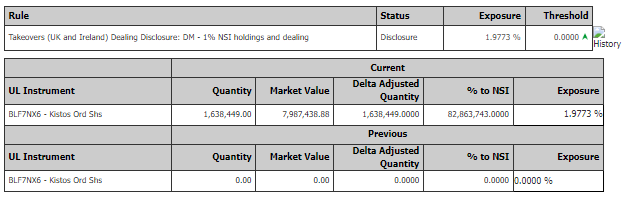

Q1. Is the issuer on the takeover table?

Q2. Does the denominator match the NSI on the takeover table?

Q3. Is the numerator correct?

Q4. Is the position held over 1%?

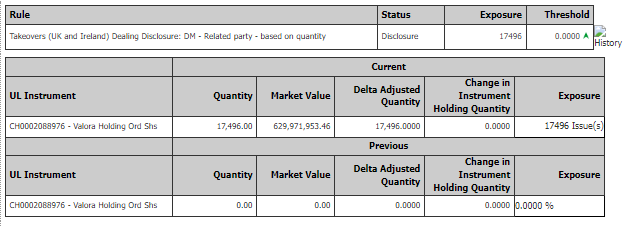

Q1. Is the issuer on the takeover table?

Q2. Does the denominator match the NSI on the takeover table?

Q3. Is the numerator correct?

Q4. Does the client hold a position in the related party that is over 1%? If yes, a dealing disclosure will be required. NB. For a related party disclosure, the position does not need to be over 1%. There just needs to be 1% held in either the offeror or the offeree.

Key Sources:

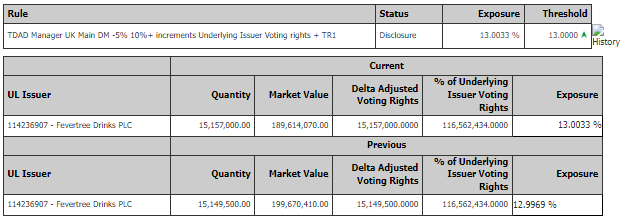

Q1. Since Brexit Transparency Directive breaches are particularly susceptible to dual disclosure – have you checked if the issuer is listed on multiple regulated markets and subsequently whether the issuer is listed on UK and EU on regulated markets. If the market is listed on a UK Regulated Market, a UK disclosure will be required. If the issuer is listed on EU regulated markets a search for the “Home Member State” announcement should be made to establish the EU jurisdiction is relevant for the disclosure.

Q2. Is the numerator correct? NB. As instruments must reference shares that have already been issued, convertible bonds only fall within the scope of the provision if the issuer can settle the bond using its treasury shares when the bondholder exercises the conversion right. However, because the holder of the conversion right does not normally have the unilateral right to acquire shares that have already been issued, these instruments are subject to the reporting requirement

Q3. Is the denominator correct? NB. This should be Total Voting Rights at Issuer level.

Q4. Has there been a change in nature of holdings? Where a holder of a previously notified financial instrument acquires the underlying shares and a shares threshold is tripped but the overall % held is unchanged, the change in nature of holding needs to be disclosed.

Q5. Is the issuer also listed in the EU? If yes, a duel disclosure may be required. Check the FIRDS database & for a home member state announcement. NB. The issuer must be listed on a regulated market.

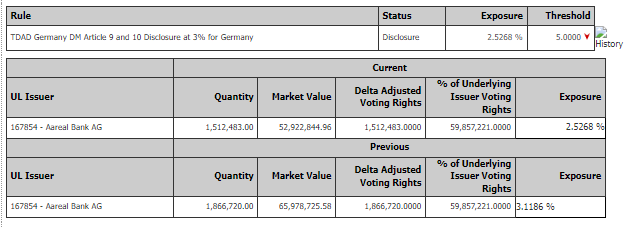

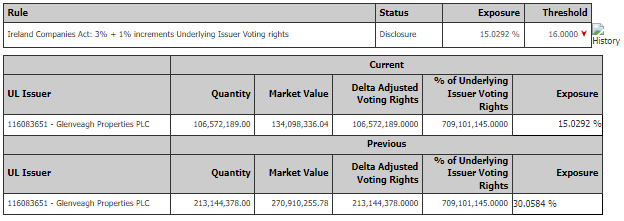

Q1. Is the numerator correct – NB. 3% threshold only applies to voting rights attached to shares only, not financial instruments.

Q2. Is the denominator correct? NB. This should be Total Voting Rights at Issuer level.

Q3. Has there been a change in nature of holdings? Where a holder of a previously notified financial instrument acquires the underlying shares and a shares threshold is tripped but the overall % held is unchanged, the change in nature of holding needs to be disclosed.

Q4. Have you checked the Germany is the Relevant Competent Authority? The disclosure rules apply only to holdings in issuers whose shares are admitted to trading on an EEA regulated market and whose home member state is Germany.

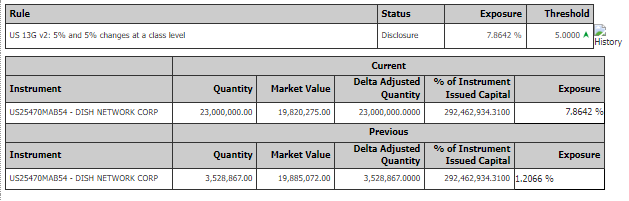

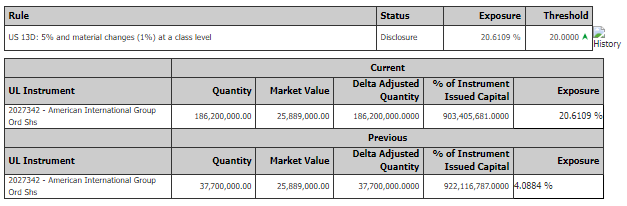

Please note checks above. Same principles apply, however, threshold is 5% and 1% changes. Additionally, calculation for 13D is conducted daily. NB. Different filing deadline for 13D:

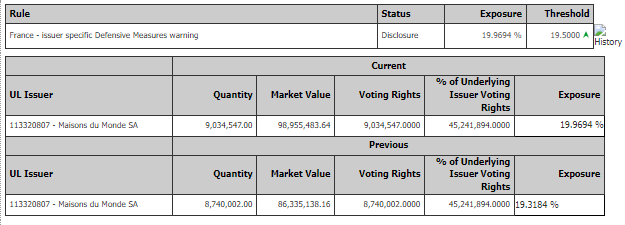

(1) Have you reviewed the latest registration document and/or bylaws? This will contain information regarding the private threshold?

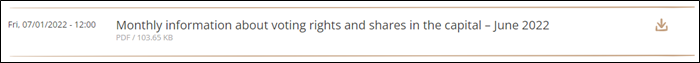

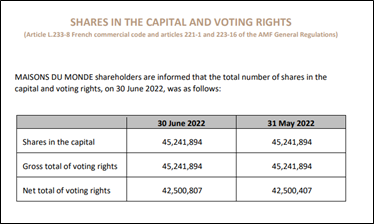

(2) Have you reviewed the latest monthly information about voting rights and capital? NB. French issuer must publish these figures on a monthly basis.

(3) Has the threshold breached the issued capital, voting rights threshold or both? Many French issuer require disclosure should a threshold be breached via either threshold.

NB. A standard French transparency directive form sent to the issuer can satisfy this disclosure when it arises. Alternatively, use shortened version.

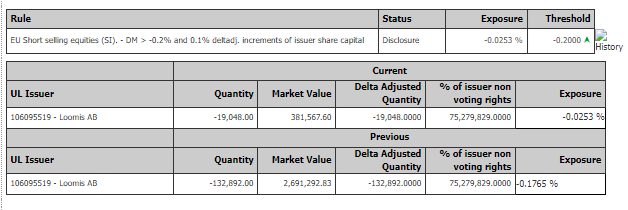

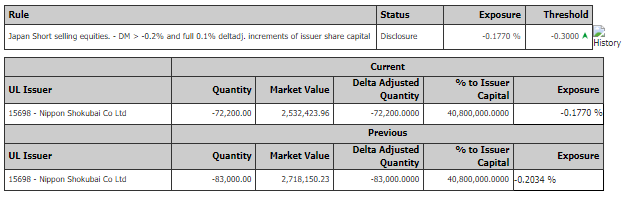

Q1. Is the numerator correct? NB. According to Article 12(1) of the Regulation, the provisions of the restriction on uncovered short sales of shares relate only to shares admitted to trading on a trading venue. That means that transactions in instruments such as subscription rights and convertible bonds e.g. performed as part of a capital increase do not fall within the scope of Article 12(1) of the Regulation.

Q2. Is the denominator correct?. NB. This should be Total Issued Capital.

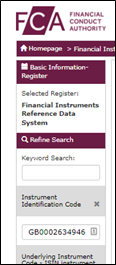

Q3. Have you checked the UK FCA FIRDS database? Is the upcoming RCA “GB? If yes – this may be in scope for a UK short selling disclosure, however, you must also check the FCA short selling exempt list.

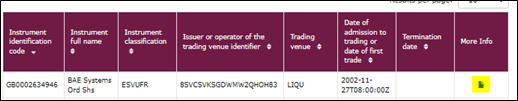

Step 1: Go to https://data.fca.org.uk/#/viewdata

Step 2: Search for the ISIN:

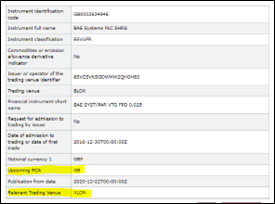

Step 3: Click “more info” icon

Step 4: Review “Upcoming RCA”. If this is GB, check the FCA SS exempted shares list.

Q4. Have you checked the EU ESMA FIRDS database? Does the “Upcoming RCA” match the jurisdiction you are making a disclosure in?

Q5. Have you checked the UK Short Selling Exempt Shares excel? NB. If the security is traded on a UK market, and appears on this list, it is exempt.

Q6. Have you checked the EU ESMA Exempted Shares under Short Selling Legal Framework database? NB. If the shares appear on the list, they are exempt from EU short selling notifications.

See UK/EU Short Selling Reporting Checks for further information.

Key Sources:

Same check required as per the Transparency Directive checks above. NB. Ireland required a disclosure using the standard form and excel submission.

Q1. Has a relevant threshold been breached? NB. In Japan, there are two thresholds that trigger short selling reporting: 1. A net short sale position of 0.2% (and more than 50 short selling units) must be reported to the exchange 2. A net short sale position 0.5% (and more than 50 short selling units) must be reported to the exchange will trigger the public disclosure requirement fulfilled by the exchange.

Q2. Is the numerator correct? The investment manager must aggregate holdings across all funds/managed accounts managed by it on a discretionary basis with dispositive control. Voting control is relevant where control intent over the issuer’s activities exists. If the investment manager forms part of a larger corporate group, the disclosure obligation will generally fall on the investment manager’s parent undertaking.

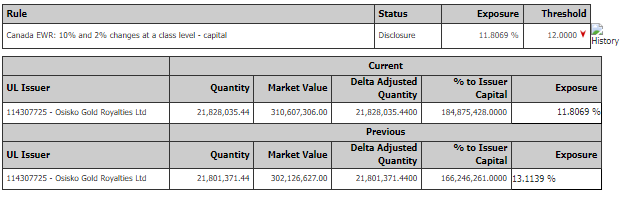

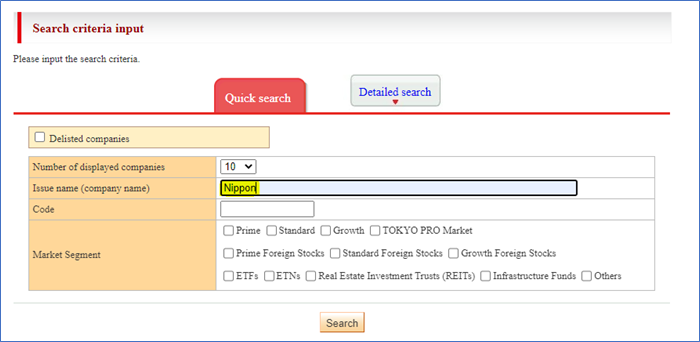

Q3. Is the denominator correct? NB. This is shares outstanding and should match the information provided on the Listed Company Search.

NB. If the person is a financial instruments business operator, report directly to the exchange on standard forms. Otherwise report to broker. Clients will generally be filing through a broker.

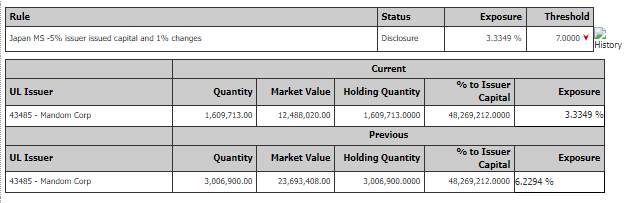

Q1. Is the numerator correct and has the position been aggregated correctly?

NB. The following:

Parent company A parent must aggregate and disclose the holdings of it and its controlled undertakings under the Joint Holders aggregation rules.

Subsidiaries If parent discloses on an aggregated basis there is no requirement for each subsidiary to make separate disclosure.

Discretionary managed holdings The investment manager must aggregate holdings across all funds/managed accounts managed by it on a discretionary basis with dispositive control. Voting control is relevant where control intent over the issuer’s activities exists. If the investment manager forms part of a larger corporate group, the disclosure obligation will generally fall on the investment manager’s parent undertaking.

Non-discretionary managed holdings The investment manager is not required to aggregate or disclose interests managed by it on a non-discretionary basis. Any disclosure obligation rests with the person with control (e.g. dispositive control, voting control with issuer control intent).

Q2. Has the position changed 1% since the previous disclosure? N.B a movement above the initial 5% threshold will require a disclosure, subsequent movements of 1% will also require a disclosure. A position falling below the 5% will not require a disclosure until there has been a 1% change from previous disclosure.

NB. In general, cash-settled equity derivatives whose underlying assets are Target Securities are not caught by the disclosure regime.

Q3. Is the denominator correct?

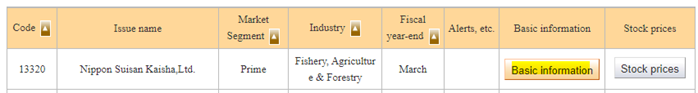

Go to Listed Company Search: https://www2.jpx.co.jp/tseHpFront/JJK020010Action.do?Show=Show

Search for company name

Click “Basic information”

Review number of listed share