To determine whether you “beneficially own” more than 5% of a class of an equity security, you need to measure the amount you are deemed to “beneficially own” against the total amount of outstanding securities of that class. For information on the total amount of the class currently outstanding, a beneficial owner may rely upon the issuer’s most recent quarterly or annual report (10-Q or 10-K) filed with the SEC and any current report (Form 8-K) filed later.

You must include any equity securities you may obtain within 60 days through the conversion or exercise of options, warrants or outstanding shares in this calculation. But you do not need to include similar non-exercised or converted shares held by anyone else.

For instance, if an issuer had 100 shares of common stock outstanding and you beneficially own a note convertible within sixty days into ten shares of the issuer’s common stock, then you are deemed to beneficially own 10/110 or 9.09% of the common stock of that issuer.

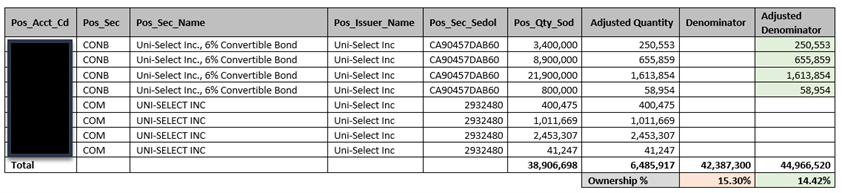

Diluted Denominator for Convertible Bonds

A diluted denominator is required for Convertible Bonds.

TOTAL Shares in issue / Voting Rights + TOTAL Adjusted Quantities of Convertibles held

Example of Diluted Denominator

Underlying Security = Uni-Select