The transfer of an asset in its current form rather than in the equivalent amount of cash. The legal ownership of the asset is transferred from one provider/scheme to another without the need to sell and re-purchase the asset. This transaction retains the asset rather than selling it which allows the client to stay invested in the market during the transfer.

What is an in-specie transfer?

Takeover Rule 8.3

For Takeover Rule 8.3, if a disclosure flags within Galaxy, and the movement is solely due to an in-specie transfer, then this is not a valid disclosure. However, when the client next makes an actual trade resulting in a valid disclosure, a note regarding the in-specie transfer needs to be included in the form under table 2a.

The note should read:

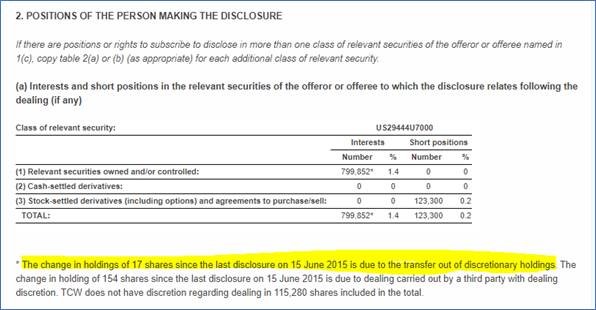

* The change in holdings of x shares since the last disclosure on DD MMMM YYYY is due to the transfer in/out of discretionary holdings.

Example below: