Rule 8 of the UK Takeover Code (the “Code”) sets out the circumstances in which Dealing Disclosures and/or Opening Position Disclosures are required to be made by:

- The parties to an offer;

- Persons acting in concert with the parties to an offer;

- Persons with an interest in relevant securities of 1% or more; and

- Exempt principal traders (“EPTs”) connected with the parties to an offer.

Here we are concerned with persons with an interest in relevant securities of 1% or more.

There are requirements for:

- Opening Position Disclosures; and

- Dealing Disclosures.

A. Summary of Requirements

1. Opening Position Disclosure

Under Rule 8.3 (a), an Opening Position Disclosure must be made by any person interested in 1% or more of any class of relevant securities of the offeree company or of any securities exchange offeror.

Timeframe for disclosure:

The Disclosure must be made no later than 3.30 pm on the 10th business day following the commencement of the offer period or the announcement that first identifies an offeror, as the case may be.

2. Public Dealing Disclosure

Under, Rule 8.3(b) , Public Dealing Disclosure must be made by any person who is, or becomes, interested in 1% or more of any class of relevant securities of the offeree company or of any securities exchange offeror if the person deals in any relevant securities of the offeree company or of any securities exchange offeror.

This means that a Disclosure will be required where, for example, you own greater than 1% in the offeror but only 0.2% in the offeree, but have a transaction to increase that holding to 0.3% in the offferee or, for example, reduce your holding in the offeree to 0.15%. Equally, you would make a disclosure where you have greater than 1% in the offeree but less than 1% in the offeror and then make a trade in respect of the offeror.

Timeframe for disclosure: The Disclosure must be made no later than 3.30 pm on the business day following the date of the relevant dealing.

3. Example

| Day | Event Timeline | Disclosure Required |

|---|---|---|

| Day 1 | Relevant Person Holds: • 1% in XYZ Issuer • 0.5% in ZZZ Issuer | No |

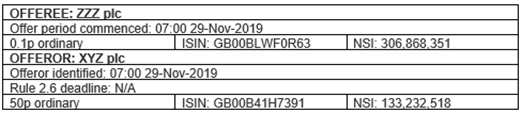

| Day 2 | Offeror XYZ plc added to Takeover Table with corresponding offeree Issuer ZZZ plc | Yes - Opening position disclosure required in XYZ plc |

| Day 3 | Trade in ZZZ Issuer increasing position to 0.65% | Yes – Dealing disclosure required in ZZZ plc |

| Day 4 | Trade in XYZ plc – position increasing to 1.20% Trade in ZZZ plc – position reducing to 0.55% | Yes - Dealing disclosure required in XYZ plc & ZZZ plc |

| Day 5 | Trade in XYZ plc – position reduced to 0.95% | Yes - Dealing disclosure required in XYZ plc |

| Day 6 | Trade in XYZ plc – position increasing to 0.80% Trade in ZZZ plc – position reducing to 0.4% | No – holdings in either issuer below 1% threshold |

B. Relevant Stocks – The Disclosure Table

The final version of the Disclosure Table is issued by 5.30 pm each business day at:

http://www.thetakeoverpanel.org.uk/disclosure/disclosure-table

The final version will be marked “Final” and persons required to make Dealing Disclosures and Opening Position Disclosures are advised to use that final version.

Exception to Disclosure requirement

Where an offeror is marked “Disclosure of dealings and positions in this offeror is not required”, dealings and positions in relevant securities of that offeror are not required to be disclosed under Rule 8. This is generally because it has been announced that the offer or possible offer is, or is likely to be, solely in cash.

C. The Denominator

The denominator to be used is the Number of Shares in Issue (NSI) as published in the Takeover Table. This should be the same as the Issued Capital, but occasionally there may be differences due to timing differences etc.

D. Content of Disclosures - Disclosure forms

Disclosure forms are available from the Takeover Panel website at:

http://www.thetakeoverpanel.org.uk/disclosure/disclosure-forms

The same Form 8.3 is used for both Opening Position Disclosures and Dealing Disclosures.

The form consists of 4 sections. Part 3 needs to be filled in for Dealing Disclosures, but not for Opening Position Disclosures.

E. Method of disclosure Public Disclosures

There is no longer a requirement to make a disclosure to the Takeover Panel. Instead, Public Opening Position Disclosures and Public Dealing Disclosures required under Rule 8 of the Code must be made to an approved Regulatory Information Service (RIS).

The following are approved Regulatory Information Services:

| Service | Tel |

|---|---|

| Business Wire Regulatory Disclosure provided by Business Wire | +44 (0)20 7626 1982 |

| ONE, provided by NASDAQ OMX Corporate Services | +44 (0)20 3753 2366 |

| News Release Express provided by Marketwire | +44 (0)20 7220 4500 |

| PR Newswire Disclose provided by PR Newswire | +44 (0)20 7454 5241 |

| RNS provided by the London Stock Exchange | +44 (0)20 7797 4400 |

| marCo – Market Communication Office provided by Tensid Ltd of Switzerland | +41 41 763 0050 |

| EQS IR.COCKPIT provided by EquityStory AG | +49 89 21 02 98 – 50 |

F. Some Local Knowledge

The following points are not in the Takeover Code provisions, but reflect Funds-Axis understanding as confirmed directly with the Takeover Panel:

– The stock and Issuer Name appearing in section 1c should appear the same as per the Takeover Table, rather than being the customised naming conventions from your source systems or other data providers (e.g. Bloomberg, Reuters etc).

– Truncation to decimal places

3. The percentage of NSI in section 2a and the prices in section 3 should be truncated (as opposed to rounded) to 2 decimal places.

– Part 3 on Deals

4. Deals should include details of actual deals, not an aggregated deal amount with price averaging

5. Deals executed at same price can be aggregated

6. Where a single deal is executed and then allocated to a number of funds, it should be presented as a single deal.

– Amendments can be made by re-submitting the amended Form 8.3 and entering text at the top of the disclosure form, either “Amendment to section [ ] of the disclosure released on [ ] 2017” or “Amendment to section [ ] of RIS No. [ ] released on [ ] 2017”. The amended form is then submitted through the RIS, the same as with an original notification. There are no special forms and no special procedures to be followed at the RIS in respect of amendments.