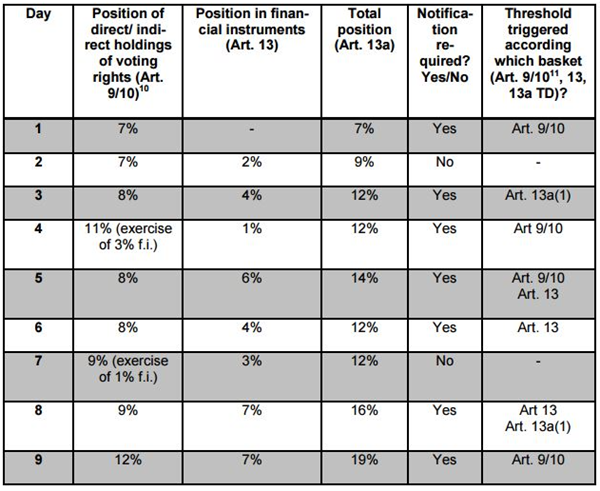

Prior to the introduction of the Transparency Directive Amending Directive (TDAD) (Directive 2013/50/EU), there was inconsistency across Member States in so far as the approach for aggregation of holdings of shares with holdings of financial instruments. The Transparency Directive only required major shareholders to perform two checks: one in relation to the holding of shares (the “shares bucket”, Articles 9 and 10 of the TD) and one in relation to the holding of financial instruments (the “financial instruments bucket”, Article 13 of the TD). It did not include an explicit requirement to perform a check on the aggregate of the two across all member states.

Horizontal Aggregation Overview

Under the Transparency Directive Amending Directive, there are now 3 requirements:

Article 9/10. Articles 9 and 10 apply to the holding of shares. Article 9 sets out the limits and applies to the direct holding of voting rights. Article 10 extends this to the indirect holdings where the person is entitled to acquire, to dispose of, or to exercise voting rights (e.g. through control agreements or discretionary management arrangements).

Article 13. Article 13 applies to the holding of financial instruments. Article 13 provides that the limits in Article 9 shall also apply to a natural person or legal entity who holds, directly or indirectly, financial instruments that result in an entitlement to acquire shares or financial instruments of similar economic effect. The wording of this was clarified under TDAD.

Article 13a. is introduced by TDAD and provides that notification is also required when the number of voting rights held directly or indirectly under Articles 9 and 10 aggregated with the number of voting rights relating to financial instruments held directly or indirectly under Article 13 reaches, exceeds or falls below the thresholds set out in Article 9(1).

In 2015, ESMA published a Q&A on the Transparency Directive. This provided a table (fig 1.) illustrating the changing position in an issuer and providing examples of the notifications to be performed assuming the minimum threshold for notification is 5%: