Has the position breached 0.1% or a subsequent 0.1% threshold? (e.g 0.1%, 0.2%, 0.3%)

For securities traded in the UK, can the issue be found on the FCA list of exempted shares:

https://www.fca.org.uk/publication/documents/uk-list-exempted-shares.xlsx

If yes, a disclosure will not be required as it is exempted under the UK short selling regime.

For securities traded in the EU, can the issue be found on the ESMA list of exempted shares:

https://registers.esma.europa.eu/publication/searchRegister?core=esma_registers_mifid_shsexs

Is the denominator correct?

NB. The denominator for short selling reporting is the Total Issued Shares Capital. This is in contrast to EU/UK major shareholding disclosure which required a Total Voting Rights denominator to be used.

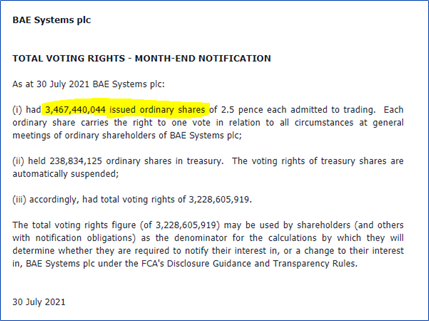

In the example below, the issuer has:

- 3,467,440,044 issued ordinary shares

- 238,834,125 ordinary shares in treasury

- 3,228,605,919 total voting rights

Therefore, the correct figure for short selling reporting is 3,467,440,044.

Have you checked the numerator is correct as per the files received?

Have you manually calculated the % held is correct?

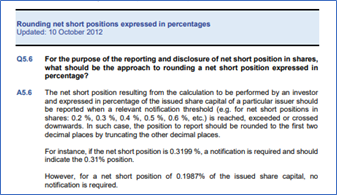

Has the % held been rounded to the first two decimal places by truncating the other decimal places. See Q 5.6 of FAQs.

Is the issuers full name correct?

Is the clients name & position holder ID correct?