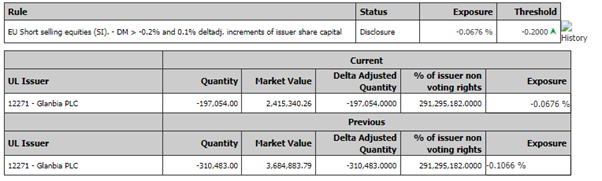

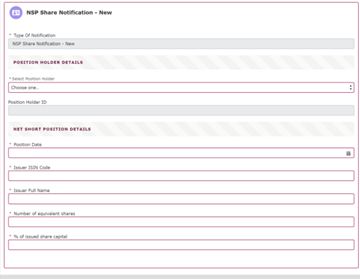

The UK minimum short selling reporting threshold is 0.1% of the issued share capital of an issuer. A private share notification must be made when the net short position in shares reaches 0.1% of the issued share capital of the company concerned, and again at each 0.1% change above 0.1%. (e.g 0.1%, 0.2%, 0.3%).

A public share notification must be made when the net short positions of shares reach 0.5% of the issued share capital of the company concerned, and again at each 0.1% change above 0.5%.

Certain shares are exempt from the notification and disclosure requirements in the UK SSR if their principal venue for trading is located outside the UK. For a list of these shares, please see the UK list of exempted shares: https://www.fca.org.uk/publication/documents/uk-list-exempted-shares.xlsx

The position should be reported by 3.30pm on the trading day after the day the position was reached.

The position to report should be rounded to the first two decimal places by truncating the other decimal places.

FAQs: https://www.esma.europa.eu/sites/default/files/library/esma70-145-408_qa_on_ssr.pdf

Disclosure Management Example: